The core claim of the Big banks and those who support them is that the financial system, as it is presently constituted, is not only fair and fit for purpose, but essential for our continued welfare. People should therefore stop complaining and knuckle down to suffer whatever deprivation is necessary. All must serve the greater good. Or as it should really be known – the Good of the Greater.

The banks are not frightened by a bank failure or two. As long as governments are prepared to force their people to bleed for the banks’ welfare it can actually be an opportunity. A bank failure is just a chance for the better connected ones to predate. Neither are they worried by a case of fraud here or an indictment there. They will settle for a sum which is of no significance to them, in return for a “no admission of guilt” clause. If necessary they are even prepared to throw one of their own to the baying crowd. No one in banking shed a tear for Fred the Shred. And why should they? Call him greedy if you want. See if he cares. He’d already sucked his millions from the wreak he left behind.

What scares the banks is any criticism that goes beyond claims of greed or fraud or even incompetence, and instead questions the system itself. The sanctity and perfection of the system and its right to ‘regulate’ itself, is what they are totally committed to protect. The system is what gives them their status and wealth. Question that and you threaten them where they are vulnerable.

It seems to me therefore that it is high time we questioned not just the probity, or even the solvency of the big global banks but their very intellectual foundation. It is time for us to wrench back the initiative from the banks. The financial elite have spent all this last year rewriting history so that blame for the banking crisis has been turned away from them and laid instead at the door of ‘people’ and then entire nations who ‘took’ on debts they coudn’t afford . It is time to counter-attack and make the case, that it was and is the way that banks and banking go about their normal business that caused this crisis and are still causing it. We have to show that it was not a break down in an otherwise fine system which caused this crisis but that it was a result and consequence of a system which is an utter failure at doing what it prides itself most on being able to do – managing risk. Not just a onetime failure but a systemic failure which presents an on-going danger to the rest of us.

So let’s be clear. There is no systemic risk at all in welfare spending, no matter how large it becomes, for the simple reason that there is no surprise in welfare spending. It does not jump out at you unexpectedly. Welfare and social spending are a slow moving behemoths that can be seen coming for decades ahead. The only danger is they will trample you to death if you are stupid enough to stand there for decades listening, slack jawed, to the competing teams of witless cretins whose flatulent play-acting is all that remains of our political process .

There is, I suggest, a very clear, present and on-going systemic risk and danger from global banking. It was, after all, banking not welfare which gave us the phrase ‘systemic risk’. Bankers deal in risk. The welfare state deals in…welfare. Like it or loath it, there is no ‘risk’ in welfare or in social spending. They are linear and entirely predictable problems. Banking on the other hand not only deals in risk, it manufactures it. Risk is what bankers bank on.

Don’t take my word for it. Andrew Haldane is the Executive Director for Financial Stability at the Bank of England. In his speech at the London ‘Future of Banking’ conference held in July 2010 he said rather clearly (Page 14),

…banks are in the risk business…’

His entire paper was analysing the ways in which banks create risk and then systematically mislead us and even each other about what they have created. He goes on to say (Page 14),

…it should be no surprise that the run-up to crisis was hallmarked by imaginative ways of manufacturing this commodity, with a view to boosting returns to labour and capital. Risk illusion is no accident; it is there by design. It is in bank managers’ interest to make mirages seem like miracles.

The mirage he refers to is the contribution banks claim to make to our over all economic well-being and security. [I would like to thank Peter Mountford-Smith for bringing this and other recent speeches by Mr Haldane to my attention].

So let’s go straight to where the banks think they are strongest and where I think they are actually terrifyingly vulnerable – their assessment of risk, in both their assets and their liabilities. I have written about risk before, but this time I want to use the bank’s own figures against them. Stay with me. You won’t regret it. We’re going to reach inside the bank’s world, take a firm grip and then yank the whole thing inside out.

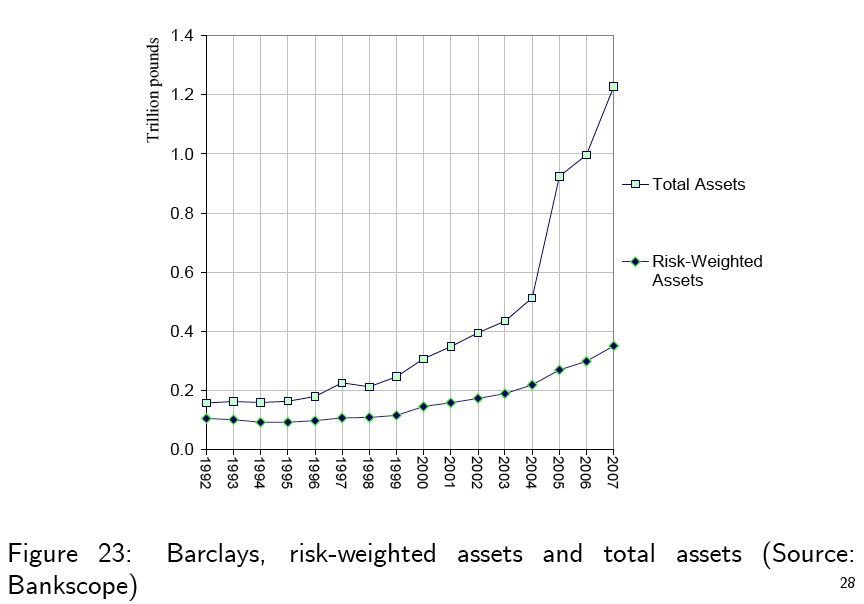

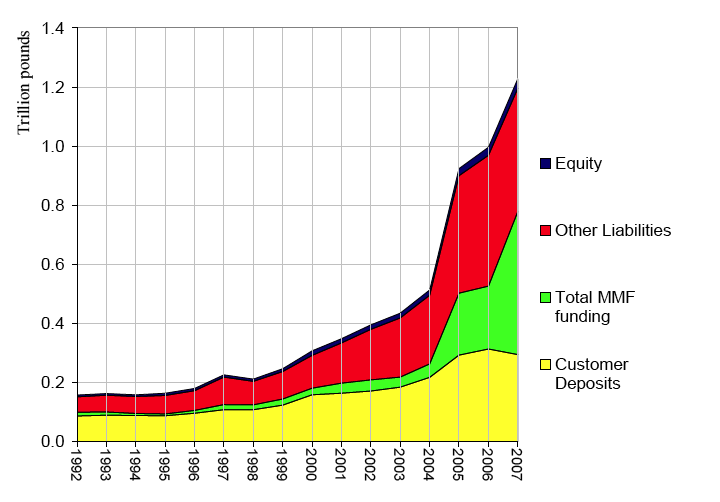

We’re going to use a series of graphs from a paper given at an the annual IMF research conference in 2011 by Princeton economist Hyun Song Shin. The stats he uses come in turn from Bankscope which compiles and sells very reliable statistics on banks. The first two both refer to Barclays Bank from ’92 to ’07; the years in which the credit and debt crisis was incubated. The first is a graph showing how Barclay’s Liabilities have grown. The second charts the growth of Barclays’ assets over the same period. Together they are the two sides of the bank’s financial health. Assets and Liabilities. Money in, money out.

The above is what too Big To Fail looks like. It’s also how it got to be that way. That curve, ascending in a steepening upward trajectory, is what is loosely called hyperbolic. It is what disaster looks like. Some time between ’92 and ’07 Barclays and all the global banks became not only Too Big To Fail but also So Fundamentally Unstable that it was Inevitable They Would Fail.

Before we go on we need to be clear about what is an asset for a bank, and what is a liability. This requires making a sketch of how a bank works but it is not difficult and will allow us to understand clearly what bankers love to keep mysterious.

In essence if you want to understand a modern bank think back to those dark days you spent in school mathematics class looking, with a heavy heart, at problems which said, ‘There is a tank with water pouring in the top while a hole in the bottom is letting water out…etc” Remember those? Hideous. But a modern bank, in once sense, is nothing more than that tank of water. It is all about flows in and out.

