On Wednesday Feb 7th 2007 HSBC issued a profit warning. It was the first in its 142 year history. The bank told its share holders it would have to take an unprecedented charge of $10.5 billion because one of its units, its sub prime lender, was in deep trouble. And so began the sub prime crisis.

Today GE issued a profit warning and cut its dividend to share holders from 12 cents to 1 cent. It is only the third time since the Great Depression that GE has reduced its dividend in this way. It told its share holders it would be taking a $22 Billion charge because one of its units, its power unit, is in deep trouble. GE has about $116 billion in debt.

In 2007 the banks had flooded the global market with sub-prime loans. The banks were also holding many of those same loans themselves or had transferred them to Special Purpose Vehicles (SPVs) they had set up, staffed and lent money to.

Today it is not the banking world which stands at the centre of the storm but the corporate world. In the last years they have flooded the market with junk rated bonds. At the same time they are also burdened with high yielding, leveraged and covenant- lite loans. Taken together they are about $2.4 Trillion of debt.

2007 sub prime loans. 2018 corporate junk bonds and leveraged loans. 2007 banks and SPVs funded by the banks. 2018?

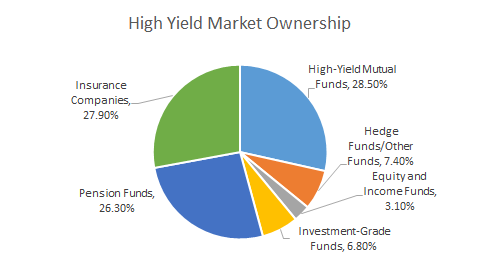

Where is this sub-prime corporate debt sitting today?

Nearly half sits in Insurance Companies and Pension funds.

Given the close ties between insurance and pensions this is not a happy picture.

Along side the pension and insurance industry who are sitting on a mountain of high risk/high return junk there is the liquidity trigger of bond backed, fixed income and high yield ETF’s. They are admittedly still small compared to the still larger mutual funds but they are a choke and panic point. The ETF market is broad in its consumer appeal but very narrow where it counts – in who makes and provides the heavy lifting for the market. There are about 5 main companies who ‘Sponsor’, which means run and control ETF’s globally. They are BlackRock, Vanguard, State Street, Invesco and Charles Schwab. According to Forbes in 2017,

Five Largest ETF Providers Manage Almost 90% Of The $3 Trillion U.S. ETF Industry

Of those 5,

…the top 3 ETF providers dominate the market with a combined market share of 82% … the top-three players also account for more than 70% of all ETF assets globally.

The sponsors in turn rely for the heavy financial lifting – to buy and sell the assets that go into an ETF – on what are called the Authorised Participants. Who are they? The main ones are … the big banks like Merrill Lynch, Fortis bank, Morgan Stanley, HSBC, Barclays, Citi etc. Some companies are both sponsor and authorised participant.

And some of those banks are also the people who have extended the leveraged loans and revolving credit lines to GE and others. Something its banks may come to regret. Because as of today GE is now shut out of what is called the Commercial paper market which is essentially very short duration bonds. This means GE is now reliant for much of the cash flow it needs for day to day operations upon revolving credit from its banks. The same banks who also buy GE bonds to put into their ETFs.

What could possibly go wrong?

Well… the Fed is trying to ‘normalise its balance sheet by withdrawing some of its liquidity. It is also trying to let interest rates rise. Taken together this is the Fed trying to bring to a much postponed end, the temporary and extraordinary measures brought in to deal with the little 2008 sub prime blip. The ECB is also planning to end in December its vast 2.4 trillion euro bond buying stimulus package of the last three years. Though it has said it will not raise interest rates till late next year. While over in China the central bank has, as far as I can see, lost control and is now more reactive than proactive. It has again and again tried tho reduce official lending and hold back the flood of shadow bank lending that fuels the property speculation market that is the centre of all regional ‘development’ and social stability in China.

Corporates are floundering in a river of debt of their own creation. They are the ones who have taken on loans they will not be able to pay if interest rates increase even a little. The banks have packaged up and sold on that leveraged loan debt and those junk bonds and they have been gobbled up by pensions and insurance companies desperate for yield after a decade of ‘temporary’ low interest rates.

