There is a particular scene in the film “It’s a wonderful life” in which the hero of the story is trying to prevent a run on the Bailey Savings and Loan. In an effort to calm the anxious savers wanting to withdraw their money George Bailey cries out “you’ve got it all wrong, the money’s not here, well your money’s in Joe’s house, that’s right next to yours, and the Kennedy house and Mrs Maitland’s house and a hundred others”.

As films go it is a genuine classic. But unfortunately it has perhaps unwittingly perpetuated a whopping misrepresentation of how banks actually work; a little white lie that the IMF have recently just driven a sledgehammer right through.

Their working paper, titled “The Chicago Plan revisited”, seems to have slipped under the mainstream media attention (and most of ours!) during the summer lull. That is until Ambrose Evans-Pritchard of the Telegraph picked it up a few weeks ago. At the core of the IMF paper is a deep seated analysis of how banks actually function in the economy and their role in the money supply. It is nothing short of revolutionary in that the paper gives full acknowledgement of, and support for, an intellectual movement that has doggedly criticised the very nature of money. Criticism that has so far been completely ignored and dismissed by mainstream economics.

We all think we know what money is (although reality gets a bit complicated when we start to lift the lid) but the more contentious issue is “where does money come from?”. How is the supply of money controlled? We know that the supply can go up and down over time, but who indeed has the power to expand or contract the money supply; the power of monetary creation and destruction?

But before we get into this we first need to clarify our terms. What is money?

As Wikipedia and all good textbooks will tell you; money is a medium of exchange and a store of value. There are other additional characteristics, but broadly these are the two most important. Indeed the history of monetary systems is riddled with tensions between these two key functions as they can work against each other [1].

Being a numerate person (and belligerent statistician by trade) it seems only fitting to start with the figures. When we look at the UK money supply, we find there isn’t one measure of money in the economy, there is a whole spectrum of measures! So, first off, money isn’t quite a singular construct. It can mean different things under different circumstances.

However, in the UK there are two main types of money that are officially recognised:

1) Narrow money (M0) – Cash (coins, notes etc.) or near cash equivalents, what we conceive of as tangible money that we can put in our wallet, and;

2) Broad money (M4) – all Narrow money, plus bank and building society deposits, wholesale deposits and certificates of deposit etc. – the additional subset is often referred to as “credit money” and is deemed to be less liquid (i.e. not as quickly, easily or widely accepted for transactions)

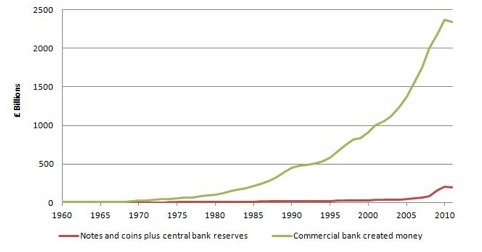

Here is a chart of the Narrow money (red) and the additional credit money that makes up the gap to Broad Money (in green):

Just by looking at these figures (which incidentally are industry generated and not in any way disputed by the banking profession or economists at large) we can clearly see some glaringly obvious issues. First is the sheer size of Broad Money versus Narrow Money. The second is the rising share driven by credit money expansion since the 1980s. Of the Broad money supply, only 3% or so is reckoned to be Narrow Money. The remaining 97% is the bank generated “credit money”. This only exists as accounting entries within the banking sector.

This is nothing less than expanding leverage that on face value alone is occurring within the banking system!

So where did this expansion come from? How was it created?

This is the crux of the IMF paper, and once and for all it should put to bed some long simmering arguments on the subject. A recent high profile example is the blog spat between Steve Keen and Paul Krugman [2]. Krugman opens the debate with some blatant Ad Hominen rhetoric, then claims that he was struggling to understand what on earth Keen was saying, and finally bowing out by saying that he was getting tired of the debate.

In the “standard” (i.e. Krugman) interpretation creditors are forfeiting purchasing power now (the money they loan out), in exchange for purchasing power in the future (repayment of interest and principal). Debtors obtain purchasing power now, in return for handing over future income (i.e. forfeiting future spending power). Krugman is channelling our dear friend Jimmy Stewart by characterising the operation as per the small town Bailey Savings and Loan description we opened with.

In this “standard” description of the system, money (cash) comes into the bank, and then gets recycled out again. It leaves one gaping problem to explain though. Where did the depositors’ money come from in the first place to put into the bank? The residents of Bedford Falls (being decent and upright people) haven’t got printing presses in their homesteads, so it can’t have been them. Maybe it was their employers who raised their wages, but again, where did their employer get the increased money from?

To answer this we just need to describe how the lending process within a bank actually works in practice. For by describing this, we can then understand how banks can spontaneously expand their balance sheet. And this is where the IMF paper [3] comes into its own. I’ve not fully read the paper yet, as much of it uses standard economic models and maths to demonstrate that which others have explained in more simple terms. However, the crunch passages from the paper are as follows:

“The critical feature of our theoretical model is that it exhibits the key function of banks in modern economies, which is not their largely incidental function as financial intermediaries between depositors and borrowers, but rather their central function as creators and destroyers of money. A realistic model needs to reflect the fact that under the present system banks do not have to wait for depositors to appear and make funds available before they can on-lend, or intermediate, those funds. Rather, they create their own funds, deposits, in the act of lending. This fact can be verified in the description of the money creation system in many central bank statements, and it is obvious to anybody who has ever lent money and created the resulting book entries.” (page 9)

“Putting this differently, the bank does not lend out reserves (money) that it already owns, rather it creates new deposit money ex nihilo.” (My emphasis)

Hopefully that is clear enough language that even a disorientated and narcoleptic Mr Krugman shouldn’t have any difficulty with it. A crystal clear message from an IMF economist, that banks are not “irrelevant” to the macro management of the economy. Quite the reverse. They are the ultimate speed governors of the economy. The buck starts and stops with them, so to speak.

At this point defenders of the “standard” interpretation might well concede that money expansion does occur, but that it is central bank governed; either through control of Narrow Money reserves or via the interest rate mechanism. This is the “money multiplier” interpretation of Fractional Reserve Banking. In this interpretation, the expansion of money is accepted as having occurred within the bank, but as a passive consequence of other actors; namely savers or Government. I have witnessed over the years some people on blog comments argue that by making a deposit any saver has “forced” the bank to lend it out. This is both preposterous in that customers cannot surely force the bank to lend on money, and more importantly risks the misinterpretation that it is all the “saver’s fault”. This is similar in flawed logic to the line of thinking that suggests that Gvt money supply methods and bank interest rates governs the banks’ lending levels [4]. In this interpretation the banks are either the passive victims of Gvt policy or those pesky consumers moving their money in and out of savings accounts.

But again, on this front, the IMF paper delivers a clear conclusion:

“The deposit multiplier is simply, in the words of Kydland and Prescott (1990), a myth. And because of this private banks are almost fully in control of the money creation process.”

The paper references a study which itself was used by Steve Keen in his seminal paper “The roving cavaliers of credit” [5], to debunk the myth that banks are passive responders. The Kydland & Prescott study showed that central bank reserves lagged bank created broad money. Therefore, the real power base in the money system lies within the private banking system:

All Mervyn King’s horses and all the Bank’s men, can’t get the process of lending going again!!

So, again, crystal clear conclusion here; the banks are in control.

And how to they obtain this control? Quite simply:

“[The Banks’] function is to create the money supply through the mortgaging of private agents’ assets.”

They, through no genuine forfeiture of assets (no genuine “consideration” of substance) obtain the means to hold us in hock to them. The assets of the nation are willingly surrendered to banks on the presumption that the bank is lending out someone else’s savings to you. But this is a complete fairly tale!