An asset for a bank is money that other people owe to the bank. Which means the loans and mortgages the bank has extended to others that they will pay back. Those are its assets. The more loans the bank has made, the greater the flow of payments in to the bank, the greater its assets. So ‘assets’ are agreements that direct a flow of money IN to the bank. The bank’s liabilities are agreements that direct the flow OUT of the bank. Money it borrowed from, and thus owes to, others. Assets and liabilities. Flow in, flow out. Money owed to the bank. Money the bank owes. It’s quite simple. It all works so long as the in-flow matches the out-flow.

Which brings us to the first of the bankers articles of faith that I want to question.

Netting Out.

We are all now familiar with the fact that all the banks have vast debts which they often owe to each other. We also know how they are dependant upon each other for funding. And we know how, thanks to the multi trillion dollars trade in various kinds of derivatives, the banks are also exposed to huge bets on everything from currency values, to insuring each others debts. BUT, whenever the banks are questioned as to the stability of such huge debts and bets they will say, ‘Don’t you fret, it might look out of control, but our various debts, bets and assets all net out and what’s left is perfectly balanced.’ Which leaves most of us none the wiser. What they mean is that within any bank, the liabilities side (the left hand graph above) balances out with the assets side (the right hand graph), so that however huge the bank’s debts, they are balanced by what it is owed. When you cancel the assets and liabilities out against each other you find what the bank is owed is just a tiny bit more than it owes to others. If you look at the two graphs above you will see they are almost always identical with the assets fractionally larger than the liabilities.

What is more, the banks will also say that when you take the vast trade in derivatives, where the banks insure each other’s debts and make huge bets with each other, and compare who has bet what with whom, these trades also ‘net out’ across the system as a whole. That is, one bet cancells another so that the actual potential losses are small. This is often what is meant by ‘hedging’, where a bet one way is balanced or offset by a bet the other.

However, have you ever been in a rowing boat when two passengers sitting side by side have tried to change places? Taken as an idealized mathematical problem there is in fact no net change occurring, the total weight in the boat does not change. On paper, at least, equal masses simply swap over and at all times they cancel each other out. In reality however as soon as people start to move the whole boat is in danger of capsizing. On paper this never happens because it is just numbers moving and cancelling. But in the real world large weights are almost impossible to balance. There will always be a moment when one person’s weight is not balanced by the other’s. And so it is in finance. Assets and liabilities in a bank, let alone in a vast system of banks, do NOT net out in perfect unison. And that is why, no matter what hedging they claim to have in place, no matter what netting-out ‘should’ occur, banks fail. As one bank fails or simply starts to lurch, tip and rock from side to side, that instability propagates through the system. This is real-world non-linearity at work. Netting out is a fiction maintained because on paper, in the idealized word of mathematics (linear mathematics that is), perfect netting-out works. However in the real world, even electronic debts of zeros and ones, move at different speeds, which in a crisis makes a mockery of the entire notion of netting out.

Netting out means the banks are tied in to a web of obligations to each other. They would like you to understand this as an arrangement which makes them stable. They talk of spreading the risk. In fact it does exactly the opposite. It propagates and amplifies the risk. One boat on its own, rocking violently is a problem, but probably manageable. Now tie lots of boats together. As one rocks, it sets off others. Those other set off yet others. And they all create waves of instibility that buffet each other, in a more and more unpredicatble manor. Now we have systemic risk and ‘contagion’.

It is the failure of netting out across the financial sysytem that causes the otherwise mysterious ‘contagion’ we hear about. Bankers warn about the dangers of ‘contagion’ whenever someone appears reluctant to bail them out, but they are coy about what causes this ‘Contagion’. Contagion is the failure of netting out.

Of course I used the analogy of a rowing boat with people moving about. The question is was that a cheat? Are banks that unstable? To answer that we have to look again at the graphs.

Because I have been working so painfully slowly at the moment I will break again just so that I can get something posted and not extend this long silence. I will continue in other posts. At the moment I think there will be at least two more parts to this series. I will try to get more done. I promise. There are just other things pressing upon my time just at the moment.

Hi Golem,

Can I just quickly point out the graphs aren’t showing, or is it just me?

I too have been wondering about this “netting out” myth. I have a friend who likes to gamble. He will place one large bet, usually odds on, that will pay back his other longer odds should they lose. It is amazing how many times his banker bet fails.

And how appropiate that name “banker bet” is. How many positions are held by banks that they see as unable to fail? The next failure can only be just round the corner. Bank on that.

Bill40: Not just you Bill40. No graphs showing with me neither.

thanks to people like you the financial world has been exposed for what it is. an ever expanding parasite amongst our breed,controlling our minds to satisfy it’s needs.

they have us brainwashed en masse.

It looks like it’s a TIFF image and (for me) Google Chrome needs a plugin to display. Probably other browsers too.

Robert

David – the word your looking for in engineering terms re: stability of movement in mass, is modulus Though, personally, I wouldn’t prostitute the profession of engineering with banking.

As yet I’ve only glanced through your post but as far as your proposition goes we are flogging a poxed horse close to death.

John,

maybe you’re right. Perhaps I am going over ground that is too familiar for people. If you prefer I’ll cancel the other parts I was planning.

Not at all David – your posts are grist to the mill.

My comment was in reference to the system not the post.

Sorry I misunderstood your comment. I do worry about going over familiar ground. The problem is that the banks and their crony politicos do nothing but. It’s Ground Hog day with wankers.

Please do not worry about going over ground… its hard at times to grasp what might for some be essentially simple. I personally find your analogies very helpful and there are times when its like sitting at the back of the class and hearing the explanation and not understanding a thing until one has read it a few times

Moreover whatever is almost obvious to us by now by dint of beating into our brains… like what a CDO is and so on remains completely unknown to 90% of the general public.

I have noticed that people are fast becoming more financially literate and this process is all part of that.

Understanding is Power in this context. It is the essential first stage of the revolutionary process

…also known as cutting through the crap.

The points you raise with banking are valid and I do not dispute them. However, I take issue with your claim that ‘there is no systemic risk with welfare spending, no matter how large’. That could not be further from the truth.

Just because a fee is predictable does not make it affordable. In case you are unconvinced of this, I refer you to the current state of financial affairs in Greece, Portugal, Italy and Ireland.

Countries whose governments have overspent are now in the hurt locker because taxes are being increased and government spending apparently reduced to electorates who up to press have only known government largesse.This is hurting those economies, where a triple whammy of tightened lending, increased taxation and reduced government spending is squeezing business, where many small business’ are now failing.

Also, governments collectively bear some responsibility, in both EU and US, where government oversight was either almost non-existent or governments were complicit in easing credit control legislation. Banks are like people that way – if you let them, they will do it, whatever it is you allow. Also, if governments had not been profligately spending their income, they might be in a better position to create recovery conditions.

Alas, governments are as culpable as bankers. And, given there have been several elections in the last 20 years, so are those electorates who have happily wallowed in government largesse (Greece) or given their governments are free ride for the duration (pretty much every western electorate).

I guess my point is that although banks have played a large part in creating this situation, so did most western governments directly and their electorates indirectly.

Yes changes need to be made to the banking sector – but they also need to introduce controls on government spending so they can’t hock the country into debt that will paid by the following two or three generations!

QLD Sceptic

Thank you for those thoughts, I feel however that the relentless propaganda has impacted on one aspect of your argument:

”government spending apparently reduced to electorates who up to press have only known government largesse.” (Greece, Portugal, Italy and Ireland).

That charge most definitely does not belong to Portugal, Italy and Ireland. Italians have learned over many years that they cannot rely on the state for anything. Portugal is ridden with poverty and holds the distinction of being the most unequal nation in Europe (the UK is second). And Ireland of course was the neoliberal posterboy.

What all those economies have in common is the fact that their elites do not believe they have ANY responsibility to the rest of the nation. Massive tax evasion, systemic corruption and bank bailouts have been a factor in all those nation’s problems.

The Scandanavian countries have excellent social systems – the key difference is that everyone there pays for them.

QDLSceptic,

Using the word ‘overspending’ is also a sign of received thought.

There are other perspectives. We could say ‘undertaxed’ or ‘under collection of tax’ or ‘over-evasion of tax’.

