So far in Propaganda Wars we have looked at the Bank’s version of reality in which the banks were blameless victims of unscrupulous and fiendishly clever paupers who ‘took’ loans from the banks against the bankers better judgelment and will. In the next part we began to turn the tables and attack the banks where they feel they are strongest – in how they manage risk. We began with “Netting Out”, where Liabilities and Assets are supposed to cancel each other out leaving the bank, no matter how huge its balance sheet, no matter how seemingly exposed to losses, just this side solvent at all times. I suggested this sort of cancelling out is fine on paper but in reality is more akin to people trying to swap sides in a rowing boat. I further suggested that this was why, despite the lovely graphs showing how it would all “Net Out”, in the event, nearly all the major banks went bust and had to be bailed out.

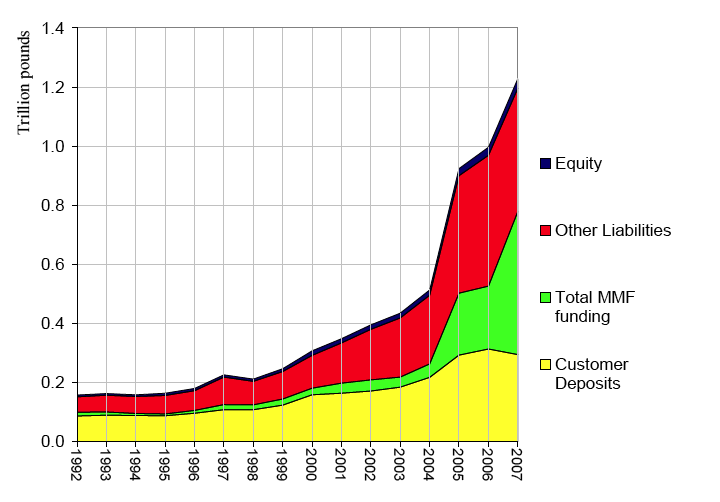

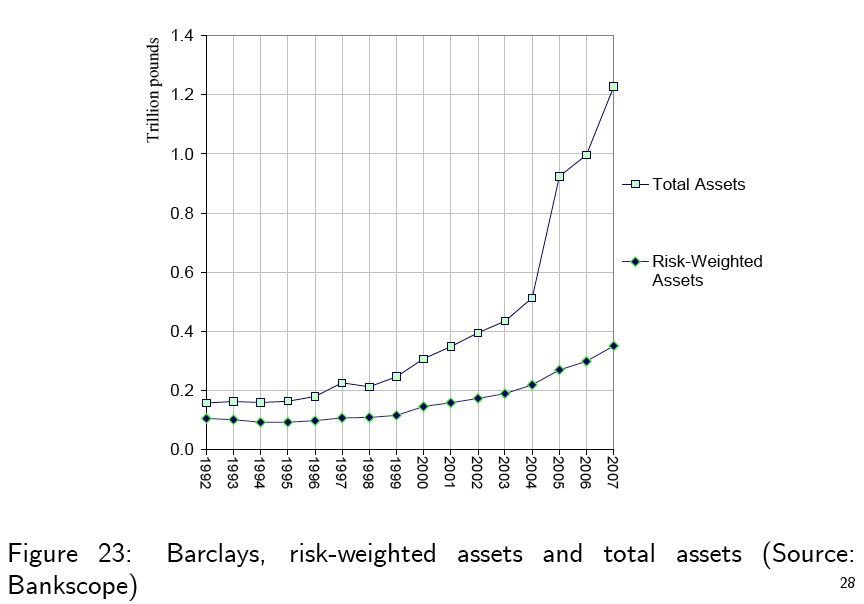

But in the spirit of fairness I ended by asking if the people moving about in a rowing boat analogy, fun as it is, was fair or a cheat? Are banks really that unstable? To answer that we have to look again at the graphs. These graphs show the history of Barclays Bank in the ‘bubble years’ of 1992 to 2007. They plot the massive growth of Barclays bank, its Assets and its Liabilites. The over all shape of these graphs and what I have to say about them would apply equally, however, to almost any of the big global banks (as we see later).

Assets and Liabilites are two sides of a bank’s “balance sheet”. So what exaclty is being balanced and is it a stable?

To answer both these questions we are going to have to move back and forth between the two sides of the balance sheet.

Don’t panic! Its a story of idiots, drunk on their own assurances of safety and brilliance but almost totally devoid of common sense and responsibility.

First thing to notice is how incredibly the bank has grown. The size of the bank is the height of the graph. It has grown from about an 180 billion pound bank to one of 1.2 trillion. It has grown in almost every respect but one – the base upon which it sits. In the Liabilities graph to right take a look at the aptly coloured ‘thin blue line’ of Equity. This is the money investors have put into the bank. It is the bulk of the bank’s capital. As you can see it was never big, but as the bank has grown it has become smaller and smaller relative to everything else. Relative to the size of the bank’s total liabilities (money the bank owes to others) on the one hand, and its total Assets (money it is owed – which means money it has lent OUT Mortgages etc. ie Money at risk) on the other, the equity base of the bank has become vanishingly small. Which is a problem because that equity is the base upon which the security of the bank rests; It is money the bank would need to call on if – in the most unlikely event – some of the loans it had made didn’t work out. Unlikely I know but bear with me.

First thing to notice is how incredibly the bank has grown. The size of the bank is the height of the graph. It has grown from about an 180 billion pound bank to one of 1.2 trillion. It has grown in almost every respect but one – the base upon which it sits. In the Liabilities graph to right take a look at the aptly coloured ‘thin blue line’ of Equity. This is the money investors have put into the bank. It is the bulk of the bank’s capital. As you can see it was never big, but as the bank has grown it has become smaller and smaller relative to everything else. Relative to the size of the bank’s total liabilities (money the bank owes to others) on the one hand, and its total Assets (money it is owed – which means money it has lent OUT Mortgages etc. ie Money at risk) on the other, the equity base of the bank has become vanishingly small. Which is a problem because that equity is the base upon which the security of the bank rests; It is money the bank would need to call on if – in the most unlikely event – some of the loans it had made didn’t work out. Unlikely I know but bear with me.

