For anyone who thinks that crushing the Greeks with even more dent and even more austerity will somehow ‘save’ europe’s insolvent banks here from Reuters is why it won’t.

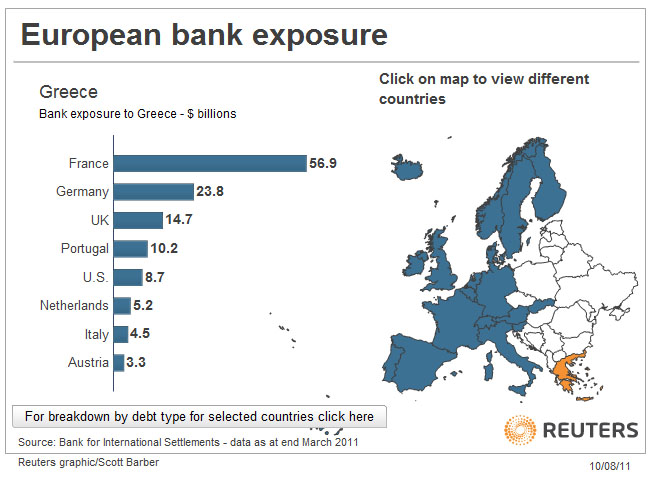

First here’s Europe’s bank exposure to Greece:

Remember this isn’t the fabled public debt wracked up by countless lazy, feckless lay-abouts and their ugly children all determinedly doing nothing and expecting to be given flat screen televisions and hospital care they don’t deserve. This is debt created by, agreed to, marketed by and because of which huge bonuses were awarded to, private bankers throughout Europe.

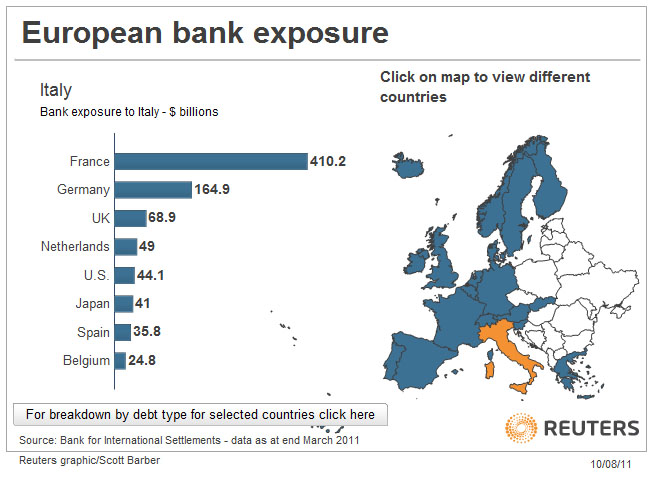

I think that shows quite clearly why French banks have been pulverized and the size of the crater on whose edge they teeter. But let’s imagine Germany ignores the rising tempest of public anger and throws its money into the hole. Now let’s look at what comes next, Italy.

Oops! France still collapses. Italy is ruled by a cretin who gives visas to men who pimp for him so he can ‘Carry on Fornicating” while Italy, never mind Rome, burns.

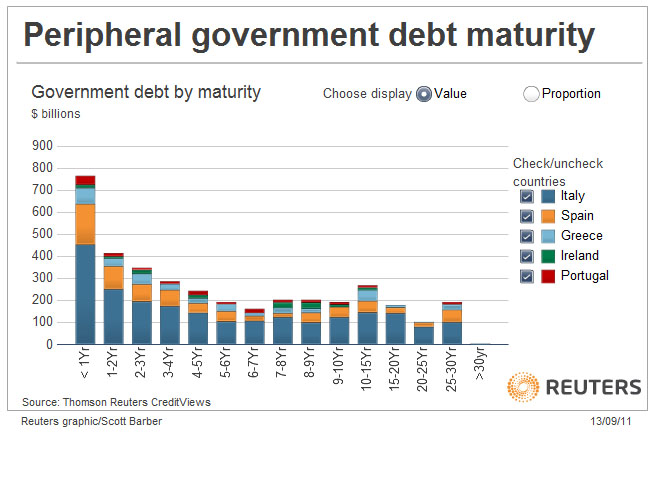

And why will Italy collapse? This is why.