We could talk about state complicity iin denuding itself of revenues, we could talk about deliberate policies of unemployment as a counter to inflation which lies at the heart of all our problems with funding welfare systems.

But ‘overspending’ is presumptive : that any state spending is ‘waste’ which could be used in some other more useful way. But that usually means even more tax cuts for the richest and well-off.

@ John Souter & Golem

One of the risks we run here on a daily basis is, I fear, an over-reliance on metaphor and analogy to express ideas and concepts for which we, as “amateurs”, lack the correct vocabulary.

This is no surprise. We use what we have to deal with the matter in hand, and as a group we lack the formal training in the field of economics that would allow us to confidently and casually trade in the jargon of that profession. Analogy/Metaphor is often all we have, so instead of the compressed and reduced “jus” of a dialogue between professionals we are forced to resort to more convoluted means of description. Not always, but sometimes we end up with broth, not “jus”.

This puts us in danger of talking at cross-purposes and, even worse, at risk of talking rubbish!

Golem is, I feel, quite right to be cautious as to the suitability of his analogy. I say this not because I know the analogy to be unsuitable per se (I myself lack the skills to decide that), but because analogy/metaphor is inherently risky and open to misinterpretation. My studies in the field of the Arts taught me that!

This should not be taken as a criticism of analogy/metaphor as a working method, but rather as a caution. At its best analogy gives an opportunity for the uninitiated to glimpse “behind the curtain” and gain an understanding that was previously concealed. At its worst its flat-out deceptive and as likely to lead one on a wild goose chase as to lead to wisdom & enlightenment!

We have, I am sure, no shortage of talent here. We have no shortage of passion & commitment either. Intelligence, imagination, anger and insight are freely exhibited here on a daily basis, above and below the line. We have people here who have indicated skills that span a wide and varied terrain, and that constitutes a considerable resource.

We are also a veritable Tower of Babel, and finding a Lingua Franca is sometimes difficult. When we stray outside our individual areas of expertise we make ourselves vulnerable to mis-information, and by now we should all be aware of the dangers of information assymetry!

My concern is that much of the value of what is said here could be lost by a careless and ill-considered metaphor that costs credibility in the eyes of a wider audience.

So… keep using the analogies, and if anyone spots a wrong ‘un then sing out loud & clear. (In the polite manner we’ve all come to expect around here, of course!)

If John is right about “modulus” then let’s hear a confirmation from one of you engineering bods out there. Anyone…?

If John is wrong… ditto. (I’m guessing he’s right, fwiw, but I know zip of value about engineering!)

As a demonstration that analogy/metaphor may enable us to see things ahead of the curve, cast your mind back to one of the most popular posts here: namely Rehypothecation.

Then see what a fairly mainstream commenter had to say a coupla weeks ago.

http://www.mindfulmoney.co.uk/wp/peter-j-r-morgan/rehypothecation-should-be-banned-or-at-least-capped/

John is on the right track with modulus, but I prefer the analogy of a “detailed balance” This is a term used in statistical mechanics and chemistry to explain how reactions remain in equilibrium for long periods of time, providing the illusion of stability: numerous reactions in one direction balance numerous directions in the other. However, eventually, a tipping point is reached where the “system” lurches in one direction and becomes irreversible.

The butterfly has flapped its wings and now a storm is brewing. The financial elite are the storm chasers and we are the bystanders whose property and livelihood are being ravaged.

Yeah! Three beers for analogies!

Free beer for richgb!

Long time, no see!

Jim I’ll take the rap – however the use of metaphor is in great part and effort to expose a lexicon (and associated acronyms) designed to obfuscate through confusion then implied as an irrevocable fact by the practitioners.

Does it matter if an analogy is used to accurately make a point in an easily understood fashion – presentations, videos, cartoons – all make use of this in order to attract the attention of the layman and for him to make sense of the logic.

We are dealing with psychological alchemy here. A fact often verified by the confusion expressed in the use of such terms by professional practitioners and MSM commentators, while we on this blog generally recognise we’re in Yossarian country. A Catch 22 we didn’t want to be in but, by being in we have no authority to get out, and no idea where we are within it; while trying to untangle why we are where we are, many out there are still searching for the pros to prove the cons.

The only certainty I have is it’s a broth of alchemy I no longer want to sup.

Any way the modulus reference was meant as a quip/metaphor.

John:

Not intended as a rap, merely as a caution as to the potential down-side with metaphor/analogy.

The danger is two-fold but connected, I think.

For the “author” of the piece, the temptation to become a little too clever, a bit too pleased with just how well their metaphor is working. It’s just too damn tempting to stretch it that bit further. The danger is one of overload, to shamelessly pinch an engineering term. (If that’s inaccurate,I rest my case!)

This leads to confusion for both author and reader, yet we ALL do it sometimes. Just part of being human, I guess.

A similar but separate danger awaits the reader, who can get carried away by a powerful metaphor and proceed to endow it with properties wholly unintended by the author.

The shorthand version is: Metaphor and Analogy are not quite the same thing, but the difference is both subtle and significant.

The longhand version, sadly, would take us right back to where we came in; a barely-penetrable morass of jargon like “non-Marxist reification”.

How do we unpick all this?

Bloody carefully, that’s my advice!

I’m sorry about the graphs. I had huge problems getting them out of the original IMF article. In the end the only way I could do it was by using a programme called ‘Grab’. And you’re right it produces a Tiff file. I will try to resave as something else.

Hi David,

I have extracted those graphs and saved in a more suitable format (.png, smaller file size), let me know where I can send them to so you can include them in the blog post.

Thank you. I have been trying to change the images with zero success. I really am a cyber cretin.

Could you email them to [email protected]

I’ll see if I can get it to work.

PM sent

Just screen shot them and paste them into windows paint box, crop the but you want paste it into a new paintbox screen and save it as a .jpg

Or just find an 8 year old – they know what to do.

“All must serve the greater good. Or as it should really be known – the Good of the Greater.”

Brilliant, I must remember that,

Try Greenshot, it’s freeware.

Cant wait for the next posts, interesting as always

“banks are in the risk business” I think not -every time i asked they first wanted proof i could pay [ and some evidence of charecter] then collateral which would stand for the loan [at fire sale prices] putting all the risk on me. Just more propaganda.

Golem

Keep it coming, it might be familiar to some people but for others it isn’t & as a financial retard myself I always find something new in your articles to add to my pile of slowly collected Bankster knowledge. I really surprise myself now when I express it, I at least now sound like I know what I am talking about, I hope.

That Scottish terrier Ian Fraser on the Dastardly banksters & the FSA.

http://www.ianfraser.org/revealed-the-hornet-and-the-sting-which-are-stopping-us-learning-the-truth-about-the-collapse-of-hbos/

Totally agree, the current banking/money creation system is seriously flawed. Current tinkering gets us nowhere.

Just a thought, would it be useful to concentrate fire on one bank? Use this to illustrate the flaws in the entire system?

The bit I find particularly interesting is the banks creating the money as an interest bearing debt. How much does this extract from the economy? I have seen work suggesting 40% of the prices we pay are hidden interest and that much of our taxes go to pay interest.

No wonder we can’t afford to manufacture in UK if we have to pay labour enough to live and pay these levels of extraction.

here’s a link to a pertinent peice with more links over at naked capitalism

Absolutely fantastic blog. Only just found it so I have plenty to read in the archives. Will be singing its praises to all and sundry. This is the future.

I recently blogged about Government funding the F.A. and said:

“I guess it’s only a matter of time before, in addition to the bailout of banks, we offer them millions to sort out corruption in the industry.”

They wouldn’t call it corruption of course but I wouldn’t be surprised if all the calls for reform end with some sort of enquiry, at our expense, which will be a whitewash and allow things to carry on in the same way.

Meanwhile, business as usual at the ‘Too Big To Fail’ bankers jamboree [nice work if you can get it pt. 763]:

“Last week, the American International Group reported a whopping $19.8 billion profit for its fourth quarter. It was a quite a feat for a company that was on its death bed just a little over three years ago, so sick that it needed a huge taxpayer bailout.