Bankers and their regulators will often refer to a bank’s ‘equity base’. If you remember in the last part of this series I imagined a bank as a tank of water with money flowing in from assets/loans and out to pay liabilites. The Equity base would be the base of the tank and the reserve of money that remains in it, as funds flow in and out. The overall size of the graph relative to that very thin blue line of equity means we have a very, very large tank standing on a very, very small base. Not only that but there are massive pipes pushing and pulling huge volumes of money in and out. Basically Barclays is an upside down pyramid trying to remain upright while it contends with the forces of the flows in and out, which are orders of magnitiude larger than the volume of tank itself and even larger than the puny base upon which the whole thing rests. Stable? Not terrifically.

If you look at the growth of this and other banks over the last century, which Andrew Haldane, Director for Financial Stability at the Bank of England does here, you find that at the start of the 20th century the equity base of US and UK banks relative to the size of their balance sheets was 15-25%. By the end of the 20th century this had fallen to about 5%. The base was 5% the size of what it was supporting.

This same ratio, of the base of the bank’s equity base relative to its operations, is also what is meant by the ‘Leverage’ of the bank. An equity base 20% of the size of the the balance sheet it underlies is a leverage of 4 times equity base. Equity which is only 5% the size of the balance sheet is 20 times leverage! Which, it seems to me, does serious violence to the word ‘balance’.

But dramatic and stupid as this sounds, and is, it falls far short of describing the real predicament, because these figures are based only on what appears ‘on-balance-sheet’ and does not count the bank’s ‘off-balance sheet’ assets and liabilies. When these are counted as well leverage at the peak of the bubble was on average 50 times the equity base! And some insitutions (think Fannie and Freddie and AIG to name a but a few) were even higher.

Now to be fair we do also talk about a banks ‘deposit base’ because, even though deposits are a liability (the money belongs to their customers who can withdraw it) it is usually a fairly stable pot of cash which banks rely on. But even being generous and adding in the deposit base the picture doesn’t get much better. In 1992 Barclays’ deposit base and its equity together were larger than their total liabilities. A very safe and stable bank at little risk of disaster. Begining in 1998 this began to change with liabilites and assets outgrowing the equity and deposit base. By 2004 the real bubble began to grow and by 2007 equity and deposits were less than a third of the size of the bank’s business and its liabilities. This change in stability was overseen by both the very clever and well paid bankers and their very trustworthy regulators.

How unstable is this kind of leverage? Well to put it in terms of our analogy of the water tank, the equity base is the volume of the reserve that remains, separate from the in and out flows. With huge leverage (very large in and out flows) you can see that any decrease in the inflow (money coming in from loans or from the bank itself borrowing) and the reserve will be run dry in a no time at all. Which is precisely what happened in 07-09 at various banks and Insurers.

The strucutre of Barclays bank and all those like it, is simply unstable. Not only that but the banks and the polticians they bought and paid for have, over the last twenty years deregulated and dismantled almost all the safeguards that might have given the banks any robustness when it came to absorbing losses. The size of Barclays bank’s internal reserve (capital base) relative to the flows of assets and liabilities which run through it, make it shockingly unable to deal with fluctuations or shocks in flows of money in and out. In short the bank is structurally at enormous risk of failure – all the time.

The obvious questions are why are global banks like this? How did they get like this? And who let them? Sadly, the answers only make things worse.

First yet another analogy to keep in mind – Boeing Jumbo jets are huge, over-engineered, immensely stable, robust and safe aircraft. Three engines can stop working and the thing can still fly and land. They are airworthy in every respect but are about as agile and resposive as they look – a Lazeeboy chair with wings. The modern jet fighter on the other hand is almost unflyable it is so unstable. Jet fighters are as agile as they are preciesly because they are on the edge of disaster all the time. They are engineered to be unstable – right at the edge of failure. The modern jet fighter is responsive in the same way as a pencil on its tip. Banks used to be built like Jumbos – for safety. Now they are engineered like jet fighters. It’s an analogy that might appeal to the testosterone addicted, morality-cripples of the banks, but it bodes ill for the rest of us.

So what are the ways the banks ditched safety and robustness in favour of performance, profit and bonus package?

Once again I hope you’ll forgive me for breaking here. I have to go away for work and thought to get at least this posted before I go.

Folks may find this interesting.

http://www.propublica.org/article/fed-shrugged-off-warning-let-banks-pay-shareholders-billions

Basically the banks paid out hundredof billions to shareholders, who then presumably were happy to let bank bosses have huge salaries etc.

The FDIC (aka taxpayer) warned against it as they thought babks were not robust without it but were over ruled.

Simply, if banks hadn’t given all that money to shareholders, taxpayers would not have had to bail them out. They would have had ‘money in the bank’ to withstand the 2008 crash.

It is very fitting you should choose Barclays as your example. So fearful are they of oversight that they refused UK government money in favour of less accountable Fed cash and a Middle eastern sovereign wealth fund.

barclays had a good crisis in the end and Bob Diamond (like a certain beer in the 70’s) worked wonders. How he , and HSBC, kept these monoliths afloat was always a mystery to me. I thought they had a secret weapon of reseves I was unaware of.

Interestingly the Telegraph is reporting the banks are being investigated for manipulation of the LIBOR rate during this period. To me that would explain a hell of a lot.

The UK won’t investigate properly but maybe, just maybe, America will.