Over 400 billion dollars worth of Italy’s debt has a maturity of ONE year. Another 250 billion in TWO years.

And just in case you were thinking it was all France and Italy,

“‘Germany’s 10 biggest banks need 127 billion euros ($175 billion) of additional capital’, German newspaper Frankfurt Allgemeine Sonntagszeitung reported, citing a study by economic research institute DIW.”

In case you want to see more of the images,they come from a very good Reuters graphic of the total European debt debacle which you can see in its horrid entirety here, here and here. The first two are part of the same group but I’m giving you different entry points. Then third is a larger package. And this is a ZeroHedge article in case you want to see what people are saying over there.

This goes to show the madness in startling clarity. I am not surprised as such by events but still manage to be totally shocked as they unfold. Even though I’ve been aware of what is going on due to your blog, Zero Hedge, Washingtons blog and others I can’t quite believe it as we see it happening and getting more vicious by the day.

The fact that whole nations and their people are being impoverished to save private banks is breathtaking.

I wonder if the Greek government will buckle once again and sack another twenty thousand public sector workers before stopping nearly all social safety nets too. And if they do and if they then get Octobers money what then? They will still default at some point. It’s a mathematical certainty and in the meantime as these graphs so clearly show the powers that be will only succeed in focusing attention on Italy anyway.

The thing is a slow motion car crash of horror and most people just aren’t aware. I was at a small gathering of friends last week and when I said the banks were insolvent they looked at me as if I was mad.

So I said – okay – I’m skint and I ask you for a loan because I need to pay some bills and I have a cash flow problem. You lend me a grand and I say I will give it you back in a couple of months. A couple of months later you ask for your money only for me to say I don’t have it and that I might need more money because I am skint again. This happens three, four, five times – and stretches out over a number of years! I asked them how long they would do this for before reaching the conclusion that I was actually flat out broke.

It’s been since 2007 that these banks started their ‘liquidity’ crisis and trillions later it is still ongoing. And yet people still buy that the system is functioning and the banks just need ‘a bit more liquidity’. I cannot get my head around it.

Even those like King, who admit it is a solvency problem, still keep acting as if all these financial institutions can ultimately be saved which is the really scary bit. Why throw good money after bad if you know they are insolvent?

David – what do you ultimately think will happen when one of the banks finally goes under? Do you think there will be another post-Lehmans type situation or something much worse with a domino effect of failing instiutions? My gut instinct is it will be worse but I’m kind of hoping I’m wrong on that one as I don’t fancy boiling up my shoe leather for sustenance.

If the last 3 years have taught us anything it is that it’s obvious the global economy is set to collapse. The only questions that remain are when and in what way.

Surely this time it must be worse, because there is no (or much less) leeway for governments to borrow in order to prop up collapsing banks.

“I wonder if the Greek government will buckle once again and sack another twenty thousand public sector workers before stopping nearly all social safety nets too. And if they do and if they then get Octobers money what then?”

Come on, what do you think?

I looked at exposure to Ireland but not sure what is meant by ‘Non-bank private’ ?

Maybe slow this am.

frog2

Wow, great data Golem. Did you play with the “bank stress test calculator” at all? If you ratchet it up from 5% to 6.3% the Spanish banks come popping out the woodwork, with whopping requirements. So two scenarios come to mind immediately:

1. Have all banks been honest regarding their Core tier 1 capital or is there already a huge requirement there?

2. If domino’s start to fall how can all those Spanish banks find the necessary capital?

Interesting times ahead!

Indeed great chart and David Lloyd if you crank up the stress test to 7% its RBS which comes out top

@Dave

It means lending by non-Irish banks to private individuals in Ireland. It looks like a lot of UK banks lent money directly to Irish folk to buy stuff. That is my reading of it at least.

merci in haste, will try to check the bis definition later , frog2

“The fact that whole nations and their people are being impoverished to save private banks is breathtaking.”

It’s all to do with what Simon Johnson calls the ‘quiet coup’, our governments have effectively been co-opted by the financial sector.