But if you dug into the numbers, it quickly became clear that $17.7 billion of that profit was pure fantasy — a tax benefit, er, gift, from the United States government. The company made only $1.6 billion during the quarter from actual operations. Yet A.I.G. not only received a tax benefit, it is unlikely to pay a cent of taxes this year, nor by some estimates, for at least a decade.

The tax benefit is notable for more than simply its size. It is the result of a rule that the Treasury unilaterally bent for A.I.G. and several other hobbled companies in 2008 that has largely been overlooked.

This rule-twisting could deprive the government of tens of billions of dollars, assuming the firm remains profitable. The tax dodge, and let’s be honest, that’s what it is, also will most likely help goose the bonuses of A.I.G.’s employees, some who helped create many of the problems that led to its role in the financial crisis.”

Andrew Ross Sorkin: http://goo.gl/Tmuzm

Meanwhile: Mary Schapiro (SEC) defends settling fraud cases to protect banks from civil claims:

“People won’t settle with us if they have to admit” wrongdoing, Ms. Schapiro said, because it opens them to liability in civil damages lawsuits.

http://goo.gl/UXP5s

See: Keiser Report: http://youtu.be/9Z58e-sEzWo

See: Michael Hudson: http://youtu.be/InQ7l4Nv1YE

Regarding the above comments on the use of metaphor, I don’t agree. I have to say that the metaphors and analogies are a way in to this subject for people like myself who find this arena otherwise impenetrable. Whilst I can see that injudicious use could lead us astray, that hardly seems to be the case here. The literary style of this blog is part of what makes it a joy to read.

Ex-Scotland Yard Fraud Squad officer Rowan Bosworth-Davies has been in rich form recently:

http://rowans-blog.blogspot.com/2012/02/liars-damned-liars-and-city-bankers.html

”Liars, Damned Liars and City Bankers

Unless you have been on some remote island without access to communications, you cannot have escaped noting that there is a significant backlash in the media and in financial circles against the wholly justified complaints about the Financial Sector for the way they have mistreated their customers, repeatedly engaged in fraudulent practices, paid themselves obscene bonuses and generally conducted themselves in a manner which is guaranteed to generate disgust and antipathy among right-thinking people.

The backwoodsmen have come out of the trees and have started their predictable calls for a cessation of ‘City Bashing’ for fear that it is likely to ‘damage the good name of the City of London’! Foreign business won’t want to come here to work, we are told, if they get the feeling that the British people are ‘anti-business’! Don’t take any notice of these protestations, there was some tame back-bench M.P or industry spokesman saying exactly the same thing at the time of the South Sea Bubble!

The financial sector, we are told, is responsible for earning huge sums of money for the benefit of the British economy, and their profits go to maintain a high degree of tax revenues for UK plc.

Well, that’s what we are told, and it is a persuasive argument, I mean it’s difficult to argue about the Corporation Tax that these institutions must be paying!

Well, I don’t think anyone who points out that the financial sector is run by a gang of spivs, wide-boys, dodgy croupiers and con-men is necessarily ‘anti-business’! Anti-liars however is another matter all together!

I am not apologising for these hard words, because today, we have been entertained to another classic case of Banker’s lies, and guess what, they are all about tax!

It seems that HMRC have clamped down on two shoddy tax avoidance schemes that were being adopted by UK banks. In the present case, Barclays Plc said it was the bank at the centre of two tax avoidance schemes, loopholes that the government had said they would close and raise more than 500 million pounds in tax that would otherwise have remained unpaid.

Barclays said it had notified Britain’s tax office about its plan to buy back its own bonds, on which it and other banks have made hefty profits in recent years. Well, there’s nothing particularly admirable about this, anyone seeking to promote a tax-avoidance scheme has to run it past H.M Treasury first, so Barclays were only doing what they were supposed to do anyway, although it is interesting to note that Barclays had already started to adopt the use of the scheme, prior to seeking approval! Perhaps they hoped that the Treasury wouldn’t grasp the nettle and legislate retrospectively!

The Treasury said on Monday the scheme and another one were “highly abusive.” That is putting it mildly. These were nothing short of an attempt to create a wholly artificial tax-avoidance scheme, and at a particularly hard time when the Government is expecting the rest of us to pay our fair share to get us out of the financial mess the bloody banks created in the first place!

Why do I accuse the banks of gross mendacity?

Well, Barclays and other banks have signed up to the Banking Code of Practice on Taxation, which contains a commitment not to engage in tax avoidance. They have now been shown to have broken that code and that was ‘unacceptable’, a Treasury spokesman said! He went on;-

“All the banks have signed a code of conduct, they have said that they wouldn’t be engaging in aggressive, artificial tax avoidance arrangements of the sort that we have seen disclosed to the HMRC, and in those circumstances, when we were aware of what this bank was doing, it is right that we took strong action,” he added.

The Treasury is willing to shut down more bank tax loopholes schemes, Treasury official David Gauke said on Tuesday.

“We are willing to act because in these particular circumstances the behaviour is not acceptable and we are prepared to step in,”

More damaging however than the financial hit could be the reputational damage. Only last November, Barclays boss Bob Diamond was pontificating on the need for banks to accept responsibility for past mistakes and show how they can contribute to society and economic growth to improve their standing with the public.

This is the sort of thing bankers say in public! What they do in private is completely another matter, as this shabby exercise of fiscal dodgy-dealing demonstrates.

The Treasury spokesman said;-

“I suspect the bank in question is regretting what it has done. It’s not going to do them any reputational good and they’ve not made any money out of it,”

That’s all very well, but it does not punish the banks enough for this shameless attempt to get out of their responsibilities to the country. Remember, banks are underwritten by H.M.Government, well, no, actually that’s you and me who have to cough up if they look like failing. There is a price for this unique privilege, which is that the greedy bastards pay their taxes, in full, and on time.

What all this tells us is that they still don’t get the real picture. They still haven’t understood why so many ordinary, hard-working people, hate them so much. Cameron and his cabinet of millionaires need to wake up and realise that these continuing examples of double standards and fiscal sleight of hand are seriously damaging the perception of legitimacy that banks and governments need, in order to stay in business. That legitimisation comes from the people, and if they begin to get the impression that all the banks’ protestations of honour and commitment are just another bunch of cheap lies, which is what they have just been proven to be, then they will rightly withdraw their willingness to accept anything the financial sector says, and they will carry on bashing the bankers for all they are worth, and rightly so!

So, let us start by recognising some unpalatable facts before we consider easing off our criticisms of the Square Mile.

Remember how much we are told the banking sector contributes to the tax take of this country? In 2011, our banking sector contributed only 7% of Corporation Tax receipts to H.M Treasury, yes that’s right, the munificent amount of 7%! Mind you, 30% of the FTSE 100 companies paid no Corporation Tax at all, so we should be grateful for small mercies, but whichever way you look at it, it wasn’t very much.

HMRC have done us all a very good service by this unusual exercise in retrospective tax clawbacks. They have not only recovered a figure close to half a billion pounds in unpaid tax, but they have demonstrated, in the clearest of terms, what a bunch of lying, cheating bastards are running the UK Banking Sector, and have confirmed the wisdom of keeping up the pressure on their wrongdoings and exposing them at every turn!”

Phil – I think RBD is about right in his analysis with one small exception.

It’s possible this figure of £500 million is merely a headline publicity stunt and as such the alleged ‘money’ will never see the inside of a treasury vault.

Of course, if ‘netting out’ worked in practice as it does in neoliberal theory we wouldn’t be in this mess.

As Greenspan half admitted, there’s a ‘…. flaw in the model that I perceived is the critical functioning structure that defines how the world works, so to speak.’

i know this is off topic, but does anyone know who this is about? its from a report in the Heily Telegraph.

“The 13-page submission from Channel Islands businessman Mark Burby claimed he had been gagged by the “ex-spouse of an Asian head of state” in a super-injunction in 2009.

He said the “Asian head of state” was a “substantial” backer of al-Qaeda, and had advance warning of the suicide bombings on London’s transport system in 2005. “

google Tony Farrel

No, that’s silly trufferism.

Synopticist,

off-topic indeed, but your quoted case features a Mrs A, who also featured in a ‘very unusual case’ featuring the Royal Bank of Scotland:

[2007] EWHC 91 (QB)

A v Aziz & Ors

29 January 2007

[Search on BAILII]

Tony Farrel is, of course, an obfuscation

Thank you.