“How he … kept these monoliths afloat was always a mystery to me.”

Luck?: http://goo.gl/DSvNX

A slight deviation from topic but this article explains how supply side economics is sold to us (from an American perspective.).http://consortiumnews.com/2012/01/27/selling-the-supply-side-myth/

The banks are of course the ultimate in supply.

And the ideology that supply side underpins:

“It is harder to see what it gives the ordinary teabaggers, who would suffer grievously from a withdrawal of government. But such is the degree of misinformation which saturates this movement and so prevalent in the US is Willy Loman syndrome (the gulf between reality and expectations) that millions blithely volunteer themselves as billionaires’ doormats.”

Monbiot on Rand: http://goo.gl/Gnli0

Balance sheets haven’t been believed for a few decades. I can think of any number of supposedly more complex reporting schemes – anyone wanting a little punishment could view this one – http://www.economonitor.com/blog/2012/02/next-generation-system-wide-liquidity-stress-testing/ .

A lot of what has gone on is not much more than bent accounting, with a number of Catch 22s built in like making the fraud only likely to be found by very, very expensive audit techniques. Non-financial firms used to book sales when the goods were unloaded at docks and repo 105 wasn’t much different. Leverage might be OK if properly regulated – there’s a compelling logic it’s efficient in getting more from less. We know regulation is the problem, but any scheme such as that above can be got round. I suspect the real problem is there is no real demand for the services of banks, much as there was none for the rotting trainers etc. in containers already booked as sales to boost stock price.

Many of the frauds start in legitimate cash flow techniques.

What’s particularly sad is that along with the relaxation of capital/reserve constraints the incentive structure for the targeting of all this money creation is skewed toward assets rather than production. It’s almost like it was designed to create a credit base property bubble.

Hi Golem,

Thank you. Great post.

Just a couple of comments:

The Barclays capital base began to be whittled down around the time that Martin Taylor (who sat on the Vickers commission) left the Blue Eagle, BarCap came into being and Barclays pretends that it abandoned prop trading.

One hopes that work goes well.

Best,

Sir Harry

Charles – Couldn’t agree with you more. The edict of philosophy is to apply logic and argument to the benefit of mankind and the world he dominates.

Rand was an anathema who would probably have been drowned in the swamp pf mediocrity were it not for the fact her message suited the mindset of the power elites.

In this respect she was a sycophantic messenger of the dog eat dog principle; a proven failure throughout the known history of evolution.

Even as a novelist she failed to present a credible ending to Atlas Shrugged.

Can’t remember who said it (mea culpa) but I liked this:

“Rand saw the world through the prism of the Russian revolution, but in typical Russian fashion she took an idea, fell in love with it, and then elevated that abstraction to a point where it became pure dogma. Her books are capitalism as envisioned by a second rate Dostoyevsky knock off. In terms of personality ironically she wasn’t very different from Lenin. Had she been born 10 years earlier she probably would have joined the Bolsheviks”

“second rate Dostoyevsky knock off….” chuckle!

bill40 -I think the author is favouring Reagan to the detriment of Nixon and his side kick Kissenger, when they dropped the gold standard on the dollar then cajoled the Saudi’s and other main producers to adopt the fiat dollar for all oil pricing.

Arguably it was this move that created the early 70s oil crises.

Looks to me like they had £.9 Trillion in ‘assets’ which are only worth that whilst we’re competing for them, wonder how austerity is working out for them?

Thats the best explanation of liquidity I’ve come across. Why doesn’t the BBC explain it like that?.Careful David, you’re becoming the Richard Feynman of finance education.

What’s that I hear? You don’t have a PhD in economics? Well, I’m shocked! The other guys are using 3rd order derivatives and mathematical modeling for their explanations.

.

‘Computer Models Versus Looking At The Facts’

http://goo.gl/BC8EW

“CDS are a form of derivative taken out by investors as insurance against default. According to the Comptroller of the Currency, nearly 95% of the banking industry’s total exposure to derivatives contracts is held by the nation’s five largest banks: JPMorgan Chase, Citigroup, Bank of America, HSBC, and Goldman Sachs. The CDS market is unregulated, and there is no requirement that the “insurer” actually have the funds to pay up. CDS are more like bets, and a massive loss at the casino could bring the house down.

It could, at least, unless the casino is rigged. Whether a “credit event” is a “default” triggering a payout is determined by the International Swaps and Derivatives Association (ISDA), and it seems that the ISDA is owned by the world’s largest banks and hedge funds. That means the house determines whether the house has to pay.

The Houses of Morgan, Goldman and the other Big Five are justifiably worried right now, because an “event of default” declared on European sovereign debt could jeopardize their $32 trillion derivatives scheme. According to Rudy Avizius in an article on The Market Oracle (UK) on February 15th, that explains what happened at MF Global, and why the 50% Greek bond write-down was not declared an event of default.

http://goo.gl/CjG4O

A Ponzi scheme is when one man, or his family, attract billions of $$s by pretending it was invested, despite laws to the contrary.

An economic system is when the professions of economists and accountants ally with those who make the money, to make it out of nothing, despite regulations to the contrary.

Was 9/11 even necessary? Should the Fed not have lowered to ZIRP in 2000? Will the system ever fail, as yet no defaults have occurred, except for Lehmans? Was that not a warning to all who might want to declare a default?

Your metaphors are a bit mixed up in my view, although your points are still valid.

The tank you discribe is “cash flow”. There is money coming in one “pipe” from assets (interest paid on loans) and money going out another “pipe” toward liabilities (interest paid on deposits, interbank loans, etc). The store of water in the tank is the liquidity (cash or nearly cash) not the equity/capital.Without a stock of Liquidity, any business cannot pay it’s bills and falls flat. Equity and capital is a notional measure of the difference between all the assets and liabilities. Some of it may be in cash but most of it is not cash or usable as cash. Capital is the measure of how solvent (or not) a business is.