This is the crux of the complaint most recently voiced by Positive Money (and can be traced back at least as far as many other monetary “cranks” such as Frederick Soddy) is that unlike a private two-way loan arrangement, when banks extend loans there is no real FORFEITURE of notional spending power. Nobody’s deposit is reduced when a bank makes a loan. Both depositors and borrowers believe that they have spending power at hand. It is only when all depositors start withdrawing their money (i.e. invoke the spending power potential of their savings) does the system start to crack.

This is what happens with a bank run. It is not just a liquidity issue for a bank, but it exposes the accounting “trickery” behind the very basis of the money. In the words of JK Galbraith “The process by which banks create money is so simple that the mind is repelled.”

It is one of economics’ most carefully coveted omerta topics, which is why the IMF paper is so revolutionary [6]. No longer can the views of “heretics” be dismissed out of hand as cranks or wonks. In one fell swoop, the IMF has ripped up the Index Librorum Prohibitorum and legitimised such previously fringe people as: Steve Keen, Frederick Soddy, Richard Werner, David Graeber and Michael Hudson [7].

Not only that, but the paper does also provide a chilling reminder of how flimsy this pyramid of credit and money really is. Money is after all, just a social convention. An accounting entry of who owes whom. But equally, debts are not real either. They are just a claim on someone else. However, the chilling thing is, if the debts don’t get honoured then neither do the savings.

That’s the thing with money. It feels totally real. Right up to the moment it isn’t!

[1] This is a topic best left for another day, however Phillip Coggan’s “Paper Promises” is a good primer on this aspect, and I thoroughly recommend his LSE podcast:

http://richmedia.lse.ac.uk/publicLecturesAndEvents/20120119_1830_paperPromises.mp3

[2] There are various articles that cover the debate between Krugman and Keen, however this is a good overview:

http://www.cnbc.com/id/46944145/Paul_Krugman_vs_MMT_The_Great_Debate

[3] “The Chicago Plan Revisted” Jaromir Benes & Michael Kumhof

http://www.imf.org/external/pubs/ft/wp/2012/wp12202.pdf

[4] Richard Werner’s 2005 book “A new paradigm in Macroeconomics” argued / demonstrated that it was merely the supply of credit – a willingness to lend – that governed credit expansion, not interest rate levels themselves. Further debunking the money multiplier theory.

[5] http://www.debtdeflation.com/blogs/2009/01/31/therovingcavaliersofcredit/

[6] This is not the first time this year that the IMF has offered some startling revelations – there have been two working papers on Peak Oil, and the latest World Economic Outlook report contained a section criticising the adverse effects of Austerity measures (which seems to have caught Madame Lagarde, off guard!

[7] This Bezemer article is also worth reading on the nature and origin of money:

http://mpra.ub.uni-muenchen.de/15766/

There is one grave danger with this proposal I fear……….

Paul Ferguson on the Irish economy blog to his credit has tried to get this stuff out there.

http://www.sensiblemoney.ie/

But he seems to think that the central bank knows best ………..therefore the central bank will for the first time create the money.

This is very dangerous in my opinion.

In many ways under the Euro the central bank creates the money and look where that has got us…………..

Although the NYFR owns and runs the US treasury there is at least a formal division of money and credit power.

The same goes for the BoE and HMT.

Giving the banks formal control of the money power is the last stage of this post 1648 journey.

I think goverment should divorce itself from the banks by creating base money that is not a interest bearing asset on commercial banks balance sheets while leaving the free banks to create credit in their own unit of account.

You will have the free banking disasters of the 19 th century but at least banks and national credit will finally be divorced from one another.

Its not going to happen this side of the coming dark age but its good to get it out in the open – perhaps someone will record it in a piece of paper or something , maybe surviving through the dark ages into the light.

“Never let banks into the halls of the sovereign. NEVER.”

A country can rise or fall based on the quality of its leadership rather then a leverage build up that was unseen until the crash.

“Although the NYFR owns and runs the US treasury there is at least a formal division of money and credit power.”

I don’t see the division you mention in the Federal Reserve.

The creation of money occurs within the Fed and is given to Treasury – this already constitutes credit creation as the Fed now holds the IOU

Treasury gives the sum to the Primary Dealers – this is where fractional reserve kicks in

The Primary Dealers give the sum to the Commercial Banks – this is where fractional reserve is amplified

Interestingly however, the Primary Dealers are also members of the Federal Reserve.

The creation of money occurs in Congress. (this is the so called fiscal cliff nonsense)

The Fed turns this money into debt (which is now the global reserve)

The treasury is controlled via the east coast banks and indeed in all western countries that I Know the banks control it as it only has mainly tax raising rather then money creation power which is in the effective monopoly of the banks

During the age of Imperium the banking hosts such as the Uk did not print or devalue , they “printed”Gold as for example they had control over the worlds below Ground reserves.

This moved to the final system of congress money creation and Fed turning this into the new global reserve.

Its really the same system.

With pre 1914 France (friendly) and Germany (hostile) holding much of the above ground gold “printed” by the UKs south african and canadian mines.

While Japan (friendly) and China (hostile) holding much of the worlds treasuries today.

In 1914 HMT did indeed print (10 shilling notes) but this was used to reduce the domestic calls on Gold (as it paid 5% interest) to free up external calls on Gold.

If a independent US treasuary secratary that did indeed want to print Greenback notes outside the banking system the $ would lose its global reserve status and therefore its ability to import more then it exports.

So the US is caught in a bind much like the UK was back in 1914.

The US $ is not a national currency.

Therefore It cannot function as a nation.

The euro experiment is a even more extreme banking experiment.

The final state of the post 1648 journey where they control all of the spice as nations cannot sustain themselves without external trade.

The guys behind the central banks are really guild navigators.

The more your country becomes dependent on spice production the more you become a victim of their system.

http://www.youtube.com/watch?v=mGygaPaneIo

The US is in exactly the same position as the UK was in 1914.

Excellent article, I fear the people who gain so much power from this system (the Government, Banks and those behind them) will have to have it torn from them as they will never give this up lightly.

When banks create/loan money, under license as it were from the state, they theoretically assume certain risks. When the mechanism to assess those risks is broken, the methods by which money is created ‘organically’ are thwarted.

In the states the Federal Reserve has a much stronger role in the latitude by which banks expand their own balance sheets, ie ‘create money,’ than some of this argument seems to allow. But since the Fed is owned by the Banks, the key role of banks in the money supply is not affected per se.

When the banking system is not able to expand the money supply organically in response to demand, then the monetary authority steps in by expanding its own balance sheet, as we saw recently in the actions of the US Federal Reserve which greatly expanded its balance sheet to supply liquidity to the economy and banking system.

Where that money resides within the system, especially with regard to the various measures of money from narrow to broad, is very much a reflection of policy and economy. Does one hold their own money in a ‘checking account’ or in a ‘certificate of deposit?’ This is in response to needs, risks and returns.

The Fed, in conjunction with the Treasury and other regulators, has the ability to pull some very meaningful levers on the ability of the banks to ‘create money.’ That they choose not to do so does not mean that they do not have that power. As part of the overall deregulatory process, the banking system has relaxed most of its safeguards against frauds and bubbles. This is ‘moral hazard.’

I saw and read the Chicago Plan paper. I have commented on the mechanisms of the money supply, using the US as my example, numerous times for practical purposes and access to information.

Many of these economic debates focus in narrowly on a few mechanisms of a rather large and ‘living system’ and can create the classic and largely unfruitful confusion as described in the story of three blind men who are examining an elephant. That the discussion takes on political and public policy overtones merely adds to the lack of clarity.

Hello Jesse,

Are there any of your writings that you could suggest as a good intro to your thinking on this subject?

Jesse

I see this as more of a question as what is the correct description of the financial system. I have not addressed or tackled the issue of what the paper actually recommends as a policy initiative, merely the key recognition that the paper gives to the “endogenous money” school.