A guy as rich as him supporting al qeada is an eye opener, regardless of his clearly loopy, bullying ex-wife.

Golem,

I’d like to add my own appreciation to the positive comments above & I’m looking forward to more in this series.

A couple of interesting items for the MMT followers here.

First is the news that a weekend conference/workshop dedicated to MMT has just taken place in Italy, attended by over 2,000 people ! WOW! People travelled from all over Europe. It was held in a sports stadium (wow again!) with MMT lecturers flown over from University of Missouri Kansas City. (Stephanie Kelton, Bill Black, Marshall Auerback, Michael Hudson)

“….we gave a number of TV, radio & press interviews over the weekend, but were told that many mainstream media had been instructed to ignore it…” – Hudson

Second item is just an especially good piece from Randall Wray, in UMKC’s MMT Primer series. Well, two items really. The first on the myth of the oft quoted “…invisible hand..” (of the ‘markets’) wrongly attributed to Adam Smith. The second an outline of differences & common ground of MMT vs Austrian School economics. (The latter a very useful reposte to ‘Austrians’ spouting forth on comment forums.)

http://www.neweconomicperspectives.org/2012/02/mmp-blog-38-mmt-for-austrians.html

I would like to add my support for this series and make a few points in addition.

The analogy is a sound one, though, as others have stated, we must take care with analogies. The danger with analogies, generally, is when we attempt to extend them. However, let’s examine our analogy as it currently stands.

In the case of the people in the boat, an obvious retort would be that a more accurate analogy is thousands of people on a cruise ship. People can move about at will, and even all move to one side of the boat, and it will not capsize. Of course, the reality lies somewhere in between the two poles of 3 or 5 people in a canoe versus thousands in a cruise ship, and there is the trouble with our analogy — how do we tell which pole we are closer to. Once we ask that question we are sunk 🙂 because then we must use financial jargon and concepts like capital bases etc. to argue about pole position. Or..

We can avoid that quagmire. There are two simple parts to the argument that sidestep these issues. The first is that we were clearly closer to the 3-5 people in a canoe in 2007-08 as the entire system was about to sink — the boat was way tippier than the pilots ever let on, and they were clearly incompetent at determining exactly how tippy. This point is key. The second part of the argument ties in with neoclassical economics and the notion of netting. From my readings over the past few years it seems that one of the many weaknesses of neoclassical economic modeling is that TIME is rarely if ever factored into the models. All events are modeled as if they happen at one point in time. In our boat analogy, given that the boat is extremely tippy as evidenced by the crisis, and given that all our netting of balancing forces (hedges) do not get calculated and paid out at the same time, it is clearly possible for the boat to tip, even from modest imbalances. Lehman’s insolvency was all about timing — they were using overnight funding to backstop a massive hole in their balance sheet. It was the timing of their debts that killed them as much as the level of their debt. Its telling that banks ignore time in their netting fantasies because time is what kills them — their very business model — borrowing short term and lending long, makes them especially vulnerable to timing issues.

Of course, even this terribly unstable boat assumes factors that weren’t true in ’08 — namely that the wonderfully netting hedges were reliable (ahem, AIG, ahem), and that there wasn’t massive fraud buried in the “assets” (MBS, CDO, CDO-squared, synthetic CDO, CDO-cubed… all consisted of a core of almost completely fraudulently valued assets).

I would also argue that the (a) way to imagine the stability of the boat, whether it was a cruise ship or a canoe, is via levels of leverage. The more leverage, the more tippy the boat.

In software design, and complex systems generally, we attempt to decouple key points as much as possible so that they have as little chance of dragging each other down as possible. The concept of orthogonality comes into play. A canoe is a terribly non-orthogonal device. A shift in forces at the back side of the boat makes the whole thing change direction. This phenomenon is used to steer a canoe from that single point. More insidiously, one person leaning over the side can cause others to lean over the side, and all of the sudden, we’ve flipped over.

Our financial system is the most horribly non-orthogonal system I’ve ever encountered. All of these entities taking on massive leverage and using each other as counterparties for hedges and bets, with tentacles extending into and through the entire real economy… its no wonder they routinely (from a historical perspective) bring down large parts of the world economy. Combine that with the myriad and multitudinous opportunities for fraud, graft and sundry corruptions, and its pretty clear that humanity is doomed unless we come up with a better and more transparent system for “funding” our world.

Keep up the great work golem. The world needs people like you more now than ever.

That there is a great extension of the original canoe analogy. Kudos.

And, indeed it is a great shame that pretty much the entire commercial banking system is run in exactly the same fashion, thereby rendering them all to exactly the same systemic failures.

Surely you would think that there were a few big shining lighthouses out there that could see the potential wreckage in neoclassical financial theory that never recoginised Time itself – Time being the only value we can ever completely trust. Fascinating really, when you think about it.

Surely there were some big knobs in suits out there who saw the virtues in systems that could shift and move with Time. The attempt to adopt a system that is as flexible as human nature itself, however impossible that may sound, to me sounds like the only way of chasing a system of sustainability – and one not centred around constant growth.

But no, they were all in on it. Amazing.

Okay – let’s try some examples.

The Manipulators —–

“We are grateful to The Washington Post, The New York Times, Time Magazine and other great publications whose directors have attended our meetings and respected their promises of discretion for almost forty years. It would have been impossible for us to develop our plan for the world if we had been subject to the bright lights of publicity during those years. But, the world is now more sophisticated and prepared to march towards a world government. The supranational sovereignty of an intellectual elite and world bankers is surely preferable to the national auto-determination practiced in past centuries.” – David Rockefeller, founder of, and in an address before, the Trilateral Commission, in June of 1991

“Our job is to give people not what they want, but what we decide they ought to have.” – Richard Salant, former President of CBS News

“The business of the journalist is to destroy the truth; to lie outright; to pervert; to vilify; to fawn at the feet of Mammon, and to sell his country and his race for his daily bread. You know it and I know it, so what folly is this toasting an independent press? We are the tools and vassals of rich men behind the scenes… They pull the strings… AND WE DANCE.” – John Swinton, former chief-of-staff for the New York Times, in an address to fellow journalists.

“When you control opinion, as corporate America controls opinion in the United States by owning the media, you can make the [many] believe almost anything you want, and you can guide them.” – Gore Vidal from The Golden Age.

A small selection from many statements by influential insiders.

Others can be found in the words of central bank chairmen and CEOs. Even Mervyn King can be quoted as saying “the present system of Banking is the worst possible.”

My question is – if the ‘insiders’ know yet choose to do nothing about it other than continue to profit from it, what does that make them – vultures or predators?

The next is – when do we accept the bitter truth and action our rejection? Because, if we do not, we are no better and equally complicit as the ‘insiders’ who administer its potions.

Those are some truly chilling quotes, John.

In all that I have read, both on this blog and on others, I have yet to come across a cogent plan – nor even a suggestion – of how we go about changing things. We seethe, we rant, we vent our spleens, we spread the word to others that we deem receptive to our alternative message. And even then, many do a piss-poor job of it.

Yesterday morning, for instance, on the radio they were interviewing a chap from the Occupy London protest camp prior to their being evicted. The news presenter patronisingly characterised them as anti-capitalists and mentioned Stalin in passing. And then, in a fit of balance, the presenter actually asked the protester what he was protesting about – the guy actually had the opportunity to tell a couple of million listeners what it was all about…

I was embarassed to listen to his waffling drivel. All he could do was mention ‘fairness’ and ‘natural justice’. I groaned. Another opportunity wasted.

This blog is wonderful. Please don’t stop. But, my fellow Golemites, we need to start putting together shorter, snappy messages/questions (sound-bites, if you will) to counter the main stream media’s bias. Here are a few of my humble suggestions…

1. On a finite planet, please explain how eternal growth is possible?

2. Why is interest charged on money loaned to business? If I borrow £1000 at 10% for my business, my business must grow at 10%, just to remain viable. The charging of interest demands growth. Growth on a finite planet…

3. How are huge interest rates on credit cards or ‘pay-day’ loans even legal? I thought higher interest rates were supposed to reflect greater RISK on the part of the lender. Yet the lenders have legal power to enforce the payment of debt PLUS INTEREST through reposession, bailiffs and the courts. So where is the increased risk?