In place of zombie banks we now have zombie corporations kept alive by low interest rates and bond buying QE. Those low interest rates have created a dysfunctional market. Zombie corporations are kept alive because they can sell their sub-prime bonds and get sub prime loans in a market where the buyers of those bonds and securitised loans, the insurers and pension funds and fund managers, are so desperate for yield that they gobble up ‘high yield’ which is just a euphemism for sub prime.

This time it will not be the banks that trigger another financial collapse. Not HSBC or Countrywide this time but GE or Caterpillar. The companies who have been propping up their share prices with endless buy backs funded by… low interest rate loans and junk bond issues. Or perhaps it will be the corporates who are merging and acquiring.

Last time the top of the market was marked by and to some extent triggered by a wave of vast and disastrous bank mergers. HSBC was early when in 2003 it bought one of the largest subprime lenders in america, Household International for $15 billion. Bank of America bought Merrill Lynch. RBS bought ABM Amro. Hypo bought Depfa. Every one of them saddled the purchaser with unmanageable debt and most ended in massive bail outs.

Today it is the turn of the corporates. 2016 – Bayer bought Monsanto. Funded with $15 billion in bond sales. 2017 – CVS, a retail pharmacy and health care company bought Aetna which is a health insurer for $70 billion 40 billion of which was funded by a bond issue. 2018 – American health provider and insurer, Cigna bought Express Scripts. Funded by a $20 billion bond issue. 2015 – AT&T bought DirectTV. Funded by debt. 2018 – AT&T bought Time Warner. Funded by debt. AT&T’s total debt is now around $180 billion which is a larger debt than many countries. Just yesterday IBM bought RedHat for $34 billion of which about $20 billion will be backed by new debt.

Buy backs supporting share prices, while huge acquisitions attempt to capture market share or buy growth that the parent can’t generate themselves and all funded by debt.

Of course you could say that issuing bonds insulates the corporates because the interest on those bonds is fixed. Quite so. The question I would ask is who bought those bonds and what with? Was it debt?

IF THIS WERE THE TITANIC, HAVE I GOT TIME TO LEARN THE VIOLIN?

Sadly, yes. Although I see the logic of crisis as inescapable, the last decade has shown how the inevitable day of reckoning can be put off if you are willing to inflate ever bigger bubbles. This one is not done yet.

Is that a prediction the SP500 makes new highs? I don’t think so.

Hello moss. No it’s not a prediction. I’m not that plugged in. I just think the Central banks aren’t going to actually stop bond buying and QE just yet. they might be hoping to. But they are not the ones in charge. They talk and talk and plan and advise, but when it comes to it the market dictates. The Central Banks and their political friends are just too deep in it now, too exposed, to risk triggering another crash.

They simply do not have the ammunition to solve what they have created. All they are doing is postponing in the hopes – and I think it is just hope – that a miracle occurs and their grotesque mockery of a market somehow returns to something self sustaining. FAT CHANCE.

But they will keep trying, keep hoping, keep putting it off.

Personally I think we are now in a period of sustained turbulence and volatility. Something will break. but when I do not know. My guess is politics is going to break something that QE, bond purchases and low interest rates will not be able to fix nor postpone.

I think you’re right that the bankers haven’t been this exposed for probably 100 years. I think Trump will, intentionally or not, provide quite the convenient fall guy for them.

Worldwide politicians seem to leave shame behind. Until a few years ago, they still remembered disgraceful statements and lies, now they are no longer ashamed of it. With bold statements and lies, they please the population. The question we need to ask ourselves is: Why do not we turn our backs on them on a massive scale? Have we become so bolt and untruthful to ourselves that they also dare to behave shamelessly? Or are we afraid that they will be shamelessly turning against us?

“It’s the economy, stupid!” I want to change Bill Clinton’s statement into: It’s the economy, religion and power, stupid! Together these three forces are poisoning society. Not only in the distant past but also in our time. In America, Trump owes its position to extreme income differences, religious conservatism and polarized politics. The toxic entanglement of economy, religion and power is constantly changing. A new poisonous mixture is already being created at this moment. IT specialists attract economic and political power in a semi-religious world of artificial intelligence. When is your book on Artificial Intelligence coming out David ?

As a new subscriber (as of today) I am concerned that although your analysis may be spot on, I am distressed that such obvious misspellings (Cygna instead of Cigna, Merril instead of MerrillABM AMBRO instead of AMRO..gives me pause as to your research, especially in facts presented

Please take more care to remove any doubts about your scholarship

Thank you

Does it matter if my name is misspelled if i am knee deep in sh…t?