We have a major “Principal / Agent” problem at the moment, where the majority of people in the country do not understand what is going on, nor how finance and banking works, and therefore defer to the “authority” positions of those in power. In other words, we are asked to “Trust Them”, for they are the Technocrats and they have our best interest at heart.

Modern banking is able to create the credit to acquire ownership title of private property (or at least accrue interest on such an activity). This wouldn’t be pernicious if they were at the same time taking on some risk. At the moment they are not. Instead we have wide scale privatisation of profits and socialised losses. Those working in finance & politics can take home large pay packets, whilst austerity is handed out to the masses.

If currently neither the public nor the political class correctly understands what is happening to them, surely there is scope for wide scale abuse of this trust?

This is a great book; The Lost Science of Money, by Stephen Zarlenga

http://www.bookstore.co.uk/TBP.Direct/PurchaseProduct/OrderProduct/CustomerSelectProduct/SearchProducts.aspx?d=bookstore&s=C&r=10000046&ui=0&bc=0&keywordSearch=the%20lost%20science%20of%20money&productGroupId=

The ability to be able to create money has been a viscious battleground throughout the ages, not that they’ll teach you that if you ever study history. Or economics. It’s strange how little understood and talked about money creation is considering how massively it affects the everyday interactions we have with others.

Indeed Orville,

Golem,

The imposition of one particular monetary system instead of another has direct repercussions not only on economic policy but also on social choices including the daily actions of everyday citizens.

Ever wonder why in the ostensibly democratic West the choice of monetary system is not submitted to the people for ratification?

Ever wonder why in our ostensibly capitalist, open and free economies interest rates are imposed by decree?

The imposition of this particular monetary system has arithmetical ramifications that are calculable (if that is a word).

To cut a fairly long story short, this monetary system can only result in government becoming the largest actor in the economy. On the way to becoming the largest actor to the economy, all productive capital as well as the profit derived thereof is gradually transferred to and concentrates in the hands of the banking industry….

… and that is why we are bailing out the banks…

In particular, there is a direct relationship between the monetary system and the devastation of the environment and the depletion of, for example, fish stocks.

Banks don’t create money – they create credit – perhaps in the case of CBs to drive down the cost of interest on goverment money from which taxes are paid

Banking credit becomes a form of money substitute but its not money until the state declares it money as in Ireland.

Only Kings / congress can create the money which is debt to banks in a post 1648 world.

.The Irish problem could have been solved by declaring AIB deposits AIB token money and not state money but it would have meant destoying the idea of banking republics which grew from the Amsterdam womb and indeed Genoa and the rest.

As it happens it was the worst of all worlds – they neither turned it into a different unit of account or wrote off the bonds.

AIB token deposit money would have devalued by a massive amount as most of its assets were non productive housing units.

These net negative consumption sinks / houses which they call assets act as a conduit & rentier for the rump physical economy and its remaining productive capacity within these false banking republics.

The claims on wealth within the UK is interesting.

Much of the “wealth” is in the form of house “assets” which is really a claim on external wealth as nothing much happens within the UK.

http://www.ons.gov.uk/ons/dcp171778_238758.pdf

See the striking graph near the bottom ……….the wealth of Europe was to a large extent the North Sea which the city exported from the UK jurisdiction in the early 80s as it closed down domestic industry during the Big bang period.

The above UK asset prices are a result of the external productivity of Europe which is now failing as the oil is running out.

To maintain UK asset prices it must destroy these PIg economies even to the point of getting negative yields from the rest of the world as is now showing on the UK current account Q2 2012.

The UK is choosing real good imports over income……….this is striking as the UK has always earned net income from the rest of the world.

Hello Dork of Cork,

If you have a moment would you drop me an email please?

“Banks don’t create money – they create credit […]”

That is not quite correct. In a first instance, the bank will create credit predicated on their deposit base. When this credit is given to an individual, this person has the right

to withdraw cash. Hence the bank has created money.

In turn, this money can be re-deposited either with the same institution or with another institution. In both cases, it expands the “deposit” base thus giving rise to more credit creation thus more money.

UK trade deficit in goods is down somewhat for the third quarter (record in Q2)

2012 £

Q1 : -25,415

Q2 : -28,059

Q3 : -25,443

However its oil balance just keeps on getting worse

2012 £

Q1 : – 3,092

Q2 : – 3,544

Q3 : – 3,750

However it 2011 Q3 was even worse at – 3,835 so we could be looking at some seasonal factors.

http://www.ons.gov.uk/ons/dcp171778_283558.pdf

Again the UKs trade balance with Germany is striking in comparison to France.

Q3 real goods trade deficit £

Germany : – 5,846 (which could be a record , must check)

France : + 90

the China deficit is almost as big (also showing signs of weakness) although there is less overall trade between those two countries

China : – 5,503

I have heard people on MMT sites claim this trade deficit is only a few % of overall GDP but they are confusing stocks and flows which perhaps the more sophisticated MMTers don’t do.

For example a 90% of car might have a lifespan of 12 years or so……….

So lets say 2 or 3 % of GDP * 12…………(although you must subtract depreciation)

As I said the UK is using its sov nature within the EU construct to buy real goods while it still can.

People in the UK & indeed Ireland are buying expensive diesel cars that in the case of Mercs will last 20 + years.

The UK was the only growing large car market this year and this month.

Why is that ?

http://www.smmt.co.uk/2012/11/resilient-new-car-market-growth-continues-in-october/

Including 32,427 C class Mercs

38,102 BMW 3s

nearly 18,000 more then all the Ellesmere Astras bought this year……….

Are these functional national economies with rational trade patterns ?

Nope.

Get it while you can………………………..

Most likely the dealers are selling the cars to themselves. I’m not joking!!!

@Richard

Its all credit as they refuse to pay the wages………they wish to move beyond Poland and into Russia & Turkey.

Renault is about to collapse because its banking arm is going under.

Y1986 Renault Ireland Austerity advert during a mini depression……

A land of 800,000 ~ private mainly mini petrol cars

http://www.youtube.com/watch?v=goCg1K6aEN8

Y2012 Renault Ireland depression Advert although no bank holiday or inflation (although massive wage deflation (euro / world labour competition in both domestic service industry and external sales markets)

A land of 1,800,000 ~ private cars many of which are 25,000 euro + diesels

http://www.youtube.com/watch?v=w044zsUwcSQ

If they paid wages in national home markets most people would at least be able to afford a 600cc 2cv……but the banks don’t want that as they can’t make a global labour arbitrage cut from shorter supply lines.

Ireland is the most dramatic rump car market in Europe with 75% new diesel sales as after the credit hyperinflation you still have people with very large deposits.

(I would buy a Diesel merc if I needed a car as they will last 20 + years now)

Look at Merc sales in Ireland

44 petrol mercs were sold

1,784 diesels !

http://www.beepbeep.ie/stats?sYear%5B%5D=2012&sYear%5B%5D=2011&sRegType=1&sMonth%5B%5D=1&sMonth%5B%5D=12&sMake%5B%5D=Mercedes-Benz&x=43&y=7

Amazing what inflation does to money:

“The Fed Mandate is for stable prices, not 2% inflation. Need I remind everyone that a 2% inflation target, if met over a 45 year working life (age 20 – 65) results in a price increase of 144%?

Of course, the actual performance of The Fed historically is closer to 3% inflation. That’s a 278% inflation over the same 45 years.

Put another way, if you earned $1 in purchasing power at age 20 and saved that dollar, you have about 35 cents left at age 65.

And this is Bernanke’s intent.

Innovation and job creation require capital formation. Capital formation is, simply put, savings.”

http://market-ticker.org/akcs-www?post=213395

“The Fraud of MMT””

“But when that “money creation” happens, all of the existing units of “M” are devalued by the exact ratable amount of the new monetary emission. It cannot be otherwise; again, the fundamental economic equality must hold.

Therefore what deficits do is destroy saving, not enhance it, as they intentionally and ratably trash the value of all such saved units of currency.