4. If I lend you £1000, I take the risk that you might not pay it back. If you don’t, I lose that money. I can’t go to the tax payers of this country to demand they pay me back on your behalf. The Banks took the risk of lending billions – for example to Greece. And now that the Greeks can’t pay back what was lent, the Banks are demanding that all the tax payers of Europe pay them so they get their money back. Oh to be a Bank!

5. The government is trying to get back to growing the economy, demanding that the Banks lend to businesses and home owners. In other words, let’s go back to the way things were before all this started. Definition of stupidity: doing the same thing and expecting different outcomes.

Come on people, you all can do way better than I can. Let’s start generating shorter, simple messages for the lay person to understand, so that when we have an audience, we can actually start turning the tide. Otherwise we risk just sitting in the corner nursing our grievances.

i suppose one option would to get heavilly involved in the Occupy movement, so that when the oppotunity comes to speak to millions of listenners, theres an intellectual adult available, able to formulate a coherent message.

Occupy will be back this summer, i’m pretty sure of that.

Hobbit – do you ever consider this contribution was chosen by the broadcaster while more relevant and lucid comments languished on the editing room floor?

I was embarassed to listen to his waffling drivel. All he could do was mention ‘fairness’ and ‘natural justice’. I groaned. Another opportunity wasted.”

Happy,

I have to second your stance. Our role here on this blog and elsewhere is to first make people understand the mechanics of what is happening and then tell them what can be done about it.

Of course, the “doing” part is not painless.

But if you think that making people understand the mechanics is hard, you will find that making people understand that passivity will eventually be more painful, is even harder.

The doing something is actually rather simple. This monetary system, sponsored by banks and enabled by politicians, is predicated on inflation. Throw a spanner in the inflation machinery and you take down the system and paralyze politics.

Of course, crimping the expansion of credit markets means material sacrifice on the part of everyone of us. Thus it means a deliberate decrease in our life style… such as it may be. Crimping the expansion of credit and the monetary base means that we should shun the global banks in favor of local and/or cooperative banks. Crimping the system means that we should save more and/or buy coins and ingots of gold and silver thereby decreasing the velocity of circulation of the currency. Crimping the system means closing all lines of credit like mortgages, credit card or vehicle financing for example.

The advantage of the individual citizen in this type of sabotage is that we can exploit the inherent leverage of the fiat monetary system in reverse. If we play the game as the banks and politicians have rigged it, they make use of leverage against us. If we collectively stop playing the game, we reverse the power of leverage unto them.

When an entity is leveraged 20 to 1 or 40 to 1, as is today not a rare case, relatively small changes in percentage in the capital base of banks will force their demise. If JPMorgan is leveraged 40 to 1, a 2.5% decrease in their capital base will blow them out of the water.

The difficulty in this strategy is that most people that may still have any wealth left are wont to close lines of credit preferring to see where the chips may fall. On the other hand, those that have nothing left and live pay cheque to pay cheque feel they cannot make do without credit. All the above may be reasonable assumptions on the part of these individuals but what they fail to realize is the arithmetical inevitability of this crisis that is now clearly a crisis of the monetary system and that, if history is any guide, will likely result in a good old fashioned conflict. You know, the kind of conflict that will see the masses drafted into the army and sent to the front along with the rationing of food and energy at home…

I hope I am wrong but I don’t see how else this particular monetary system which is 100 years old can be maintained without some drastic social, political, economic and fiscal action that will require the obliteration of industrial capacity on a planetary scale.

John Souter

I was actually having a chat with a friend last night on the vulture/predator question. We were framing it more around whether the current ‘badies’ (bankers/neocons/military industrial complex/whatever) were the architects (at least genetically through some sort of banking dynasty) of the economic structure we have now, or actually just the sort of people who will naturally be rewarded and hence successful within such a system.

The thing is we’re both on exactly the same side with regards to the effects of the current system and the fact that it is broken and needs fixing. So what does it matter if they are vultures or predators? Does the answer to that question change any action we might/should undertake?

I don’t think there’s much of a distinction: vultures will predate sick and wounded animals.

They are both. They predate on the people, leave carnage in their wake, and then come back to pick at the corpses for whatever remains.

The way I look at it – generally vultures wait for the scraps off the predators efforts.

Example – The Bilderberg hosts – Rothchild’s, Saudi Royal’s and global CEOs of any discipline et al -predators.

Politicians, board directors, editors, journalists/presenters – vultures.

How do we go about countering it?

I’m working on that at the moment – I don’t think demonstrations alone will do it. For most they’re impractical,, show very little gain and are often aggravated by authority then presented as riots.

It’s is my opinion we have to reverse the weapons they use against us which in most instances is the use they make of law to threaten and cajole us into submission.

The ‘They’ have money and power and have bought the State – So we can forget our government.

We know their power is bought by money that costs them nothing – So when we act individually or even in a minor way (10 -20- 50,000) it’s a mediocre threat and one they’re already immune from.

Their Achilles heels I reckon are their banks and the governments. We need to attack both with a combination of civil disobedience and law suits. Nothing complicated and spectacular, they out gun us on both counts – but a white noise of annoyance, debilitating by its continuance and cheap (possibly profitable) in their application..

All ideas, thought’s, options welcome – shooting, hanging and attacks on the person excepted.

Its possible it is already happening without people really realizing. I read yesterday in the Guardian that ‘after years of low productivity, UK companies are attempting to increase output per unit of labour. Former defence minister Liam Fox said it was the single most important improvement that could be made and laws allowing a hire-and-fire ethos in the UK were necessary for sustained growth because the more a worker produces from the same investment in plant and machinery, the bigger the potential profits.’

If it is true that labour productivity has dropped (I am not sure it is true) then possibly workers are reacting to poor pay and poor working conditions by withdrawing their good will. I know that companies hate it when unions organize ‘work to rule’ actions because it does have a major effect on productivity. Perhaps people are working to rule without it being officially organized?

Nell

This article is a bit of an eye opener. Working in an online retailers warehouse in the US. From what I can gather it’s pretty bad in the Amazon place in Cork, but not quite so bad in the UK. Definately Chinese style work practises, it kind of reminds me of what workers in the Great Depression were forced to do, dying of heat exhaustion on the Hoover dam for instance.

http://motherjones.com/politics/2012/02/mac-mcclelland-free-online-shipping-warehouses-labor

The race to the bottom continues…….

Nell – its possible but not a positive response – as Fox illustrates the fear of hire and fire shows quicker results than aspiration encouraging motivation.

But here’s a possible strategy for those that want to protest.

Forget chants, placards and dressing up for a protest. Equally do not request permission for a protest. That way the authorities have made provisions and take control.

Organise initially by snail mail to individual organisers districts and communities which includes a simple diversionary code as to intended location ie Newcastle means London. Organiser then passes details to 4 individuals preferably by land phone, these pass the details another 4 now 16 who then repeat the process.

Any transport arranged does not go in to the target city but drops off in the outskirts and the protesters use public transport.

Once they reach the location they do not converge but mingle with the normal pedestrian traffic, until at the predetermined time they simply sit down, remain quiet and create traffic chaos.

And, if asked by authorities or media as to what they are doing they simply answer “What do you think.”

I would just like to take this opportunity on behalf of myself & all the contributors to this blog, who I think would agree with me on this point:

An apology is in order to any rat, vulture, pig, cockroach, slug, weasel or any other of our animal friends who might feel insulted because of the comparison that is often made between themselves & Bankers, bondholders, media tycoons, corrupt politicians & the brown nose brigade.

We fully realise that our animal cousins are creatures of instinct who have, at no fault of their own, arrived at an evolutionary level, in which decisions are limited for them in finding a means to survive & therefore to procreate, this behaviour, however unknowingly, benefits their species.

Perhaps if a pig, were to indirectly slaughter his own species for profit & power, subject whole nations to drudgery, grow immensely fat & rich while millions starve as the resources for children yet unborn are looted to feed the same bottomless greed, perhaps that pig would be deserving of being insulted by being called a Banker or another name from the above list who are empty selfish miserable versions of all that makes human beings & their cousins the animals, worthy of a place in this universe.