Once you understand that, it all makes perfect sense. The banks were let off the leash, messed up, and now are dead in the water. Even a massive injection of public money can’t save them long term – but in the short-term the bonuses can still be accrued at the expense of a hollowing out of the private sector.

Further down the line a massive 1930s style restructuring is inevitable – but the longer that can be postponed, the more can be siphoned off up to that point. And, just as important, is the management of expectations of the bottom 90%.

I think the reason for all this “illogical action”, on the politicians and senior civil servants part, to prop up the banks at all costs is because they understand that the game is over and are just stalling for time, not that it will do any good, as the system is finished. It’s just a question of when and how it will collapse. After all, which of them wants a revolution on their hands?

A ZeroHedge reader provided a link to an interesting article [highly recommended] in the comments section, reminiscent of David’s post on mutual debt cancellation:

Time for Europe’s Bond-Burning Party

.

Ever wonder why the US Fed & Treasury officials seem so relaxed about things?

“What is to stop U.S. banks and their customers from creating $1 trillion, $10 trillion or even $50 trillion on their computer keyboards to buy up all the bonds and stocks in the world, along with all the land and other assets for sale in the hope of making capital gains and pocketing the arbitrage spreads by debt leveraging at less than 1 per cent interest cost? This is the game that is being played today.

Finance is the new form of warfare – without the expense of a military overhead and an occupation against unwilling hosts. ……. The key is to persuade foreign central banks to accept this electronic credit.”

http://www.counterpunch.org/2010/10/11/why-the-u-s-has-launched-a-new-financial-world-war-and-how-the-the-rest-of-the-world-will-fight-back/

And that is exactly what we have seen happening in recent weeks, and are likely to see later this week. With various Central Banks (including our dear BoE) lapping up the dollar liquidity gushing across the Atlantic.

From the US point of view: everything is going to plan.

However, the game changer lurks in the shadows: “The BRIC countries are simply creating their own parallel system.”

And with that could herald the dawn of a new world reserve currency. BRICS + 10, The West -10.

“This is debt created by, agreed to, marketed by and because of which huge bonuses were awarded to, private bankers throughout Europe.”

This would make an wonderful epitaph for the European private banking system.

Correction: ‘… hollowing out of the PUBLIC sector.’ !

David Lloyd,

The UK banks did indeed lend a lot to Irish developers and individuals. One of the biggest lenders was RBS. The fact that RBS is, alongside Soc. Gen., the bank getting hit the hardest suggests to me that the markets expext Irish Problems to resurface.

From the details of the UK Asset Protection Scheme regarding RBS.

P.41 RBS has €4.7 billion of loans in the scheme on properties, often of buy-to-let in Eire and N.Ireland much of it in the greater Dublin and Belfast area. 62% of it has LTV (Loan to Value) OVER 100%. In other words the loan is for more than the property was worth even before this latest downturn.

P.43 €1.4 billion of loans to businesses across Eire and N.Ireland.

P.44 € 13 billion in loans to 2300 real estate and property groups/developers. 45% are residential developments. All are in default – and they are the loans that coudn’t even get into NAMA.

So as I have said many times before RBS is the walking dead.

http://www.bbc.co.uk/news/world-europe-14972539

Interesting piece showing the strain greeks are under. There has been no referendum, the greek government were not elected on a mandate of cutbacks and austerity. Surely this the sort of thing that will lead to a revolution of the people, as it has done through the history of modern world.

See: http://goo.gl/XBXaW

Hopefully not another military coup.

The sell-off is accelerating. All European bourses were down 3% already. As soon as New York openind the AMerican markets ran off a cliff, Wily Coyote style , 200 points down and still dropping nearly a half hour after the open.

Europe has responded by diving hard again. Down nearly 3.6% in Frankfurt at 3pm GMT.

Yep, those German banks sure are safe.

Charles Wheeler 12.39 — hollowed out was an expression I first met applied to the US when industries were delocalised to Mexico, becoming more applicable everywhere .