Now compare this act of destroying the value (denominated in non-monetary terms — e.g. gallons of gasoline, bushels of wheat, etc) of the tokens used for exchange (what we call “dollars”) with the government deciding to tax the same amount from the citizens instead.

Economically they are identical — If the IRS man shows up at your door and demands 50% of everything you have acquired in dollars “to date” or if the government renders your saved dollars worth 50% less the impact in terms of gallons of gasoline, pounds of steak, or medical care for your grandmother that you can purchase with your currency and credit 10 minutes later is exactly the same.

In other words the government’s decision to run a deficit is exactly identical economically to the government deciding to raise taxes retroactively on all existing currency and credit by exactly the same amount of money!

That is, the claim that MMTers make that government deficit spending is “wealth” in the private economy is false; such an act does nothing other than devalue the currency and credit in circulation and by doing so the impact on purchasing power, which is all you care about, is exactly identical to that of having that currency and credit confiscated by taxation!

This, incidentally, is why the economy has not recovered even though the government has run deficits from 8-12% of GDP sequentially for the last four years. This, for those who are not math-challenged, is an approximate 50% compounded devaluation in terms of GDP over those four years.

http://market-ticker.org/akcs-www?post=213147

Quantity of Money Theory i.e. devaluing the currency by quantity of tokens, was debunked in the 30s.

PS Good stuff Hawkeye.

Thanks John!

´´That is, the claim that MMTers make that government deficit spending is “wealth” in the private economy is false; such an act does nothing other than devalue the currency and credit in circulation and by doing so the impact on purchasing power, which is all you care about, is exactly identical to that of having that currency and credit confiscated by taxation!´´?

Hi Backwards evolution. I think it should be made quite clear that Money, Credit, debt, financial instruments of any kind are never Wealth. The most they can ever be elevated too is a claim on wealth or a means of keeping account between those who have ownership of something and the promise of another to give something in return. John Ruskin makes a very good job of explaining this in Unto this last and Samuel Taylor Coleridge also does so in Table Talk.

Another Myth related to where the wealth of the world can be found is ,as represented by its potential, is the Oil myth . Oil and Debt have served as very good control mechanisms and have monopolised ruthlessly by excluding better alternatives that are difficult to monopolise. Within the Economic paradigm the world has suffered under since the Industrial revolution and particularly since the mass production of the internal Combustion engine a prime cheerleader of the deception has been the religion of Economics it has taken over where the Church left off. Markets and consumerism as the opium of the masses instead of religion.

Capitalism is an invention and a bad one at that.

Appropriate, then, that the new head of CofE should be a former oil exec

Mr Welby is also described as having “a strong financial background and business sense”.

Looks like a clear case of Ecclesiastical Capture!

Roger – such a good comparison between the Church versus markets and consumerism. “Opium of the masses” is indeed bang on!

Money (cash) used to be real wealth. You worked hard (produced), paid your expenses, and then whatever you had left over, you saved a little and spent a little. Businesses did the same. But now with never-ending credit and leverage, derivatives, hypothecation and rehypothecation, they have devalued the worth of hard-earned money. It became, “Why save when you can leverage up?”

There is so much leverage out there, it’s frightening. When this falls apart, so many people are going to be scrambling for a chair in the game of musical chairs, all in the hopes of getting there to claim the wealth before the other leveraged guy. Too many claims out there.

If the people with the make-believe wealth (the debtors, those with financial instruments) can just keep the party going a little longer, can get the government to pump more money into the economy, boosting inflation, then they will have devalued all real money (cash). They will have done this with no skin in the game at all, just leverage; no hard work, no saving, nothing.

Capitalism has been great for the elite; not so much for the little guy. I think we can do better than that.

Sorry backwardsevolution, but this Karl Denninger (market-ticker.org) stuff is pure drivel.

In the piece you link above Denninger says this: (quote)

“The problem is that these claims, in particular the last claim, must fit into the fundamental economic equality, which is:

MV = PQ

That is, “M” (credit and currency in circulation) * “V” (velocity, or times each unit of credit or currency is used in the economy) = P (price of each unit of good or service) * Q (quantity of each good or service)

PQ is what we called “GDP”; by definition all units of production of goods and services that are sold times their price is equal to the GDP of the nation.

“V”, or velocity, can be thought of as the “animal spirits” index. The more confident businesses and consumers are in the economy the more-likely they are to exchange currency or credit for a good or service; that is, the higher the likelihood that they believe the necessary expenditure on goods and services from a future capacity to acquire more “M” will be possible. This can be indirectly influenced but not directly controlled.

Finally, “M” is not just currency but also includes all circulating credit that is expended in the economy. The latter is almost-always ignored by mainstream economists but this is a trivially-proved self-delusion as virtually everyone uses credit interchangeably with currency in their daily lives. You pump gas and swipe your credit card to pay for it, you pull out the VISA card in the store interchangeably with $20 bills, etc.

So let’s presume that the government simply “emits” 100% of GDP into the economy by “creating money” through the purported “sale” of Treasury Instruments. The Central Bank monetizes those by pushing a button and now Treasury has $16 trillion dollars, which the government decides to evenly distribute to everyone. That is, tomorrow you go to your mailbox and find in it a check for $51,499 for every man, woman and child in your household, payable to you, printed out of literal thin air.

You’re wealthy according to MMT! Happy days are here again, let’s go have a party!

Uh, wait a second.

Remember, MV = PQ.

“V” hasn’t changed.

But “Q” hasn’t changed either; when you woke up this morning there weren’t new factories that magically materialized, there weren’t any new jobs that magically materialized, there weren’t new services invented out of thin air, none of that happened.

In fact, what happened is that “M” was dramatically increased.

Since “Q” didn’t change, and “V” hasn’t changed (yet), what does the fundamental economic equality say must occur?

That’s right — “P” must rise in an exactly ratable amount.

It has to, because third grade arithmetic says that it must as a matter of economic axiom.

As such the so-called “wealth” created by this MMT action is a scam, because “P” (price) immediately rises across the economy in the exact amount of the “money” that you created.

GDP (defined as “PQ”) rises but this is not economic progress, it is inflation!….”

(end quote)

So, what’s wrong with this?

Denninger asserts that the quantity of goods & services, Q, in this fundamental equation (MV=PQ) cannot possibly increase – under any circumstances, note – such that +any+ increase in money supply, M, must always & automatically bid the price, P, up to balance absolutely pro-rata. (V, velocity of transactions being ignored)

How utterly absurd to suggest this in any way represents reality. What an utter dick…

For a start, there are +inventories+ of both money on the one hand & goods (services too in capacity to supply) on the other. Whereas on Mr Denningers planet there are certainly none at all on the supply side.

We must always and everywhere turn up to the shops & expect some surreal process whereby the shop owners must coral every buyer for their goods whilst they collude instantly with every other store selling that item & decide what price the now mandatory transactions will take place at to exactly sell every piece they hold in stock. As part of this process, the store owners must know precisely what proportion of the ‘new’ money that consumers will allocate on this item & every other good & service in the universe & what proportion they might keep for some other day, or indeed for their pension in 30 years time.

Every day, indeed every part of a day, & everywhere, Denninger states categorically, markets must clear completely & exactly, such that for a fixed quantity of goods they must find exact & matching price discovery relating to the the prices desires & spending wishes of every consumer.

Does Denninger live on this planet? If he does, maybe he’s never been shopping & has some deaf mute flunkies (who can never divulge what they do) to go get alll his needs & wants for him?

Well, ok. I can’t really get inside Denninger’s head to figure how he thinks shopping works.

What I do know is that, typically, most markets in the real world are reasonably competitive. When Fred the TV retailer notices the rate of sales from his (multi day) inventory selling well, he places a bigger order for new inventory on his supplier, who in turn will suggest the manufacturer increase their inventory levels &, ultimately & in due course, take +timely+ measures to make more TVs.