Stevie – Agreed.

I’ll visit the zoo tomorrow and render my apologies.

Stevie: Agreed.

John: How about we take a few bankers/politicians to the zoo, and let the big cats just rend them!

[ Rend:-

Verb:

1.Tear (something) into two or more pieces.

2.Cause great emotional pain to (a person or their heart). ]

Stevie – most animals are choosy in regard to their diet and as an animal lover I would hate to poison them.

Besides even the big cats would only manage one banker per day!

And I should add, the ‘render’ in my previous post should of course read tender.

And it’s too quick. I’d rather ban them from ever holding even a modest managerial position or from being involved in any business, even self employed and condemn them to a lifetime of penury that they in their elitist riches thought we so richly deserved.

But John, “render” is more literary.

Print a load and plaster ’em all over the place! (boom tish)

Homo fiscus: a sub-species of modern humans characterised by its lack of herding instinct and its distinctive call that sounds like “Gimme! Gimme!” The male of this sub-species is noted for its amazing array of penile substitutes, whereas the female typically demonstratea an obsession in auto-augmentation.

There’s no doubt a paper along the lines of ” Social Observation in Modern Media, with Emphasis on Animation” being written somewhere right now, m8!

http://www.youtube.com/watch?v=eNiR5ZTb_MA

http://www.youtube.com/watch?v=J6d4kCdbLc0

http://www.youtube.com/watch?v=eA_HDzf-17Y

Not by me tho!

‘Britain on path of bankruptcy’

A prominent professor says UK’s economic and financial model is a failure amid Chancellor George Osborne’s announcement that the country has run out of money.

Press TV has conducted an interview with Rodney Shakespeare, professor of binary economics, to further discuss the issue.

Excellent link!

This learned man is frank and leaves little room for doubt regarding his dire warnings about the future of the UK economy. Unfortunately, what he says that George Osborne should do will never happen; it’s all too late. Have the academics suddenly woken up?

The alternative therapies have been tried, but the cancer is still growing. Toxic debt requires a bitter pill. Currently, the phrase “this is hurting me more than you” certainly holds true for the sticking plasters being liberally applied.

‘…banks are in the risk business…’

It is beautiful isn’t it?

But the most beautiful irony in it is that so monumentally poor is the job that they have done in the risk business, that they were able to take a stranglehold in the governing business.

Our elected representatives falling under the fantastical spell of ‘too big to fail’ should never be far from the front of our minds when formulating plans for future change. The Fed backed the ECB and BoE at critical points, allowing them to act as standover men and pose the threat: this is what will happen if you don’t.

Any plan should be a multi pronged attack – a beast – the Seven Headed Hydra.

And, in my opinion, this multi faceted approach should not ignore the one language banksters understand. Money. The de-consolidation of power should begin at a local and fundamental level. People need to remember to vote with their wallets.

It is interesting to discover what the State of Massachusetts launched a commission into in 2011 in an attempt to create somewhat of a safety net in liquidity for future crises.

http://www.bos.frb.org/economic/neppc/researchreports/2011/rr1102.htm

An interesting phenomena in the financial world the MSM does not really talk about, but being able to store our collective money in a facility for the good of the people must be part of the plan. We become hypocritical if we don’t, and self serving for the greater good if we do.

Corrupt, centralised power needs to be questioned via the very conduit they took the power. Big banks are not representative of us, and we need to show it.

The rise and rise of the co-op.

just to add from Ellen Brown, one of my favourite monetary reformists:

hot off the press.

http://www.atimes.com/atimes/Global_Economy/NC01Dj02.html

“… We may not be able to beat the banks, but we don’t have to play their game. We can take our marbles and go home. The Move Your Money campaign has already prompted more than 600,000 consumers to move their funds out of Wall Street banks into local banks, and there are much larger pools that could be pulled out in the form of state revenues…”

This too is part of the credit cycle.

The point is that while the credit cycle is well known now, it is ignored, hidden and ridiculed with the famous phrase: this time it is different. It never is of course, but if those who have something to lose do not protect it, why should anyone else care?

The whole point of a welfare state, dole and circuses, is to keep the mob quiet while those, who think they know what is happening, get on with losing their money, often in surprising ways.

True, it is destabilising, as the French monarchy found out. That just introduces a greater element of risk. It is natural therefore that those who wish to reform society will use the credit cycle to crack open the weak areas and enable them to infiltrate. As we know, those changes that do not suit are discarded while those that “promote” remain.

Removal of certainties provides motivation?

unintentionally or not, think you were on the money with “render” –

ren·der1 [ren-der] Show IPA

verb (used with object)

1.

to cause to be or become; make: to render someone helpless.

2.

to do; perform: to render a service.

3.

to furnish; provide: to render aid.

4.

to exhibit or show (obedience, attention, etc.).

5.

to present for consideration, approval, payment, action, etc., as an account.

6.

to return; to make (a payment in money, kind, or service) as by a tenant to a superior: knights rendering military service to the lord.

7.

to pay as due (a tax, tribute, etc.).

8.

to deliver formally or officially; hand down: to render a verdict.

9.

to translate into another language: to render French poems into English.

10.

to represent; depict, as in painting: to render a landscape.

11.

to represent (a perspective view of a projected building) in drawing or painting.

12.

to bring out the meaning of by performance or execution; interpret, as a part in a drama or a piece of music.

13.

to give in return or requital: to render good for evil.

14.

to give back; restore (often followed by back ).

15.

to give up; surrender.

16.

Building Trades . to cover (masonry) with a first coat of plaster.

17.

to melt down; extract the impurities from by melting: to render fat.

18.

to process, as for industrial use: to render livestock carcasses

especially liked the penultimate solution.

MUST READ from Satyajit Das on the continuing blind allegiance to a failed ideology:

“… even now it is hard to find fault with the concept … as opposed to the practical application, of many of the most demonised products.”

“Average investment periods for shares have shortened from around 7 years to 7 months since 1940. HFT now accounts for over 60% of equity trading, with an average holding period of around 11 seconds.”

“The discussion may remind the reader of an observation of Groucho Marx: “A child of five would understand this. Send someone to fetch a child of five”.

“There is no acknowledgement that much of what is called financial innovation is economic rent extraction, exploiting lack of transparency as well as information and knowledge asymmetries. There is no discussion of the destructive bonus culture which encourages certain behaviours in financial institutions. Thomas Philippon and Ariel Reshef have estimated that around 30-50% of the extra pay bankers received compared to similar professionals is attributable to economic rents.

In a January 2009 speech, Lord Adair Turner, chairman of UK’s Financial Services Authority, observed that: “Much of the structuring and trading activity involved in the complex version of securitized credit was not required to deliver credit intermediation efficiently, but achieved an economic rent extraction made possible by the opacity of margins and the asymmetry of information and knowledge between…users of financial services and producers…financial innovation which delivers no fundamental economic benefit, can for a time flourish and earn for the individuals and institutions which innovated very large returns.”

The unpalatable reality that few, self interested industry participants and their cheerleaders are prepared to admit is that much of what passes for financial innovation is specifically designed to conceal risk, obfuscate investors and reduce transparency. The process is entirely deliberate. Efficiency and transparency is not consistent with the high profit margins on Wall Street and the City. Financial products need to be opaque and priced inefficiently to produce excessive profits. The Report does not canvas this issue.”

“The risks were ignored. Alan Greenspan argued: “The lack of a spare tire is of no concern if you do not get a flat.”

“Professor Simon Johnson has pointed repeatedly to one cause of the financial crisis – the political economy of the financial system and the lobbying power of financial institutions. If the press becomes part of this political economy, consciously or subliminally, then the problems are exacerbated. Advertising and sponsorship revenues as well as control over access to information and key decision makers, deemed news worthy, are essential commercial links which make newspapers and media susceptible to being influenced.