Other words or expressions are ‘recession’ , taboo a few years back, and ‘depression’, ‘protectionism’, and ‘control of capital movements’. I’ve waited some years for each to become more commonly used …

“Other countries are now reviewing how to impose capital controls to protect themselves from the tsunami of credit from flowing into their currencies and buying up their assets – along with gold and other commodities that are turning into vehicles for speculation rather than actual use in production. Brazil took a modest step along this path by using tax policy rather than outright capital controls when it taxed foreign buyers of its bonds last week.” (Hudson Oct 2010)

From Hawkeye’s link today http://www.counterpunch.org/2010/10/11/why-the-u-s-has-launched-a-new-financial-world-war-and-how-the-the-rest-of-the-world-will-fight-back/

In my simple way I’ve always thought of the WTO as a near-criminal org , and the IMF too. The various ‘Free Trade’ Treaties have been a disaster for many , and there are more in the pipeline.

As I understand it, on the face of it there should be no problem as the loan conditions to Greece include punitative interest rates to cover the risk of default; (i.e. the risk of default has already been factored into the loan) plus (I thought) all these mega-deals were re-insured, so if Greece (and/or Italy) default then they are covered.

Of course the real danger is that of a re-insurance domino effect as there most probably isn’t enough overall banking (central and private) solvency to cover the global sovereign debt re-insurances, (even if sovereign governments were able to re-appropriate all of the capital held in off-shore accounts).

On the other hand why can’t the European debtor nations do whatever it is that Japan has done to avoid going bankrupt/being downgraded/being in default? (I still don’t understand how Japan is afloat given the size of it’s deficit against GDP and the total amount it owes – the size of which beggars the EU national debts).

Re Japan, you’ll find some useful commentary at Bill Mitchell’s blog in this entry discussing the irrelevance of ratings agencys’ downgrading of gov debt of sovereign currency issuers.

http://bilbo.economicoutlook.net/blog/?p=15580

Whilst Japan chose to ‘borrow’ to fund its deficit, ‘markets’ know full well it can create as many Yen as needed to pay any debt, so no bankruptcy risk exists. (Same with US, as Greenspan actually stated himself in a Congressional hearing.)

Eurozone debtor nations cannot follow Japan as they are currency users, not issuers. Of course a Euro central treasury could provide all the money required, debt free, to member states’ to employ the unemployed, stimulate growth, repay debt etc.

Of course, the Banksters don’t want these ideas explored at all – it threatens their free lunch in money creation as debt & the debt peonage that gives them power.

Charles’ 2.52 link is Max Kaiser on Greece, there’s a Part 2 after that one.

@ Hawkeye: “Finance is the new form of warfare…”

It looks like Vince Cable agrees:

http://www.bbc.co.uk/news/uk-14967061

Reggie middleton has put up an analysis of how the collapse of BNP paribas will happen of course the could apply to any or all banks but its interesting to see the mechanics of it and understand just how stupid there guys have been, he is doing a spot on max keiser as well which I don’t want to miss

Reggie is at boombustblog

But you can find the article at zerohedge as well but then you miss out on his earlier stuff.

provide link ! frog2

Here is the zero hedge link

http://www.zerohedge.com/contributed/i-will-fly-face-common-wisdom-walk-through-run-bnp-international-television

And this to his blog, but something strange is going on with his blog because his most recent stuff is not there but its well worth reading his assessment of the euro problems which he wrote before it happened

http://boombustblog.com/

It seems there are two possibilities:

a) Financiers and governments know the current measures can’t work – that, in the words of Michael Hudson, ‘Debts that cannot be repaid, won’t be repaid’ – but see short-term ‘fixes’ as the ideal opportunity to dismantle welfarism and inject economies with a harsh dose of neoliberal medicine before the crash – re-setting expectations (no longer will the masses expect home-ownership or social housing, free education of healthcare, adequate state-backed pensions and social care, out-of-work or disability benefits) – reducing the future burdens on high earners.

or

b) None of this is pre-meditated, and they really don’t know what they’re doing.

I’m not sure which is more scary.

IMO

Most at the ‘top’ fully understand a)

Many in politics, media, economics etc come under b) but their useful ignorance is well rewarded, commensurate with their standing as ‘gatekeepers’.