Fred the TV, being aware that there are many other TV retailers, selling his & other rival brands, will +not+ choose to raise his prices on foot of what might be only a temporary increase in consumer demand. He knows that if he tries that his customers might go elsewhere to buy TVs & indeed never return.

Do I really need to spell this out in infants class language? Seemingly for Denninger, I do, but for the rest of us?

So, no, Mr Denninger, in the real world – certainly the one I’ve lived in for 50+ years, on both the seller & buyer side of the equation, the quantity of supply moves +way+ before price. Suppliers in my experience will near always go for market share & near always address profit margins by first reducing cost inputs, not prices. Cost inputs is probably the most sweated over issue by every entrepreneurial head, manager or businness school by a country mile. Probably occupies more time with micro economists than anything else too. ‘Obsessive’ would probably be a fair description. Hardly likely to be the case if prices could be hiked as easily as Denninger suggests.

And one thing we do know with certainty is that in a recession, esp a deep one, like now, we most certainly have plenty of idle capacity on the supply side – because in many sectors that capacity was actually producing +before+ the recession.

When MMT proposes increasing government sector net spending in such circumstances, it is only to close this output gap, & in a steady & careful fashion – no more, no less. And certainly not by dumping 100% of GDP into folks’ pockets in a single instant (as Denninger implies).

When the economy nears full capacity & inflation begins to show, MMT says governments should then back off or reduce their net spending. It ain’t rocket science.

Karl (who I do not religiously follow) has been a businessman himself. He sold his Internet company in the 90’s for a lot of money, and all because he could see the writing on the wall. He constantly talks about cost inputs, margin compression, etc.

“Back in the 1990s when I ran MCSNet I was astonished as the firm went from serving a few hundred customers to thousands in a very short period of time, placing incredible demands on both my time and ability to think faster than the technology was evolving. It was not the meteoric rise of the Internet that got a rocket-level boost from the introduction of Windows 95 that made me sit back in my chair and wonder how stupid everyone was; rather it was the number of pundits, analysts and various economists who all argued that the growth rates we were seeing would continue for a very long period of time — decades even.

I chuckled at such prognostications because just a few moments with a calculator led to the inescapable conclusion that at the rates of growth we were seeing every bacterium on the planet would have Internet access by 2020. In 1998, seeing the inevitability of what was to come but of course not knowing exactly how far the insanity would go, I sold the company and made sure I was both at minimum safe distance and was facing the other way before the bright flash burned out my eyeballs.”

I heard someone say recently that MMT’ers are elite shills who want the game to continue, not for the good of the country, but for the good of themselves. This may be a very unfair representation. I confess I don’t know enough about MMT myself, but will look into it.

From what you’re saying, MMT advocates spending in bad times (like Keynesians) in order to end up with a “beautiful deleveraging”, just enough money coming from the government side to balance deflation on the private side.

I just have one question for you: when all the bubble-making was going on, the Ponzi real estate party, loans being given to anyone who could breathe, where were MMT followers? Were they out warning the government and the people that if this behaviour continued, there’d be hell to pay when it all deflated, or were they silent?

And if they were silent, is that because they liked the party, benefited from it, and are only speaking up now because they want the government to come in and save them, smooth everything over? A lot of people made a lot of money from the party, and they certainly don’t want the bad times to take that away.

I may be totally wrong, and please correct me if I am, but I seldom heard anyone advocating putting the brakes on when the fun was going on, but now that things are bad, they’re coming out of the woodwork wanting to be bailed.

It just seems the winners at the poker table want all the upside and none of the down.

backwardsevolution

I have to say you absolutely amaze me. You’ve been around on this blog site for some time I think? No end of people here have posted links to MMT’s primary blog sites & those of key supporters. Their positions & motivations are hardly hidden. (In contrast to the ‘sound money’ brigade who don’t have the balls to actually come out & say they couldn’t give a sh1t about working or unemployed peoples’ welfare, rather care only for the value of their own personal cash pile.)

One such primary MMT supporter is Bill Black, an Associate Professor at UMKC, the centre of MMT academic thinking in the US for many years, long before the 08 crisis. Black has spent his entire career fighting the fraudsters of finance, from providing the evidence to jail hundreds of bank execs in the S&L scam to repeatedly publicly accusing the current top execs of Wall St. of systemic control fraud. It’s not an accident Black is at UMKC. MMT co-founder UMKC Prof Randall Wray is on record stating that “…95% of what the finance sector does should be banned…”. Ain’t nobody among the ‘elites’ promoting UMKC’s work.

Bill Mitchell has spent his entire career championing the rights of labour to a fair return & full opportunity for employment. I believe Mtchell has also described himself as somewhat in the Marxian school. That is In regard to the economics critique of the type of unregulated Capitalism Marx would have seen, as opposed to all the propaganda & hijacking BS that has occurred with some spurious label attached in the century or so since. (Contrary to this prevailing BS, Marx himself never got around to writing about any possible solutions much, if he indeed ever had any. So any ‘model’ society purported to be Marxian is based on BS from the off.)

If you think these people are either Johnny-come-latelys or shills for the elite, well, I have a lovely bridge I’d like to sell you.

They tried for years, along with other heterodox economists, Post Keynesians etc. to get their papers discussed in the academic mainstream.

It’s now abundantly clear from recent papers from the staff of BIS, the Fed, ECB, BoE & IMF etc that MMT’s (& other P-Ks like Keen, Lavoie & others) understanding of banking & the monetary system is correct. Their macro economics understanding that flow from this is also correct. The Eurozone is collapsing in precisely the manner they said it would back in the 90s.

As Bernard Lietaer says…”…academically, MMT has never been challenged…”

The reason is obvious & laid bare with the global economic mess as badly informed today as it was in the decades that made it inevitable. The mainstream was captured decades ago & both conservatives & progressives alike have so much personal capital & prestige in it they cannot begin to imagine the enormity of their often unthinking complicity.

To raise another of Denningers most stupid scribblings (well, rants)…he denies categorically the accounting identity that is sectoral balances – a cornerstone of MMT (& other P-K) thinking. While the economics mainstream still does not aknowledge the value of this analytical tool, none who expect to be taken seriously dare deny the $ for $ verity of it’s accounting balance basis. Such facts are plain to see in the national accounting data. Denninger is such a twat as to not even notice. Or is he? God knows what his angle is, but his BS is not based in this universe.

Mike Hall – I greatly admire Professor Bill Black from the University of Missouri, having posted his articles many times, and am currently reading a research paper by Randall Wray.

But sometimes I feel Bill Black is too naive. He seems to be able to see the banking system as fraudulent and corrupt, the corporations as too powerful as far as campaign contributions, leveraged buyouts, monopolization, etc., but he does not see the government’s role in all of this. He writes as though Obama and politicians are simply “blindly” following the financial elite. He does not see that they are part of it. He loses me there, I’m sorry.

As far as Krugman goes, he’s either a shill or he’s naive (I’m betting on the former). Look who the elite gave the pseudo Nobel Prize in Economics to – Krugman. Gee, I wonder why. Again, he’s all for keeping the game going, bailing out the banks, but doing it under the guise of “helping the little guy”. It’s perfect.

And most of the so-called helpers out there could give a crap about the little guy. How do I know this? Well, they used them on the way up. They made a fortune off them: fees, bonuses, betting against them, putting them over their heads, etc. But, boy, do they ever come in handy when they need to bail themselves out. All of a sudden it’s “let’s help the little guy”. There’s a whole list of vested interests who want to see this gravy train continue and they’ll use whoever they can to ensure that it does.

This whole mess is pitting two sides against each other, and I don’t like it one bit. Do I want the little guy to suffer? Hell, no! I’m one of them. But since you’re obviously on the other side and would like to see more money printing, you would be quite content to see people who did not leverage up suffer?