So the point I see from your graph above, is banks may be solvent (in some cases, maybe, if you assume the accounting story really reflects reality) but in most cases they are only solvent by the slimmest of margins even when everything is going great.

Your metaphor of the rowing boat isn’t far off but too small in scale. The situation is more like a big square raft with lots of people constantly moving around on top. The theory suggests that as one person randomly moves to one side another will move the opposite way and the raft will stay in balance due to the large number of randomly moving people.

But…. the people can’t move in a truely random way. They are tied with cords to a number of other people on the raft. If one person in a group pulls to one side their group will be pulled in that direction. If a couple of people in a group pull to one side the rest the group will struggle resist the pull. The bigger and stronger the individual, the more they will influence the group as a whole.

But….. people are not just tied to one group. They are tied to lots of groups in very complex ways………

and everybody else’s cords are invisible.

So what should, in theory, be a self balancing system…… is not…. by a long shot.

I like this raft analogy. What about a big wave coming like Peak Oil?

Another excellent resource is The Crash Course at http://www.chrismartensen.com

Lori

Chris Martenson’s Crash Course is a very good broad based primer.

His big picture view is second to none.

anybody else following this yet best thing since max kieser

http://rt.com/programs/capital-account/

makes the rest of msm news look like a soap opera for people too snotty to watch east enders

More unforeseen consequences of a Greek default. (Orderly/disorderly: take your pick!)

When things have got this far out of whack, it’s no wonder we have to resort to metaphor.

“”In the beginning, all I had was this number, and I didn’t really know what it meant,” says Sinn, who is president of the Munich-based Ifo Institute for Economic Research. “The Bundesbank told me those were irrelevant balances. But that didn’t reassure me.”

“We’re caught in a trap,” Sinn says. “If the euro breaks apart, we’re left with an outstanding balance of nearly €500 billion, owed by a system that no longer exists.” That figure, €500 billion, is more than one and a half times Germany’s annual federal budget.

http://www.spiegel.de/international/europe/0,1518,818966,00.html

“The Bundesbank told me those were irrelevant balances. But that didn’t reassure me.”

I think we all know that feeling, Hans.

Welcome to the party!

““I don’t think Libor can continue to be something which is policed and monitored by the banks” bombshell …

But wait …

““There is a serious point regarding the extent to which regulatory intervention is desirable in what should be a market function.”

For some, in other words, market manipulation is preferable to regulation.

http://goo.gl/1ulbc

Who needs liquidity when fractionalised banking has developed and extended into fictionalised banking?

Next question – Assuming the above is true, to what purpose -fact or fiction – does austerity serve?

Some encouraging news for supporters of MMT & its Job Guarantee scheme. 🙂

The JG is proposed for the UK at ‘Liberal Democrat Voice’ (“…The most-read website by & for Lib Dem supporters…”)

http://www.libdemvoice.org/opinion-job-guarantees-a-economic-stimulus-worth-considering-27360.html

Unfortunately LibDem members no longer have any influence on party policy.

@ Golem (& others)

David, I have just seen an online audio-visual explainer of the macro economy ‘How The Economy Works’ here:

http://econviz.org/

It’s absolutely excellent & I suggest putting it in your limks section. Everybody should understand this.

That’s a good overview – but it doesn’t seem to matter how many times you try to tell people how the monetary system works, they don’t believe you.

‘Banks take in money from depositors and loan it out to borrowers, private banks can’t ‘create’ money’ is the default setting, and it’s difficult to budge!

That’s why politicians are having such an easy ride with their ‘it’s like a household’ balanced budget mantras.

i think this is an example of the type of crap Golem is talking about: Seemingly we elect governments to protect us from amongst other things financial predators, but unless we are ALL vigilant with EVERYBODY ( I’m not sure if this includes children, prisoners & the mentally incompetent ) keeping an eye on things like, the repeal of Glass-Steagall & all matters of high finance & economics we are ALL deemed culpable when it goes pear shaped.

Apparently EVERYBODY should educate themselves & somehow keep an eye on the machinations of people like Greenspan, Summers & goldman Sachs. We must then turn up with pitchforks & demand our government does something to stop neo-liberalism, the use of derivatives, & sub-prime mortgage fraud etc. This is because our great leaders would otherwise think everything is OK & not bother.

We have to do this while being under a barrage of disinformation, assurances of lots of jam tomorrow & propaganda from a media that if it knew what was going on, sure as hell would not tell us. Instead the opposite is true that the population is actively encouraged through marketing to adopt lifestyles that have lead to the present mess.

I wanted to have a good rant on the comments section, but you have to register, I had a quick look at some of the other articles & decided I would rather not waste my time.

I would like to say to her, be careful of what you wish for, because we don’t need everybody.

http://www.theatlantic.com/international/archive/2012/03/iceland-is-wrong-to-blame-its-leaders-for-the-financial-crisis-and-so-are-we/254039/

Wierd. Exactly what was on my mind. A bloke gets up and goes to work. After paying his bills he’s got some money left over. He sees an Ipod but before he buys it he’s supposed to think “Hang on, I’d better check out the entire global financial system first and make sure everything is OK before I spend this money otherwise if the system crashes it’ll be my fault.” It’s a complete nonsense isn’t it?

The people who run the system can’t get their heads around it so what chance does Joe in the street have?

The same with the “shouldn’t have taken that mortgage” story. People need somewhere to live and it was “buy now because it’ll cost twice as much next year.”

I paid more than I thought it was worth for exactly that reason. I wish I’d have bought earlier but I thought they were overpriced and would come down. But they kept going up.

These reasons are pumped into the press by PR agencies because they are want to distract people from the real reason, the banks can create money and they went wild.