Golem

Silly question or at least frivolous but how do we post avaters I don’t like being a grey man, I like flying the larland flag not because I have any connection to lapland but just because its pretty.

I don’t know. But I think it would be nice to have personal avatars. Though no big-tittie spread-cheekie things please.

Try gravatar

http://en.gravatar.com/

Charles Wheeler – Ah the quiet coup is one of the best articles I’ve ever read on the whole affair. But despite knowing all that – and why – it still takes my breath away that they are going this far – and so hard and fast. Because I think it is such a dangerous, dangerous game they are playing.

If they push people too far, if they push the economy too far, they could end up shafting themselves too. These are the conditions that cause revolutions and the fall into fascism. That’s why at times I really do think your option B is a bit more likely – they don’t actually know what they are doing. Or – more – they once did but now the wheels have come off the whole damn thing in a way they never quite predicted and they’re terrified but set on a path and they can’t change. I think the wild swings we are seeing from people like Lagarde show that she – and the IMF – are not quite as in control as they’d like us to think. If this was all some grand plan conspiracy, they’d not be running around like headless chickens.

I don’t mean by this that they are benign fools. They are neo-liberal nutters and they are dangerous but I do think they are also deeply incompetent. And they’ve been so wrapped up in this ideology – taught TINA from day one – that now they don’t know what to do as all the things they thought would make this ‘better’ just make it worse. But they have no alternative. They have no other answers. They are fundamentalists. So they will keep on this path and then probably be genuinely surprised when there is civil war in Europe.

That sums things up pretty well.

Charles Wheeler 5.59

a) dismantling welfarism, reducing the incomes of the middle class etc is what they were doing historically , for ideological or just plain greedy reasons

b) didn’t predict where it’d end up !

And that’s the shortened version!

Lol.

@ Mike Hall

Thank you for that link.

Though I’ll have to read it through a few times before it sinks in.

Evening all

despite being a left winger i’m no particular fan of the Socialist Worker’s Party but i thought the removal of the stall that they have had on Market St in Manchester for years and years was a worrying sign of things to come.

http://www.youtube.com/watch?v=2QEZFvU2eVg

David spoke last week on the right to assembly. I will be most intrigued to see how the March for the Alternative at the Tory party conference on 2nd October will be policed.

Evening all

I’m a left winger but i’m no fan of the Socialist Workers Party – however i think it is a worrying sign that the stall they have had on Market St in Manchester was removed by the police on Saturday.

http://www.youtube.com/watch?v=2QEZFvU2eVg

David spoke last week on the right to assembly. I will be most intrigued to see how the March for the Alternative at the Tory party conference on 2nd October is policed.

“Deflation does hurt debtors and lenders, but it also advantages savers and institutions with cash to buy assets cheaply. The buyers of dead banks and bad assets generate real growth and jobs. When Roubini, Posen and other mainstream economists call for measures to avoid deflation, they actually cut off one of the few ways that consumers and private business have to offset the ill-effects of secular inflation — the real culprit behind the financial crisis.

Reversion of an inflationary bubble (the S&P 500 went from about 100 to 1200 today!) is not deflation. It is mean-reversion. If you inflate something to 10x it’s original size and then deflate it back, you did not experience “deflation.” You repaired an unsustainable bubble.”

http://market-ticker.org/akcs-www?post=194412

Phil 8.43 that was a Dale Fam link, not SWP ! l

So S&P have cut Italy’s rating by one level to A from A+

So once again you’re ahead of the curve.

So the Global Central Banks Flood Market With Dollars which was supposed to

in the short term, slow the euro’s decline versus the world’s other major currencies.

Has once again failed. Wonder how may dollars were put into circulation for this latest failure.

S&P’s downgrade will make even hard for Italy to meet it promised budget targets.

So we have not just Greece under the microscope. But Italy too and as the graphs you’ve

posted show, along with all your previous comments on Italy.

That’s an entirely different and more worrying kettle of fish.