This is like at the end of a Monopoly game where one wins and one loses, and the loser says, “No, I’m going to take some of the money out of the bank and bail myself out before I end the game. There, you lose.”

be

You write:

“This whole mess is pitting two sides against each other, and I don’t like it one bit. Do I want the little guy to suffer? Hell, no! I’m one of them. But since you’re obviously on the other side and would like to see more money printing, you would be quite content to see people who did not leverage up suffer?”

You have me totally wrong there. I’m unemployed & no assets, how ‘little’ are you?

It seems to me you are still, to some extent, swallowing this myth that increasing the money supply (directly into the economy) via debt free government issuance will always & everywhere lead to inflation & less wealth for ordinary citizens. It’s simply not the case. The key determinant of inflation is the capacity to supply real goods & services. Up that limit, little inflation will arise, & if it does it can easily be dealt with & on a more intelligent sectoral basis.

Just step away from this value of money stuff for a moment & consider what real standards of living actually are – production of goods and services. That is optimised when we have the maximum number of people employed.

The sectoral balance analysis – accounting identity, remember – means that if the non-government sector (us) desire to save some of their income, then there will be insufficient spending for full employment. Can’t be any other result.

So, if we want to optimise our standards of living in real goods & services – meaning full employment – then government (using fiat issuance) is the only sector left who can make up the spending gap and accomodate our desire to save, on a sustainable basis.

Now, at the point of near full inflation, MMT accepts that some small inflation in wages will happen. The economy is large & complex, we cannot always expect a perfect match between labour’s abilities & the jobs to be done. But consider this. Which is better, a permanent loss of wealth in real goods and services, approaching 1% of GDP for every 1% of unemployment (ie around $1.6 trillion/yr in the US at 10% unemployment), or 2 to 3% higher inflation? My maths make it a no-brainer. (Andrew Haldane, BoE, discussed the real cost of unemployment in a paper considering the compensation potential of a ‘Tobin’ tax – the various proposals for the latter didn’t even get close to compensating society for these ‘real’ costs – a taboo topic among most ‘authorities’.)

But let’s also consider the social cost of persistent high unemployment. Bill Mitchell talks about this a lot.

It’s highly divisive & induces huge personal stress into people’s lives. Not just among the jobless themselves, but among vast numbers of the rest out of permanent fear that they might also see their lives destroyed thru’ loss of their job. Such pressures lead to greater knock-on effects in anti-social behaviour & crime. These are a substantial cost to society as well. (And not included in the costs considered by Andrew Haldane.)

MMT are absolutely right imo to focus on the Job Guarantee as the one (& only) policy prescription they insist is part of what is otherwise a purely descriptive monetary & macro framework to inform the options available to the democratic process of fiscal policy. (‘Small’ government or ‘Big’ government, MMT is agnostic to all other fiscal choices, except the JG.)

MMT also make a robust ‘price stability’ economics argument for JG. But I don’t really care. It’s worth to me in social cohesion far outweighs any other argument against it.

And in case you think I’m ignoring the very real impending & urgent ‘limits to growth’ (in real resources terms, not in ‘money’ or ‘economic’ growth – please note the important distinction) – not at all.

IMO we need to be addressing social cohesion with the utmost urgency because it is probably +the+ most important factor in whether humanity will survive the upcoming existential resource (& pollution) challenges – or not.

Poll after poll these last few years, since the crisis, have shown diminishing public concern for climate change & other sustainability issues – whilst the science is telling us at every new input of data, the prospects are getting worse. Why is this?

Well, it’s not rocket science. Regressing social cohesion thru’ increased financial insecurity & regressive social policy. Maslows hierarchy of needs writ large. Division & conflict escalating most everywhere.

Unless humanity can reverse this trend to personal selfishness and greed, to put it bluntly, we are fcuked (within a generation or three).

That means we must aim to meet the essential needs of +all+ citizens. In modern industrial societies, this means employment. It matters like nothing else.

Among all the economics ‘schools’ putting out their stuff on the blogosphere in this global crisis, MMT are about the only people who appear to me to give a sh1t, & have rock solid monetary & macro foundations, readlly implented.

@Backward

I don’t like Karls take because he does not often or not always anyway talks about how you would have to radically change the present monetary system to make the no deficit rule sustainable.

The wealth has already been destroyed via bank credit (chiefly consumer bank credit)

I think MMT just wants to continue the flow without stopping it dead as in the Eurozone.

You cannot have a halfway house in this , its pre 1648 or post 1648

The banks are part of goverment or they are not.

They also use a central bank as in a war which is as old as the central bank meme.

Infact this is deficit spending.

It pays to look back at the birth of Keynes ideas during the first world war.

reading “The first world war vol 1″ by Hew Strachan – the “financing the war section” – a must read.

The Germans & French held much of the above ground gold ( not unlike China & Japan $ treasury holdings today ?)

The UK could “print” more Gold as the Empire had control over most of the below ground stuff in Canada & South Africa.

While India gave it a favourable balance of trade ( I think Europe of today functions as the modern India)

OK there was a run on the BoE………in my opinion because the US became both China & Saudi Arabia in one monster package.

The Bank act was suspended and the clearing banks expected the Gold standard to finish as the BoE would need to issue more notes , but HMT issued the notes (legal tender in Scotland & Ireland)

Keynes hammered home 2 points – the first was the difference between the internal demand for gold and the external.

1. The first was the internal vs external demand for Gold – the 10shilling notes (paying 5% interest) were for the former.

By easing the domestic calls for Gold the Bank had more gold available for exchange purposes.

2. He reiterated throughout the war that it was useless to accumulate gold reserves in times of peace unless it was intended to utilise them in time of danger.

This is the MMT full employment meme in its ancient form.

By maintaining purchasing power Britian could SUSTAIN ITS PURCHASING POWER IN INTERNATIONAL MARKETS AND WOULD RETAIN FOREGIN CONFIDENCE & THEREFORE FOREGIN BALANCES IN LONDON.

But if HMT just issued raw notes into the economic medium – what would have happened ?

Would we have had the War to end all wars ?

The UK would have become poorer if HMT just printed unbacked notes but no Flanders fields most probally.

This in reality is game theory played at the very highest level.

You can see from the above trade figures that the Anglos are keeping their purchasing power at the expense of lets say , God only knows italian consumption.

But these sov currencies need hinterlands that they can strip or non sov areas.

For example Cromwells new model army tried to turn Ireland into a ranch or drive it into surplus which he pretty much did.

The UK soon after had all that nice legal stuff that comes with republics.

There is a trade off with all of this.

But I think Karl is taking the Austrian thing a bit too far………#

The flow of life is important after all.

Thanks for this hawkeye, it has become my mission to educate as many people as I can about how money comes into existence. But even now after years of knowing the truth I find it sloping out of my mind. The mind does indeed rebel, that’s why we need to keep on reminding ourselves and anyone who will listen

Hawkeye – thank you for the very good article. Very informative.

The Dork of Cork – “I don’t like Karls take because he does not often or not always anyway talks about how you would have to radically change the present monetary system to make the no deficit rule sustainable.”

Karl talks about his One Dollar of Capital being a solution. I guess his point is that if you don’t let things get out of control in the first place, don’t allow bubbles to form (and he sets out how), then you wouldn’t need deficit financing (except in times of war or other like situations).

Here’s his definition of “Sound Money”:

“One Dollar of Capital is simply the principle that nobody be permitted to “create credit out of thin air”, thus artificially expanding the spendable supply of “money” in the system. This, and only this, is the reason for all of the bubbles and financial collapses throughout history. This sleight-of-hand is why Tulip Mania happened, it’s why we had a crash in 1873, it’s why we had a crash in 1929, it is why the tech market blew up in 2000 and it’s why we had a crash in 2008 in housing. It is why we’re threatened with collapse in Europe now. It is a scam as old as the money changers during the time of Hammurabi, and until we stop it there will never be stability in the banking and financial system. This sleight-of-hand is in fact exactly identical in mathematical and economic impact to counterfeiting of the nation’s currency, a crime which we all should recognize, condemn, and when it occurs the punishment should include both imprisonment and forfeiture of every dollar of ill-gotten gain.

Putting a stop to unbridled credit creation also removes the threat of “inflation” because it makes inflation by sleight-of-hand flatly impossible. It returns the ability to cause inflation to the one place where it should rest — the entity that is supposed to be in control of the money supply, the federal government (specifically, Congress.) We have in fact had monstrous inflation over the last 30 years; one need only look at the increase in the price of stocks, of college educations and medical services to see it. The bankers and their cronies have tried to hide its impact on the common man through offshoring of labor so as to hold down “prices” in the CPI, but that’s a lie too as a man who loses his high-paying job to some slave in China has his spendable income destroyed at the same time as he gets “lower prices” at WalMart.

Simply put, for every dollar of alleged GDP there must be one dollar of credit or currency with which to buy the goods and services produced. If you increase the denominator, that is, the number of units of either credit or currency in the system, then each unit must inevitably be worth less than it was before. Only when those units are exactly in balance with economic output is there zero inflation and protection of the currency’s purchasing power.”

Karl then states the standards he would impose on all institutions. Please read the whole thing. The bankers must be constrained, kept on a tight leash, otherwise we’re just going to go through this all over again. Every time I hear the word “innovation,” I cringe. It’s just another way for them to loot, and it’s really only trading paper back and forth.

I’m not saying that his way is the best way, but to just say, “Oh, well, done is done, let’s just paper it over by printing more money,” then I have a problem with that. When does it stop? Do we paper over the current losers’ losses, the next ones, but then not the next? Who says when it’s time to stop?

This “current” crisis would not have happened without a lot of fraud and corruption, and the current propping up of the bubble (not allowing it to deflate) has only occurred because of massive manipulation, accounting changes, etc. How about we let the air out and begin again? Who wouldn’t like lower prices.

http://market-ticker.org/akcs-www?singlepost=2996132

@Backward

You cannot allow it to deflate – you would get civilizational collapse as people would not have the medium of exchange from which to trade.

The capital (oil) is mostly gone now – you cannot bring it back.

There was stuff they could have done such as turning AIB deposits into devalued AIB token money but thats over with now.

You cannot stop private creation of credit – you just can’t.

But the goverment fiat systems should seek to reduce the leverage in the system by simply printing taxable tokens that also repay the banking debt.

When they do this the capital does not disappear , how could it ?

The amount of physical capital in the system remains static at any given day.

I like to look at transport systems

In the north of Ireland Northern irish railways has been recording record passenger numbers (april – june up 10% from last year)

http://www.drdni.gov.uk/quarterly_road_and_rail_transport_statistics_apr-jun_2012.pdf

But you can’t get post 2010 transport data in the south – it appears to be a state secret with CIE refusing to publish its financial accounts.

Both NIR & IR have a similar vertical integration model – they pretty much operate on a identical basis unlike the mainland UK.

The UK is at least not stopping the flow , it is reducing the waste of capital (fuel) not unlike the south ( but perhaps not dramatically) but Ireland is stopping the flow to achieve the same goals but with much higher wastage rates.

Karl still remains in a agricultural mindset with relative fixed energy flows give or take a bad harvest.

Oil has changed everything.

The Dork of Cork – “You cannot allow it to deflate…” That sounds like what the banks told us when the crisis happened, that they were too big to fail and we CANNOT allow them to go under. That was not true. It’s called bankruptcy. They should have been nationalized, their assets should have been sold off, they should have been split up, depositors should have been protected, all upper management and CEO’s fired, no bonuses. There is no perpetual motion, and there isn’t in economics either.

If this continues to go on, if it is allowed to build up again (and the banks are trying desperately to reinflate the bubble, and they have NOT been constrained in their attempts), do you think the resulting blow-up is going to be any less hard?

Are you really saying this cannot be stopped? Really? Because it will be stopped some day when our civilization falls apart, and that, when you look at history, has happened over and over and over again.

You said, “You cannot stop private creation of credit – you just can’t.” Who is advocating that? Karl said, “Putting a stop to unbridled credit creation also removes the threat of “inflation” because it makes inflation by sleight-of-hand flatly impossible.” He is talking about “unbridled” credit, uncontrolled and run-away credit.

The banks ran out of credit-worthy borrowers when the crisis happened; they knew these people would never pay the money back. Are you saying that everyone, no matter how irresponsible, should get credit in order to keep the game going? For who?

Dork of Cork, it is this very thinking that is going to ruin this planet we live on, and destroy the people along with it. We cannot have perpetual “growth” as there will be nothing left. It is this mentality that has gotten us to where we are now.

You said, “Karl still remains in an agricultural mindset with relative fixed energy flows…” Shouldn’t something be relatively fixed in this world? Bringing more and more energy on stream just causes more and more people to have more children, which causes less food and higher prices, fewer commodities, and on and on. It cannot continue to go on like this. This is the CANNOT that we should be talking about.

We are treating the world like a free-for-all, one giant orgy of mining and stripping, all to keep the sacred “credit” flowing. I say bullsh%t. Like a drunk when he crashes his car, loses his job and his marriage, sometimes that is the very thing that saves his life, finally wakes him up. The people currently in charge are going to run all of us into a wall at full speed because they’re too afraid to take the alcohol away. They want to kick the can down the road, making out like bandits all along the way, until our children get to go through what we are desperately trying to put off.

Short-term, don’t cause ME any pain thinking, push it off onto someone else’s shift. Our narcissistic/sociopathic leaders are removing all sovereignty, any feeling of nationality. Perhaps it’s time to get rid of the slick-suited, fraud-minded people who are running us into the ground and get back to some sanity.

This ISN’T about helping the ordinary Joe, even though they make out like it is. This is all about helping the elite, keeping their money machine cranked up. Follow the money.

@backwards

You may not be getting what I am saying.

When they started to really build the euro post 1986 goverments could not really print their own currency.

When goverments cannot print they must export their capital outside their own borders.

What is generally not understood is that the Brics are the products of European capital export and inside Europe the PIigs capital consumption are a product of French, German & indeed UK capital export.

indeed Chinese coal consumption went vertical in 2002 at physical introduction of the Euro……….what does that tell you ?

When goverments truely print is is just a medium that can pay off the debt build up………..therefore the state need not “grow” via new machines to pay for this debt.

Its really a anti growth measure although some investments need also to be made in stuff that will be used again in a lower energy intensity envoirment. – (think of the reversing the Beeching cuts in the UK)

Believe me the banks don’t want national goverments to print as it devalues their claims on the existing physical wealth base.

Steve from Virgina says it best………

Steve from Virgina.

Credit money expansion (Banks) replaces a great debt with another, greater debt. There is never a net reduction in the debt, only a perpetual increase.

(we are reducing our debt by exporting our debt / symbolic wealth via goods export elsewhere destroying internal commerce)

Treasury money expansion is repudiation of debts => repudiation of (pre-existing) money, institutionalized default (expansion includes purposeful inflation).

Finance offers fiat debt then demands repayment in circulating currency (gold clause effect). Fiat currency offered by the government to retire fiat debt: both the debt and the currency are extinguished at once.

The creditor says, “You owe us, you must pay with circulating money!”

The debtor says, “There is no circulating money, the creditors refuse to lend …”

The creditor says, “We will seize your property instead and destroy your economy!”

The government (which is also a debtor) says:

– “We will create money without borrowing and repay the loans as they come due. We can do this because we are the government, our money is paid to our army.”