Precisely. With the demise of social housing you have the ‘choice’ of paying exhorbitant rent for a damp shoebox with little security of tenure and complete reliance on the whim of a landlord, or taking on a mortgage at the market rate – that’s it.

But the idea that there is some kind of symmetry between lender/debtor is one of the great myths of neoliberalism.

That article made me gag too!

The revisionist narrative is that the credit bubble came out of a clear blue sky and couldn’t have been foreseen, and in any case, we are ALL culpable for taking the other side of the deal.

It’s as if 30 years of deregulation and lobbying and craven complicity by politicians never happened.

Anyone who reads Robert Sherrill’s account of the S&L debacle (‘The Looting Decade’) in The Nation in 1990, sees Byron Dorgan’s address to Congress on Gramm-Leach-Bliley in 1999, reads up on Brooksley Born’s battles with Greenspan/Rubin/Summers over her attempt to regulate OTC derivatives (see; Frontline’s ‘The Warning’), or reads ‘All the Devils Are Here’ knows this isn’t true.

Satyajit Das’s ‘Traders, Guns & Money’ and ‘Extreme Money’ also lift the lid on the shenanigans going on out of sight of public awareness.

But, of course, saying we are all guilty is equivalent to arguing none can be blamed.

p.s. This latest interview with Das on the Keiser Report offers another case for the prosecution: http://youtu.be/HloixPNGsgM?t=13m3s

That magazine is some appalling sh*t.

The faux progressives media show their concern for socially liberal good causes, yet when it comes to the true crunch, they do the 1% propoganda job.

Just like the BBC, the Indie and the Guardian. Shift the Overton window rightwards on the economy and finance, but make the correct liberal noises over social issues, and the future job with the oligarch owned media is still on.

Sim & Syn

Ironically if we all did what she suggests it would be the end of boom bust on the back of bubbles & a disaster for the lords of finance. She knows damned well that this education process would never happen, it’s just more passing the buck. The fact is, if enough people start to even doubt the bullshit about so called good investments like property this could stop a bubble forming. This is why G is right to concentrate on the propaganda aspect, if enough people are made to see what the Emperor is really wearing, who knows what could happen.

As Chris Hedges said in as many words, One expects it from the GOP, but the so called progressives are the biggest let down.

Just came across this another rabbit hole on the legal complexities that bind us

http://sherriequestioningall.blogspot.com/2012/03/own-stocks-and-bonds-think-they-are.html

I think I am right in saying that Golem said 2012 would be a year of repression. here’s an article on a definate growth industry in the US, like burgers it will probably travel over the Atlantic, UK police privatisation a possible start or continuance.

http://www.thenation.com/article/166600/how-fund-american-police-state

“A violent burglary. The scenes of crime officer who visits your house is employed by G4S. Fibre samples are found, swabs taken and despatched to G4S Forensics. A suspect is held in police cells run by G4S, appears before magistrates trained by the company. At Crown Court the accused is found guilty, sentenced, driven to a G4S prison in a G4S van. On probation he attends a G4S work programme wearing a G4S electronic tag. This is not some dystopian future. All this and more is happening in Britain today. I have only brought together in one story a small sample of the domestic activities of G4S, the world’s largest security company.

http://goo.gl/jRVkC

Compare and contrast …

“Omni Consumer Products (OCP) is a fictional megacorporation in the RoboCop franchise. It creates products for virtually every consumer need, has entered into endeavors normally deemed non-profit, and even manufactured an entire city to be maintained exclusively by the corporation.[14][15] OCP is a modern example of the longstanding trope of the evil megacorporation in science fiction.[16][17]

OCP is depicted as a megacorporation with divisions affecting nearly every level of consumer need, society, and government. Their products range from consumer products to military weaponry and private space travel. Their projects included the RoboCop, the ED-209, and the RoboCop 2 cyborg. OCP owns and operates a privatized Detroit Police Department and have been known to employ criminals to achieve their goals.[14]

OCP, throughout its depictions in the RoboCop films, has sought to fully privatize Detroit, Michigan into Delta City, a manufactured municipality governed by a corporatocracy, with fully privatized services — such as police — and with residents exercising their representative citizenship through the purchase of shares of OCP stock. They also serve as part of the military-industrial complex; according to OCP executive Richard “Dick” Jones, “We practically are the military.” Jones observes in RoboCop that OCP has “gambled in markets traditionally regarded as non-profit: hospitals, prisons, space exploration. I say good business is where you find it.”

http://goo.gl/TPTVI

Charles when you consider that most ‘petty’ criminality is driven by the drugs trade it puts our presence in afghanistan in a different perspective

“We are in alliance with an Afghan government and army dominated by Northen Alliance warlords, plus the renegade Karzai clan of Pashtuns, fighting on the losing side of a civil war to support a massively corrupt government, which is incompetent only in that we have a total misunderstanding of what it is trying to achieve. The purpose of the Afghan government is to use NATO forces to enforce a temporary monopoly of power by the warlords who control the government. This will enable them as long as it lasts to loot billions in aid money and control the booming heroin trade. Then when NATO leave, so will they with their billions.” from Craig Murray

Another excellent piece from Ellen Brown

http://webofdebt.wordpress.com/2012/03/08/public-sector-banks-from-black-sheep-to-global-leaders/#more-3194

but more of “you couldn’t make it up” at london banker

http://londonbanker.blogspot.com/2012/03/complexity-costs.html

“you couldn’t make it up”

In that vein – MFGlobal are looking to pay bonuses to their executives – they went bankrupt, remember?