I like to call a spade a spade. What we have is a crisis of capitalism, perhaps the ultimate crisis. Capitalism, is really all about the accumulation of capital or wealth. The financial sector is the perfect means through which to accumulate wealth, through the creation of debt. Eventually though, too much wealth becomes accumulated into too few hands and demand plummets as a result, creating the crisis (excess supply, and lack of demand). One could argue that it has taken over a hundred years of ‘accumulation’ to get here, and that the crisis is the inevitable result of the flaws that capitalism has. One of the major flaws is that the future will always be bigger, but in a world of finite resources the opposite is true. You cant have endless grow. I dont have a alternative solution of course, because the only alternatives tried to date have all failed. But some system that factors in a stable equilibrium without growth will be required at some point, and perhaps sooner than we think if Richard Heinberg is correct.

Has it ever made any sense to try and reconstitute the ingredients of a liquidised soup?

Especially one that didn’t satisfy either the taste buds nor the nutritional values it claimed and charged for?

This has been mentioned here before, but worth a repost:

‘Netting out EU debt”, from Smart Taxes Network this time:

http://smarttaxes.org/2011/09/18/european-sovereign-debt-cant-we-all-just-net-along/

Interesting to see where the bulk of ‘net’ debt lies…

Test

Test again

@Bill 40

I found this a little while ago, very good article on rating agencies, mainly Standard & Poor, it’s from a US perspective but it’s conclusions apply worldwide.

http://zunguzungu.wordpress.com/2011/08/06/reading-about-the-credit-downgrade/

Cheers Mr Finn, I enjoyed that.

Ooops !!!

Yes I got my flag, I’m not a grey man anymore. Yipee

Sorry, this is the footage of the police removing a political party stall which has been there for years.

http://www.youtube.com/watch?v=uVWQMaBLi34&feature=share

The politics of the comments threads is pretty worrying. George Monbiot has written about how free market think tanks and libetarians target them to post their ideology and muddy the waters for those who are not sure where they stand. The Guardian and the New Statesmen in particular are targeted but as you say the Telegraph has its fair share of trolls – which is ironic since there have been some articles on there which have been much more critical of the bankers than on the Guardian/ New Statesman. The Left is much more concerned with the Tory government and fighting austerity than the banks.

This is from Charles Moore, former editor of the Telegraph!

http://www.telegraph.co.uk/news/politics/8655106/Im-starting-to-think-that-the-Left-might-actually-be-right.html

I post this not to grand stand as a Leftie but to illustrate that the banks are an issue for EVERYONE.

http://www.washingtonsblog.com/2011/09/imf-inequality-increases-national-debt.html

Good article this, showing how over accumulation of wealth, or inequality, is a negative to the economy and not a positive. And the complete opposite of those that keep arguing that tax rates for the rich should be lowered “to encourage entrepreneurs”.

Paul Mason on the IMF/EU shock doctrine for Greece:

“In Greece, what is happening is that the IMF and eurozone are, effectively, overriding the traumatic austerity package passed on 24 June 2011, and revising the bailout deal they did on 21 July 2011. Greece has missed this year’s deficit reduction target – it is 2.7bn euros short, mainly due to falling tax revenues and a shrinking economy.

‘Economic shock’

The IMF has, from the comments of its delegation, clearly looked at the numbers and decided this is not a near miss. One City economist, poring over the figures, sent me this reading (which is considerably bleaker than anything the IMF or Greek government have said publicly):

“Nominal GDP has fallen, with the last two quarters (Q4 and Q1) showing an average decline of 5.1% y/y. The real GDP data showed a faster rate of decline – down 7.3% y/y. Either way, if it is assumed (optimistically) that the decline in nominal GDP is no more than 5.0% y/y for 2011, this would be enough to push the deficit to GDP ratio up to around 13.1% of GDP.”

Gradual cutbacks in the state, combined with a perennial shrinkage of the economy are clearly not working, hence the IMF is advocating an economic shock. IMF delegate Bob Traa told journalists on Monday:

“If you can do it (staff cuts) up front, you get over it much more quickly. Whether society can support that is a different issue. Our experience is that… if you do things gradually that may induce the public getting very tired. Adjustment fatigue is something that happens in every country.” (Associated Press)

So what is being planned – it is reported – is to put 85,000 public sector workers, including some teachers, on enforced leave pretty promptly, cutting their pay by 60%. The number of public entities to be closed is to be doubled, to 65, and all kinds of pension cuts are to be enacted immediately, rather than in 2012.

Will the patient survive?

The question is, as with all shocks, does it kill the patient? Or, through catharsis, lay the basis for rapid recovery? What the IMF/EU will be asking is:

a) Can the Greek government actually deliver this slaughtering of its own electoral base?

b) Once it is done, can economic growth come back fast enough, and the tax take rise fast enough (it is falling 5% right now despite the tax hikes) to prevent default?”

From http://www.bbc.co.uk/news/business-14987458 .

As one commenter observes, the obvious answers to a) and b) are no and no.

Paul Mason on the IMF/EU shock doctrine for Greece:

“In Greece, what is happening is that the IMF and eurozone are, effectively, overriding the traumatic austerity package passed on 24 June 2011, and revising the bailout deal they did on 21 July 2011. Greece has missed this year’s deficit reduction target – it is 2.7bn euros short, mainly due to falling tax revenues and a shrinking economy.

‘Economic shock’

The IMF has, from the comments of its delegation, clearly looked at the numbers and decided this is not a near miss. One City economist, poring over the figures, sent me this reading (which is considerably bleaker than anything the IMF or Greek government have said publicly):

“Nominal GDP has fallen, with the last two quarters (Q4 and Q1) showing an average decline of 5.1% y/y. The real GDP data showed a faster rate of decline – down 7.3% y/y. Either way, if it is assumed (optimistically) that the decline in nominal GDP is no more than 5.0% y/y for 2011, this would be enough to push the deficit to GDP ratio up to around 13.1% of GDP.”

Gradual cutbacks in the state, combined with a perennial shrinkage of the economy are clearly not working, hence the IMF is advocating an economic shock. IMF delegate Bob Traa told journalists on Monday:

“If you can do it (staff cuts) up front, you get over it much more quickly. Whether society can support that is a different issue. Our experience is that… if you do things gradually that may induce the public getting very tired. Adjustment fatigue is something that happens in every country.” (Associated Press)

So what is being planned – it is reported – is to put 85,000 public sector workers, including some teachers, on enforced leave pretty promptly, cutting their pay by 60%. The number of public entities to be closed is to be doubled, to 65, and all kinds of pension cuts are to be enacted immediately, rather than in 2012.

Will the patient survive?

The question is, as with all shocks, does it kill the patient? Or, through catharsis, lay the basis for rapid recovery? What the IMF/EU will be asking is:

a) Can the Greek government actually deliver this slaughtering of its own electoral base?

b) Once it is done, can economic growth come back fast enough, and the tax take rise fast enough (it is falling 5% right now despite the tax hikes) to prevent default?”

From http://www.bbc.co.uk/news/business-14987458 .

As one commenter observes, the obvious answers to a) and b) are no and no.

That’s funny – I posted something and it seems to have been inserted half-way up the thread, so I asked for it to be removed and then reposted it, only for the same to happen again. ???

I just tested the same thing, only realised you’d posted at all before because the comment total went up !

Golem, or whoever comments seem to be ending up all over the place.

Neil’s latest at 5.03.PM today is neatly placed yesterday .

http://www.bbc.co.uk/news/business-14987458

his Paul Mason link…

Hmmm…I was unable to post earlier, hope this works. Some great links for you today.

On the ‘netting’ of EU debt, been here before maybe but worth a repeat:

http://smarttaxes.org/2011/09/18/european-sovereign-debt-cant-we-all-just-net-along/

Bill Mitchell’s brilliance continues with two great pieces on Greece & the Euro mess:

http://bilbo.economicoutlook.net/blog/?p=16201

http://bilbo.economicoutlook.net/blog/?p=16164

And a little publicised BIS report identifying the flows of the credit/asset bubble casino, with link & commentary here:

http://www.nakedcapitalism.com/2011/09/the-very-important-and-of-course-blacklisted-bis-paper-about-the-crisis.html

Hello all,

I’ve been out with children and just got back.

RE posts appearing in odd places. As far as I understand it – your comment goes at the end as per usual UNLESS you have replied to a particular comment in which case it goes under that comment and is indented.

If there is something else going on let me know and I’ll ask Marcus.

OK That answers that questions doesn’t it.

I don’t understand why my comment didn’t go at the end. I’ll ask.

Still a problem with the order of comments appearing? (I haven’t been hitting the ‘reply’ button in error.)

My last comment should only have Golem’s last two comments below it by time stamp?

Crumbs events are shaping up today. Most major bourses up along with gold and silver. As John Paul Young might have sung….

QE is in the air, everywhere you look around……”

Surely this delay of execution regarding the failure of Greece to reduce its deficit is because the banks are being given the chance to cut their losses by bailing out of greek bonds for almost whatever they can get for them thus bolstering (temporarily) their tier one ratios and evading to a large extent the haircut that is sure to come – is this too simplistic ?

testing

Hey Stevie,

Have you heard of Dean Clifford?

He talks about trust law.

Talking about presumption of law http://www.youtube.com/watch?v=Qd5TuLqKqM0

I find it interesting that if we can all get our heads round rebutting the presumptions they attach to everything we turn them back into public servants to serve, rather than being treated as imbeciles.

He also blows away a lot of the myths of the freeman on the land. Very much down the same road of Mary Croft.

Her free book is well worth plugging twice,

http://www.freedomfiles.org/mary-book.pdf

If you have the cahones you can clear your debt with this book.

Wonder if it would work for Ireland?

@24K

Thanks for the link, too late for me though, ” If I only knew then, what I know now”. I have saved the book, just in case, It would be good to go to court & not just be a witness to my own powerlessness.

It should work anywhere that has had the British legal system put in place, during the days of empire. It is at the root of the system, should be the same even if the growth above it is different.

@Neil

Great link, near the beginning he talks about making the oligarchy’s take a hit in countries that need IMF intervention. I have seen sweet FA evidence of that in Ireland & Greece. IMF reports have been consistently wrong, they seem to write them to justify the actions they are about to take. I suppose as they are basically unacountable that’s possible. Why if they are so *&^%ing clever are they grinding Greece into the dust, it can only be to aid these financial oligarchies & any damned fool can see it’s not going to help that economy, the opposite in fact. They remind me of medieval doctors, there answer to everything, add more leeches.

I wonder when it will dawn on enough people that Greece could be a window into the future for all of us.

I wonder where this will end up? Could the spam have been a virus ?

testing2

Paul Mason on the Today programme this morning on the horrendous austerity measures being proposed for Greece http://news.bbc.co.uk/today/hi/today/newsid_9596000/9596296.stm .

He’s met ordinary families already running out of money for food and describes the ruling Pasok party as being engaged in “legitimacy suicide”.

Thought for the Day.

Do you really want to give the financial shamans , with all their attributes of jiggery-pookery and mumbo-jumbo, Power of Attorney over your life and those of your children and their children?

Because if you don’t, that’s the stake in the game being played.

James Goldsmith was spot on in the 90’s and everyone called him a cranky, crazy old relic of the past.

http://www.youtube.com/watch?v=4PQrz8F0dBI

WOW!!! More than a hundred comments! Your blog has sure come a long way…

Congrats on the 100th comment, shame it’s not a monkey.

Most excellent way the blog now disperses comments like a garden sprinkler.

Also, if we get a troll can we keep it?

I’ll feed it and take it out for walks promise 🙂

Parallel universe? I thought I hid that quite well…

As far as I can see we must not only stop this money bleeding away to banks but more importantly we must try to get back what has already been lost. Are we going to have to have a violent revolution on account of the fact that our democratically elected politicians have been hijacked? I hope not but if that is what it is going to need then in the interests of our country and the whole world economy it must happen and the sooner the better.

Hello there, simply become alert to your weblog through Google, and located that it’s really informative. I?m going to be careful for brussels. I?ll appreciate in the event you continue this in future. Lots of people might be benefited out of your writing. Cheers!

Would you like 1K Likes on Twitter for free? Try this http://addmf.cc/?QGP0U1Q

Was singled out because the Greatest Skilled Providers Interactive

Software award winner for 2004 by the IAC Internet

Advertising Affiliation for this Search Engine Relationship Chart.