– “The loans are fiat — they were created by the lender with the stroke on a keyboard, they were not made from circulating currency. To act as if they were is a crime, a false claim. The lenders will be repaid by a stroke of the keyboard, in the same form as the debts were issued. If you or other lenders touch our property or our citizens we will throw you into prison and decide later whether to feed you or not.”

– “Because lenders have impoverished our country with endless false claims we will punish you severely whenever we can get our hands on you. You are our enemy and we will destroy you if we can, because you have sought to destroy us!”

PS

You just cannot stop the flow in systems – any system.

The Spice must flow…………….

http://www.youtube.com/watch?v=9XqeB692JyI

Love a rave tune to brighten things up!

Cornell West, a critique of Wall Street and Obama A Socratic Blues man of the mind.

I only found this mans work a month or so ago looking at The Anarchist Turn conference and reading some Simon Critchley.

http://www.youtube.com/watch?v=dH1uxEMoBMY

Roger – Cornell West is righteous !

Here is another link that might interest you, be sure to view the short video embedded… Best wishes

http://www.huffingtonpost.com/2012/05/02/cornel-west-mitt-romney_n_1471061.html

In an interview with the Huffington Post, the Princeton University Professor had these scathing words for our President and the Republican candidate fighting to unseat him, “Mitt Romney is a catastrophic response to a catastrophe whereas Obama is a disastrous response to a catastrophe…”

Reading this gets me excited about (very very unfortunately….) one of my favorite (Protestant ?) subjects.

Think about the word “credit”. It is in relation to “credere”, belief.

The shaky FIAT money system that you describe reposes on… belief.

Read through the post, and notice that “we” are now positing the “creation” “ex nihilo” of money…

So… logically that means that WHO is creating money ex nihilo ?

I believe…. that it is very.. tempting to believe that THEY… the banks, the State (interesting the continued references to the King under our democratic system) create money but basically, the democratic system under which we now live (and yes, in spite of great temptation to think the contrary, we have stuck a democratic process in place) means that WE create the money. Rather… our.. FAITH (and belief) in money has created a very complex system with actors who are in the light, and under the projectors, and actors… who are in the shadows, and that means… the people.

To this extent, we can remark that at this point in time.. OUR FAITH (the faith of “we the people”) is not doing very well.

Faith in what ?

Faith in… the numbers, the numbers.

Faith in the idea that the numbers speak unadulterated truth to us, and allow us to usurp a place that used to guarantee the power of money symbolically : the place of God (not the numbers, not the numbers…).

For info, I thought you would like to know the enormous difference between the way credit works in France, and in the U.S.

In the U.S…. you learn early to use a credit card, in order to demonstrate that by borrowing money, buying on credit, and paying back your debt, you are a TRUSTworthy person…

Which means that in the U.S., if you show up to buy a house with a wad of cash ? and bank account figures that prove that you’ve got dough in the bank, if you have no.. CREDIT HISTORY, you will not be trustworthy and you will not be given credit…

In France, for example, credit does not work this way.

You have to show that you HAVE money, not that you pay back your debts in order to receive any kind of credit…

Those are radically different ways of seeing… money, in my book.

And we are not looking carefully enough at the role of the.. credit institutions in this question. They function independantly of the banks, don’t they ?

These questions are much more complex in an increasingly globalized economy than we are capable of apprehending right now…

And.. what have we done with the.. FAITH of our fathers ?…

No comment. (And I’m not a Christian either..)

But I do believe that we can not reduce these questions to a machinized.. computation of numbers, and balancing accounting sheets, either.

I think using “Its a Wonderful Life” which is a great parable for life under neo-liberal economics aka the 1% vision of the world, Pottersville against the alternative of Bedford Falls when societies institutions work for the 99% not the 1% is a film and message way ahead of it’s time.

Apart from the usual people trying to alert us to the dangers of the 1% there is a little known commentator Byron Dale at http://www.wealthmoney.org/ he has worked hard on the theory of debt free money it’s creation and use for society in general and I think he has some good ideas. If Scotland has the good sense in 2014 to leave the UK, unless we(Scotland) get debt free money creation aka using Byron’s ideas, it will all end in tears.

Thanks to Golem for a great blog, and many valuable informative articles.

Alan D

You are right to point out the thinly disguised parable in the film. The Bailey Savings and Loan is framed as a mutual, where the depositors are collective shareholders and investors. In this regard, the ownership is distributed, rather than concentrated (as per Pottersville).

The Western World has now been “Pottersvilled”, where fear is used to scare the average investor into sacrificing the mutual model. Where is our George Bailey to stand up against the 1%?

Great stuff Hawkeye it’s good to have an explanation of IMF speak.

That inspired piece of ‘ Capracorn ‘ & ‘Scrooge’ with Alistair Sim were two films that were must see items for myself during the seventies at Christmas. It’s a pity that everybody is not given a lesson in the effect their life has had on the world, although I think Clarence & the Christmas ghosts would have their work cut out with the likes of Fred Goodwin, the Koch brothers & countless others.

Not hard to spot the Potter equivalents, but as you say the George Bailey’s are much harder to identify, a few candidates around here I suspect.

A healthy government bases its money on the productivity of its nation. The amount of money (of both types) in circulation should only be enough to facilitate productivity, the life blood of any nation. Speculative finance (basically gambling) should not be allowed to mix with productive finance. Interest is a tax on productivity and the bankers that the lion’s share of it. Tax speculation not productivity.

Helvena – I agree with you. The principle of supply and demand (what always caused prices to rise and fall) is now dwarfed by the outright speculative frenzy which is pushing prices up into the stratosphere. The amount of copper, aluminum, etc. that is being held in huge warehouses all over the U.S. (Detroit, New Orleans, etc.) in an effort to raise prices is staggering. It’s happening everywhere, in Hong Kong, China. The leverage in the system is unbelievable, and of course when you’re RUNNING THE SYSTEM, you know exactly when to hold and when to fold.

This is a good article by Ellen Brown called “It’s the Interest, Stupid! Why Bankers Rule the World”.

“In the 2012 edition of Occupy Money released last week, Professor Margrit Kennedy writes that a stunning 35% to 40% of everything we buy goes to interest. This interest goes to bankers, financiers, and bondholders, who take a 35% to 40% cut of our GDP. That helps explain how wealth is systematically transferred from Main Street to Wall Street. The rich get progressively richer at the expense of the poor, not just because of “Wall Street greed” but because of the inexorable mathematics of our private banking system.

This hidden tribute to the banks will come as a surprise to most people, who think that if they pay their credit card bills on time and don’t take out loans, they aren’t paying interest. This, says Dr. Kennedy, is not true. Tradesmen, suppliers, wholesalers and retailers all along the chain of production rely on credit to pay their bills. They must pay for labor and materials before they have a product to sell and before the end buyer pays for the product 90 days later. Each supplier in the chain adds interest to its production costs, which are passed on to the ultimate consumer. Dr. Kennedy cites interest charges ranging from 12% for garbage collection, to 38% for drinking water to, 77% for rent in public housing in her native Germany.”

http://www.globalresearch.ca/its-the-interest-stupid-why-bankers-rule-the-world/5311030

The systematic transfer of wealth from Main Street to Wall Street! It’s a “system” which benefits them, but not us.

I’d like to know what happened in 1970 that started the separation between narrow and broad money.

Johnny

It can probably be pinned at the door of the EuroDollar market expansion and general policy of Central Banks to relax restrictions on private bank credit creation.

Some also mention the US closing the gold window and essentially the commencement of the fiat money regime we now inhabit. This article from Peter Warburton is very good:

http://www.gata.org/node/8303

Andy Haldane’s “Banking on the State” has about 5-6 charts showing the major shift in banking structure around the 1970s era:

http://www.bis.org/review/r091111e.pdf

Nixon breaking the dollar link with gold unleashed the banks to go on a credit expansion frenzy as there was no limiting factor to the money supply.