Hello Chas,

Sorry about the misspellings. Sometimes it is simple dyslexia. I have a mild case but it does often make me blind to quite elementary mistakes. Other times it is that I am tired and hurrying. I agree it is both annoying and might well, as you say, undermine people’s confidence. Fixed now.

Why is the number of comments wrong? It happened with your last post. It says there are 38 comments to this post but there are only 7 on the one I opened. Perhaps there is something wrong with my computer?

Hello Patricia,

Nothing wrong with your computer. The comment count includes, for some reason, the number of ‘trackbacks/ping backs’. Which means the places that have used it or linked back to it.

Frog2 from Guardian CiF,

I’m the fourth or fifth person to be, historically, on this blog from the olden days when the GFC was new news and David was commenting so successfully at the G.

Good to see you back, now to read what you said 🙂

Frog2. I’d like to personally thank you for putting me in touch with Golem. Like you, I was avidly reading up about this stuff. I then saw your recomendation to read GolemXIV. I did. And here we are.

Thank you very much.

Just saw you, thanks for the thanks 🙂

Was that way back in Guardian times ?

Merry Christmas!

As a drone incident at Gatwick develops to include a military response and No-deal Brexit being actively planned for. Please could you advise where this disaster capitalism is heading.

It will be interesting to see where in ends up.

Another round of QE and corporate bind buy backs perhaps if the pressure intensifies ?

Or debt deflation and unemployment ?

Anyone’s guess I’d say.

Thanks for the blog posts,.looking forward to the next one.

https://longhairedmusings.wordpress.com/2019/01/17/listening-to-brexit/

Listening to GolemXIV ListeningtoBrexit. https://theconquestofdough.weebly.com/some-documentary-films.html

Hi David

Joe Taylor from Wigan here.

Just tried to email you on a personal matter but the address (a demon.co.uk one) bounced.

Could you please email me so I can reach you.

Cheers, Joe

How do Joe,

I direct you to the U tube videos of Prof, Richard Werner, of the Dept of Banking and Finance at Southampton University. very enlightening with solutions to our economic woes.

Ho Do Chaps, Deeply memory holed work of Paul Grignon

http://paulgrignon.netfirms.com/MoneyasDebt/essays.htm

I found links to his work from my blog back in 2011.

He has been busy in the intervening period and the SIte bears serious study.

Thanks for sharing.Nice and valuable blog, In this busy and expensive world, I believe most of the people will go for this loans as they are the life savers at some situation, Seek debt assistance with IVA debt services from financial institutions and repay your debts in an affordable and controlled way. But i know a place which provide these loans without any hassle and you can get these loans as soon as possible with them.

Here’s some latest figures from the BIS, as to the top of the ‘hit parade in terms of corporate debt to GDP excluding banks :

24: Australia – 74.4 %

23: Turkey – 80.3 %

22: UK – 83.3 %

21: New Zealand – 83.8 %

20: Austria – 89.9 %

19: Spain – 93.7 %

18: Chile – 96.3 %

17: South Korea – 101.2 %

16: Japan – 101.2 %

15: Portugal – 101.4 %

14: Denmark – 111.8 %

13: Canada – 113.2 %

12: Singapore – 114.9 %

11: Finland – 115.1 %

10: Switzerland – 118 %

9: Norway – 135.4 %

8: France – 146.6 %

7: China – 152.9 %

6: Sweden – 158.2 %

5: Belgium – 161.1 %

4: Netherlands – 170.8 %

3: Ireland – 195.3 %

2: Hong Kong – 222.9 %

1. Luxembourg – 222.9 %

The US comes in at No. 25 – 73.9 %

ETF’s a warning from @DavidGolemXIV David Malone is ( D’Artagnan) #4Pamphleteers @GrubStreetJorno @Survation @wiki_ballot @financialeyes #WIKIBALLOTPICK #IABATO #SAM #GE2019 #MagicMoneyTree https://longhairedmusings.wordpress.com/2019/11/17/etfs-a-warning-from-davidgolemxiv-david-malone-is-dartagnan-4pamphleteers-grubstreetjorno-survation-wiki_ballot-financialeyes-wikiballotpick-iabato-sam-ge2019-magicmoneytree/