“The value that Brad, Henri and Laurie bring by helping to liquidate and recover assets for the estate outweighs the cost to retain them,” Piantidosi said. It would cost more to replace them with outside consultants less familiar with MF Global’s operations, he said.”

http://goo.gl/R0VuX

Nice work if you can get it [pt. 936]

“The compensation packages are still being prepared, and would apply to Chief Operating Officer Bradley Abelow, General Counsel Laurie Ferber and Chief Financial Officer Henri J. Steenkamp,”

So the top operating officer, top lawyer, and top finance guy. It’s all so beyond satire that comments are superflous, but 60 odd backroom staff, blameless secretaries and the like, were booted out of the door without pay the day MF went down.

Oh, and the missing (or rather vapurized) funds have now risen to 1.6 billion. Up from 600 million when the story first broke. Nice bit of lowballing.

Just like to add that the news about MF Global paying bonuses to people who should be in jail was announced on friday evening, as Greece was defaulting.

Even a couple of years ago, if anyone had outlined to me the salient points of the MF Global story, and told me that that was truly how the world was, i wouldn’t have believed them.

I’d have dismissed them as Trots, or wierdo conspiracy theorists. It’s has shattered my whole worldview.

Know the feeling, somebody is on the case though an American Greek sends a threatening letter to another American Greek, namely Jamie Dimon. The theft of MF customers funds he lays directly at JP Morgans door. It’s good to read, it doesn’t pull any punches & it is almost a declaration of war.

http://prudent-speculation.blogspot.com/2012/03/but-of-course-its-not-one-giant-cess.html

Good stuff,

I’m a boring accountant and most attempts to explain banking drive me mental because they are wildly incorrect*, yours are pretty spot on. I like the comparison between Jumbo jets and fighter jets, I’ve used that analogy before (albeit to describe other things) but it’s pretty appropriate here.

Just one little caveat – not only are bank liabilities the mirror of bank assets, the flip side of bank assets (i.e. mortgages) is a bubble in asset prices, i.e. the selling price of land. The whole banking/land system is a giant machine to suck up and destroy wealth.

* I have tried to explain to people that for every financial asset there is a financial liability, so that while a mortgage is a liability from the borrower’s point of view, it is an asset from the bank’s point of view. I have tried to explain to people that once the BoE has bought back UK government bonds it might as well tear them up, as you cannot owe yourself money. But to little avail.

Completely off-topic, but who cares? (while the Golem cat’s away…)

For your edification, I offer the thoughts of a (name withheld) commenter at the Guardian on the complex nature of our current financial woes.

“It’s actually feminist capitalism that caused the credit crunch – women with more more money and greater expectations of their men combined with men with less money and the need to invent some to impress women , plus a huge number of property shows on TV , equals mass credit to buy property equals the credit crunch.”

There, ladies and gentlemen, is either an indication of the mountain of ignorance / misinformation we have to conquer or perhaps one of the finest trolls I’ve seen in many a year!

You choose!

He must be an ugly troll if that’s his method of impressing women, sounds like an embittered divorcee, wonder if he still has his sports car ?

Yves Smith at naked capitalism on great form here:

http://www.nakedcapitalism.com/2012/03/gillian-tett-exhibits-undue-faith-in-data-and-models.html

Long been ambivalent about Tett’s ‘analyses’ – her celebrated ‘Fool’s Gold’ was a glorified PR job for JP Morgan with Jamie Dimon as saviour of the world!

This made me laugh a lot- from Jim M

I do understand your point but I think the troll (I doubt it-more a naif) has a point- that there is an awful lot of what we see unfolded and unfolding at the moment, has a lot to do with some quite primitive ideas and behaviour and , just as importantly, the way people interpret the behaviour of others. Public relations and advertising and propaganda propagate certain behaviours. Our banking operatives are motivated by crude ideas. Our so called Mainstream media propagate ideas which are interpreted in some way which is often delusional-sometimes intended and sometimes not.

Dick swinging in a world where women are now earning and exerting influence is definitely different to a world where women are, for the most part, economic dependents.Burdens change. Responsibilities change.

Go on the average high street on a Saturday night and watch the women swinging along.

It is all part of the great delusion of the times. It is in some ways the folly of falling for the idea that social progressiveness and libertarianism is in any way about social progress. The empowerment of infantilism is not social progress.

Perhaps we need to draw attention to the distinction between the 68% and the 32% -the (approximate) distinction between those who can understand abstraction-and those who cannot-rather than the 1% and 99%.

Just watched this from the House of Commons. Steve Baker MP, on a bill that makes bankers bear their own commercial risks. Riveting…

http://www.stevebaker.info/campaigns/the-financial-system/financial-institutions-reform-bill/

Very interesting and thanks for posting the link. There is hope.

The current system cannot survive. Naturally there is fierce opposition to changing this.

That’s human nature, not evidence that the world is run by evil bald guys.

It’s disappointing to see how many MPs leave the chamber when Mr Baker starts to speak. I think many are too lazy to do the hard thinking. Massive disconnect.

I don’t care if an idea comes from the right or the left. I’m sure most here know that right/left is a load of nonsense. Might as well divide on fat and thin, it makes as much sense.

Anyway, thanks for the link. Apologies if I’ve rambled but I’m in my cups.

Well spotted Labled. I think making people morally responsible for their own actions will be more effective at reforming the financial sector than attempting to tax every transaction or imposing arbitrary limits on bonuses.

Bankers can gorge on as much money as they like – I don’t care – but, they must always be accountable to their host. Every good blood-sucking parasite knows that.

That is good viewing Labled. Many thanks.

Some similar entertainment here for the good blog followers, Libertarian party presidential candidate Bill Still gets on a roll here – just wait until the fangs come out.

Opening dialogue sets the tone nicely:

“…Yesterday I got an email from my Texas coordinator that I thought was pretty interesting…. Quote. ‘I think congress should wear uniforms, you know, like NASCAR drivers, so we could identify their corporate sponsors’ (laughter)… I thought that was a pretty good idea…”

http://www.youtube.com/watch?v=oGhcngTNMoM

I am almost certain many blog comment contributors have viewed Still’s 2010 award winning documentary The Secret of Oz – a reworking of 90’s doco, The Money Masters. However, for those that haven’t here you go. And, look out for a champion of our times Ellen Brown. Enjoy.

http://www.youtube.com/watch?v=swkq2E8mswI

This documentary changed everything for me, as I instantly came to understand why I had never taken the risk of entangle myself with the banking system.

A must watch for those that haven’t. I cannot stress that enough.

Off topic, but just something I wanted to share about the deeper meaning of life & its bearing on our choices in economics. A comment from a regular contributor, Tom Hickey, on the MMT blogs, particularly http://mikenormaneconomics.blogspot.com/

It was posted as a comment at heteconomist.com & is something I can entirely relate to in countless experiences in my own very eclectic life (now in its 58th year). In fact, considering the challenges facing humanity in the 21st century, one could consider the things Tom alludes to as increasingly underlying everything in human affairs.

Tom Hickey –

“Just to bring it back to economics, “The heart is finally fulfilled. The mind becomes still in its Presence. The Self is finally known,” implies the state of fulfillment that lies beyond desire and aversion. That is to say, self-interest persists as long as illusory personality and individuality remain, constrained by the finite limiting mind that knows and feels only partially.

I recall one of my teachers (Maharishi Mahesh Yogi) saying that “spiritual” means holistic and that spirituality is the study of the whole. This is the practice of yoga, the quest for spiritual union as identification with the whole rather than with only a part (body, mind, personality, limited self). The state of yoga is realization of one’s true nature as the whole.

The more holistic one’s consciousness becomes, the less attached to the partial it remains, shown by the receding of desire and aversion for limited experiences that center on self-interest.

Contemporary economics is all about self-interest as the motivating force of life, pursuit of which is considered rational action. This is an expression of spiritual ignorance from the spiritual or holistic point of view , that is, ignorance of who and what one really is. This ignorance impels a person to pursuit illusion rather than reality. Pursuit of illusions through ignorance always ends badly, which is how human beings finally get the message that there is no cheese at the end of those tunnels and embark on the quest.

Economics based on self-interest as rational encourages people in this pursuit, while spirituality encourages people to rise above self-interest if they are to find what they actually are seeking, which is abiding fulfillment. Thus, contemporary economics is antithetical to perennial wisdom. Ayn Rand realized this, and threw her lot in with Illusion, pursuit of which condemns one to the wheel of karma, that is, the endless cycle of alternating happiness and suffering until one wakes up to this folly.”

Mike ,

Your comment is spot on. one problem I have with the philosophy I am reading at the moment which is a strand running through the classical Greek Variety is that it is really quite elitist and the fear of the mob and promotion of the State all be it the city state back then and its interest over the self or individual is uncomfortable for me.

The meta physical has a place and a big place the modern fixation with the empirical and a stoic insistence that to be Just is to pay ones debts all leave out an appreciation of just what an odious chapter the past 30 years have been in a descent into triviality puffery and illusory lies.

James Burke has a lot of interesting things to say about specialisation and its own special form of blindness to a wider appreciation of the secular life. We are all shuffled into our water tight compartments a la dale carnegie and effectively mushroomed by the system.

Mushroomed= kept in the dark and fed shit.

A lecturer I know said to me, ‘capitalists run the money, but the money ends up running them.’

EF Schumacher was also of the opinion that contemporary economics were a symbol of spiritual failing.

The ideas are not new of course:

‘A man who builds a mountain of treasure has a lot to lose.’ Lao Tzu

‘It is is easier for a camel to pass through the eye of a needle than for a rich man to enter the Kingdom of Heave.’ Jesus Christ.

The Vietnamese Buddhist monk Thich Naht Hahn always urges as much compassion for the rich as for the poor since they both suffer in their own ways. The problem I suppose is when The Powers That Be are so alienated from their own humanity that they can’t be reasoned with.

What is money and where did it come from?

L. Randall Wray: http://goo.gl/uATJk

Bit off topic this but has anyone else noticed that a ‘credit event’ occurred on Friday evening, the MSM made a very small mention in passing (BBC News) that some of the bondholders (ie those who didn’t line up for buzzcut no.2) will get compensation.

1. is GS one of the holdouts ?

2. why did some bondholders voluntarily give up the claim to some money ?

a. it is other peoples money and they don’t care

b. it was uninsured and this was the best they could get ?

3. as the insurance (CDS) has been shown to pay out, why would anyone agree to future haircuts ?

Everybody knows that it won’t stop with Greece. Portugal, Spain and Italy are on a knife edge, the probability of CDS trigger has increased and with it the price of Sovereign bonds should also increase (a self fulfilling prophesy)

ZH is the only site giving any details about the default (in its own inimitable style), now either it is a non-event or it is the elephant in the room, either way, no one else seems to be talking about it (it is a default in the EuroZone for gods sake).

So the question I’m really asking is :-

Are events in Greece with regard to default and the credit event significant ?

Any help on understanding the implications would be much appreciated.

A lot of good stuff referring to the unholy mess on the Slog:

http://hat4uk.wordpress.com/

Bob R – they are significant in the sense they expose yet another ploy in the infinite library of financial alchemy.

In any real sense it underlines the fact that democracy is a sham when governments are controlled by the financial oligarchs.

Then laws and acts of legislation, sovereignty of monarchs, parliaments or peoples are merely methods of exploitation and containment.

It’s the 21st century version of serfdom and most Western governments are choosing to bond their citizens into it.

In essence, the choice these citizens are left with is either to take back control by reaffirming their rights too democracy or be corralled by the financial oligarchs.

It’s as basic as that. And for it to happen we need governments that are frightened of the people they’re supposed to serve.

12 March 2012 20:42

The big imponderable is whether Credit Default Swaps are worth the paper they’re written on. If a ‘default’ occurs and creditors claim their ‘insurance’ payout the issuers are in trouble if they haven’t set aside funds to pay (and there was no legal obligation to do so) – see: AIG. But it seems that many issuers of CDS are also holders. The fact that the ISDA (controlled by the big banks) has been reluctant to trigger payouts suggests that CDS were really no more than a fig-leaf to offer a false sense of security – enabling higher leverage.

Meanwhile, central banks can continue to restore private banks balance sheets with a bottomless pit of cheap finance, while austerity is imposed on the masses – when as much has been extracted from the Greeks as they can get away with, the caravan moves on to Spain, Portugal, Italy … France?

Look out for the four horsemen, the film I mean, not those guys hovering over Greece.

A review:

http://www.newscientist.com/blogs/culturelab/2012/03/can-we-turn-a-free-market-into-a-fair-market.html

“TODAY is my last day at Goldman Sachs. After almost 12 years at the firm — first as a summer intern while at Stanford, then in New York for 10 years, and now in London — I believe I have worked here long enough to understand the trajectory of its culture, its people and its identity. And I can honestly say that the environment now is as toxic and destructive as I have ever seen it.”

http://www.nytimes.com/2012/03/14/opinion/why-i-am-leaving-goldman-sachs.html?_r=4&hp

The first of many to wake up, perhaps?

No formal acknowledgement of illegality from the Exec, but a clear exposition of endemic deception (which if properly interpretted, a.la. William K Black, is a betrayal of trust, ie. fraud). But then perhaps normalised occurences of fraud has rendered it not illegal in the minds of the perpetrators??

On a very similar theme http://londonbanker.blogspot.com/2012/03/your-bank-fiduciary-or-predator.html

Yes. He’s careful to say none of the shenanigans were ‘illegal’ (probably advised on that) – which just highlights what you can get away with without breaking the law.

Apparently, shafting your client by selling him products you know are dodgy/overpriced, or which are entirely inappropriate to their needs is not ‘fraud’ in the financial sector.

The whole emphasis on modern finance is to create products so impenetrable that the client will never undestand them – drawing economic rent from asymmetric information – the exact OPPOSITE of how ‘free markets’ are supposed to operate (Michael Hudson is very good on this in the latest ‘Keiser Report’).

A lot of small traders taken to task on Watchdog must realise they were in the wrong profession!

But anyone whose read Satyajit Das’s ‘Traders, Guns and Money’, McLean/Nocera’s ‘All the Devils Are There’, or Matt Taibbi’s dispatches from the frontline of the financial war knew that already.

So.. you are talking about the bank bubble..

At the turn of the century in my adopted city, Grenoble, we had a tramway system.

Grenoble, like most of France’s cities, was NOT SO BIG at the turn of the century…

That tramway system was ripped out, and something else (it’s called.. progress, right ?) took its place.

Right now, Grenoble is building another tramway system. More.. progress, right ?

The colossal building plans, AMOUNT OF MONEY INVOLVED, are a demonstration, and symptom of what you’re talking about in this post.

Isn’t there a proverb that says “the bigger they come, the harder they fall” ?

I think so.

(You could substitute “higher” for bigger, too.)

Concentration in the banking sector is driven by the desire to limit risk.

But… nothing will eliminate the risk of failure. And the human animal has a propensity, like other animals, to test the limits.

The more you insure yourself against failure, the higher you up the ante, and ultimately the MORE RISK you introduce as a result of your desire to eliminate all risk.

Insurance, and the collective desire for security are what’s driving a lot of these bubbles.

In the meantime, my adopted home town is starting to look more and more like Soviet Russia every day. Unbelievable, huh ? Take my word for it.

It’s called… the planned economy. And it’s.. BIG.

Frankly, at this point, the salvation that I see lies in.. failure.

Yep, you heard me. This system has gotta fail in order for US to survive.

Life is full of paradoxes.

When this is all over let’s turn the roulette tables in to matchsticks. I bet 10 matchsticks that this crisis will be a distant memory in 20 years time. That will be the time when convention dictates that I retire. LOL

You seem to have over-simplified the explanation of equity and confusingly refer to it as ‘reserves’.

Let us take the water tank analogy: I am a bank owner, so my and the depositors’ money is pooled together in a tank. The money is then lent out, nothing will remain in the tank. A small part of the money is deposited with (i.e. lent to) the central bank and is known as the bank reserve. When money flows back to the tank I am the last in line to receive my share, so I would lose all my money before the depositors lose any of their money. In bad years the equity goes down and in good years part of the profit is retained (lent back) to increase the equity base.

Reserves were important when currency was linked to gold and bank runs were more common, now they play a minor role. Banks that have deposit insurance pay a yearly premium.

Great article, keep up the good work.

Remarkable things here. I’m very happy to look your post. Thanks so much and I am having a look forward to touch you. Will you please drop me a mail?

Woah! I’m really loving the template/theme of this site. It’s

simple, yet effective. A lot of times it’s challenging to get that “perfect balance” between user friendliness and appearance. I must say that you’ve done a great job with this.

Additionally, the blog loads extremely quick for me on

Chrome. Exceptional Blog!

There could very well be no other gambling game that’s easier to win plus much more fun to play compared to game of blackjack. Doyle Brunson obtained through taking part in throughout against the law games in exchange Block, Ft Value, and Texas which has a close friend called Dwayne Hamilton.

Hi, i read your blog occasionally and i own a similar one and i was just

curious if you get a lot of spam feedback? If so how do you protect against it, any

plugin or anything you can advise? I get so much lately it’s

driving me crazy so any help is very much appreciated.