Zdener Urbanek, the dissident Czech novelist, observed that assumptions about what was written are dangerous: “In dictatorships…. We believe nothing of what we read in the newspapers and nothing of what we watch on television, because we know it’s propaganda and lies. Unlike you in the West. We’ve learned to look behind the propaganda and to read between the lines and, unlike you, we know that the real truth is always subversive.”

http://goo.gl/MQ50K

Smart guy that Satyajit Das! One of the few like David who accurately predicted the GFC.

The New Priesthood: An Interview with Yanis Varoufakis Part I:

“So, how do economists respond when some real crisis hits? How do their account for the fact that when their model had left no room for it? The fascinating answer is that they assume the crisis to have been the result of a random ‘disturbance’. Something like a meteor falling on an otherwise harmonious Earth; an event that is to be untheorised per se. Then, they employ all their mathematical prowess in order to ‘study’ how the ‘system’ (i.e. capitalism) absorbs this shock. As you may imagine, the result of this ‘recovery’ path is founded on assumptions which can only yield one plausible answer: The process of adjustment to the shock of the crisis is best left to the markets which, prior to the crisis, were assumed incapable of causing a crisis!”

…

“Economics, I submit to you, is not much different. Whenever it fails to predict properly some economic phenomenon (which is more often than not), that failure is accounted for by appealing to the same mystical economic notions which failed in the first place. Occasionally new notions are created in order to account for the failure of the earlier ones. For instance, the notion of natural unemployment was created in order to explain the failure of the market to engender full employment and of economics to explain that failure. More generally, unemployment and excess demand (or supply) is ‘proof’ of insufficient competition which is to be fought by the magic of deregulation. If deregulation does not work, more privatisation will do the trick. If this fails, it must have been the fault of the labour market which is not sufficiently liberated from the spell of unions and government social security benefits. And so on. The fact that these ex post rationalisations of theoretical failure are narrated in mathematically complex language, and accompanied by myriad statistical ‘tests’, adds to their social power to silence critics without and doubts within.”

http://goo.gl/m5WN6

Agree. Good posts Charles (as usual!) 🙂

Agree with these points, although not all economists subscribe to the neoclassical or free market textbooks of course.

There are many economists that don’t subscribe to these views – unfortunately most are frozen out of the mainstream, see: http://youtu.be/1yOdicriZ4k for example.

Moreover, the economics has been politicised to serve an ideology which rationalises the self-interest of a small elite, for whom neoliberal axioms such as the ‘Efficient Market Hypothesis’, Ricardian Equivalence, and Rational Expectations’ theory serve a specific purpose – to negate the role of government and champion the market as inviolable, thus justifying the privatisation of welfare, the NHS and even the police force: http://goo.gl/Pdb9r

The logical conclusion of such market fundamentalism is the eradication of any public sphere subject to democratic control, in favour of ‘the democracy of the market’ – where the wealthy get the most votes.

Especially sums up the IMF who are attracting little attention in the West as they rub Sri Lankan fishermen’s noses in the dirt. One of whom was killed by police at an anti-austerity demo.

http://www.wsws.org/articles/2012/feb2012/sril-f16.shtml

Discovered Sophie Scholl tonight, she was executed by the Nazis aged 22, just over 70 years ago. She was part of the White Rose non violent resistance group. She wrote the following:

“The real damage is done by those millions who want to ‘get by.’ The ordinary men who just want to be left in peace. Those who don’t want their little lives disturbed by anything bigger than themselves. Those with no sides and no causes. Those who won’t take measure of their own strength, for fear of antagonizing their own weakness. Those who don’t like to make waves—or enemies.

Those for whom freedom, honour, truth, and principles are only literature. Those who live small, love small, die small. It’s the reductionist approach to life: if you keep it small, you’ll keep it under control. If you don’t make any noise, the bogeyman won’t find you.

But it’s all an illusion, because they die too, those people who roll up their spirits into tiny little balls so as to be safe. Safe?! From what? Life is always on the edge of death; narrow streets lead to the same place as wide avenues, and a little candle burns itself out just like a flaming torch does.

I choose my own way to burn.”

Sophie Scholl

Re: steviefinn’s post:

Good film on Sophie Scholl: http://goo.gl/Wyj54

A real life heroine.

Great piece! A few decades ago people called ‘quants’ began to be hired by ‘banks’ to design software that would allow them to ‘model’ markets, crystal balls to predict movements and thereby profit. The term ‘quant’ is key, because the concept of ‘netting out’ is a corruption of Heisenberg’s Uncertainty Principle.

Time & Energy are a pair of quantities that cannot simultaneously be assessed, this allows there to be ANY amount of energy in any instant but ZERO energy when averaged out over time.

Financially everything is okay if assets and liabilities zero out, there’s isn’t actually a vast amount of money but ANY amount of money can be made to appear, perform a service in this world, and then vanish back into the ether.

The trick is to ensure that, in the anhialation of money and anti-money, there’s something left over, just like the original big bang, for the financial alchemist to trouser. So far, so good (?!!)

The corruption of Heisenberg is that the alchemists, in this case the ‘banks’, refuse to allow any actual zeroing out. They took money AND anti-money from the ether and used BOTH to perform lucrative services in this world.

But they altered the fundamental nature of BOTH, and created a situation where they cannot truly ‘net out’. They have tried to keep transient virtual money in existance in order to continuously leverage it in this world.

This introduces a further corruption, as money / anti-money pairs are not being allowed to freely anhialate in order to zero the average, when the average is finally assessed there’s no reason why it should be zero. The system cannot collapse simultaneously, it must decay over time* but not necessarily smoothly. There’s no reason why there should not be wild oscillations and excursions to extremes, as the system strives to find zero. (*or with respect to some other metric)

Indeed the whole thing may resemble nuclear fission; a number of containers of unstable particles, in close proximity to each other; are subject to strong external stimulus.

Given that these unstable particles (assets) are highly similar due to refining (cross collateralisation of ‘banks’), a detonation is possible. ‘Bank’s’ contracts with each other serve as the momentum carriers that smash into other asset particles and cause the cascade that sends the whole lot up at once.

Of course there is also the possibility of nuclear fire, where everything melts down and keeps melting down, as long as there are still unstable assets particles to flare up.

So to defuse this bomb requires banks to carefully and gradually cancel out these contracts, making certain to do so without excitement and as symetrically as possible, one yell or tilt of scales could cause ignition.

Clearly the ‘markets’ must be sent home for a few months, and fitted with GPS leg irons so we know where they all are. Any trader in proximity to the bomb will be unable to resist the urge to take a punt on whether it’ll go off if they bet on whether it’ll go off. The ratings agencies will have to be snatched off the streets, all at exactly the same instant. They can be locked in with the ‘banks’ in an enormous underground cavern with all the paperwork.

It’s not all humourous, it seems clear that there must be a global reset that absolutely nobody gets to profit from vicariously.

Bloody hell mate. That’s a really different way of looking at it. I’m impressed.

Probability waveforms, virtual particles and finance. What a wonderful image!

Off-sheet assets will be the equivalent of Schrodinger’s cat: they exist in limbo between the states of alive and dead, at least for the public, until the box is opened and all is revealed – “mark to market” takes place. Frequenters of this blog strongly suspect that what is in the box died a while ago, but perhaps they have spookily influenced the outcome from a distance.

Yes indeed , Schrodinger’s cat ! Nice analogy . Of course they’re planning to pull a ‘bait & switch’ I believe it’s called , by rigging the market’s reference points in the instant before the ‘mark to market’ takes place , which disguises the severity of the ‘haircut’ , thus failing to trigger the CDS avalanche . Then they’ll all just glance to the sky , start whistling , and walk away inconspicuously chuckling that there’s more than one way to skin a cat .

I see the Sophie Scholl quote more often these days. It is not part of the blame the victim excuses trotted out by winners. The lack of willingness to be aware of the system is the key.

Putting psychopaths in control of banks and similar vehicles with a licence to create debt/money is a recipe for disaster that no one seems to worry about until after the event. We know what will happen: Kondratieff and Fischer not to mention many others, all covered in economics texts.

But we all go along …… Our institutions are not stupid, they have been deliberately sculpted to allow this to happen every two or three generations.

WHY? WHO wins? Follow the money, or is that too dangerous?

A few posts up the list here the Happy Hobit posted: