Further to Saturday’s look at the FT’s careful shepherding of public opinion, the weekend provided another fine example of the same process but done so very subtly I suspect the perpetrator, The BBC’s Robert Peston, was not even aware he was doing it. My thanks to Phil for pointing it out and providing the link.

Official figures are important things. We have to have them or we would have little or no basis for discussion. The problem is those who can influence how we decide what gets counted get to control most of the arguments from then on. And of course the powerful lobbies are the ones who have their experts sit on the advisory and expert committees which do the deciding.

This article takes a short critical look at the figures the banks use in order to say how vitally important they are. As we all know it has been, throughout the bank debacle, important to the Banks that they be able to say how central they are to the economy of every nation. It forms the first line of defence in arguments over the bail outs. So it rather suits the banks for figures to be defined in ways that paint the best possible picture and then have them bandied about uncritically, so they can then form the accepted framework for all further analysis.

I use Peston’s article just as a jumping off point. (Before I start I’d like to say I think Mr Peston is actually better than many.)

Right at the start of his article on proposals for a European banking union Peston sets out the to-be-accepted framework of reality inside which the discussion will take place.

Whether we like it or not (some don’t) the City of London and financial services is important to the UK economy. Depending on what you include in that industry, it represents between 8% and 14% of national output or GDP

In this article I am not interested in the banking union, I am interested in these figures he wishes us to accept uncritically and which he perhaps accepts himself as such right at the outset.

Odd don’t you think, that they very ground for Peston’s argument and incidentally one of the things the banks like to say as frequently as possible, namely how much banking contributes to the economy, should be so vaguely measured: between 8% and 14%? One estimate is nearly half the other. And indeed Mr Peston is glossing over a travel trunk of oddness. To my mind the propaganda job Mr Peston does, perhaps unwittingly, is not whatever he argues in the body of his article but the way he silently ‘suggests’ that the figures he presents are unproblematic and objective. This, is a very valuable service to the banks, even if he did not intend it.

He cites figures for the bank’s contribution to GDP as if he were reporting on how many cars GM sold or how many sparrows were counted in East Anglia.By doing so he helps to legitimate them.

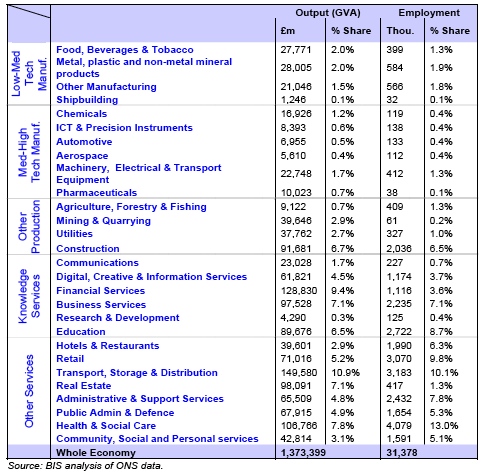

The government compiles figures for what various sectors of the economy contribute. This chart is taken from a Department for Business, Innovation and Skills publication. As you can see it lists Financial services as contributing 9.4%. The lower end of Mr Peston’s vague window of possibilities. You might also notice the chart talks not about contribution to GDP but something called GVA. GVA is Gross Value Added. And is a very useful term for those like the banks.

The government compiles figures for what various sectors of the economy contribute. This chart is taken from a Department for Business, Innovation and Skills publication. As you can see it lists Financial services as contributing 9.4%. The lower end of Mr Peston’s vague window of possibilities. You might also notice the chart talks not about contribution to GDP but something called GVA. GVA is Gross Value Added. And is a very useful term for those like the banks.

GVA can sound rather simple. It is just the total value of what a sector produces minus the total cost of all the things used in production. Pretty clear for cars and pencils. But not for banking.

That might seem a rather brusque and categorical statement. It also happens to be true.

To start let’s take a trip down memory lane with a speech given by Andrew Haldane of the Bank of England in July 2010 with the title, ” The Contribution of the Financial Sector – Miracle or Mirage?” .

In September 2008, the collapse of Lehman Brothers precipitated a chain reaction in financial markets. This brought the financial system, and many of the world’s largest institutions, close to the point of collapse. During the fourth quarter of 2008, equity prices of the major global banks fell by around 50% on average, a loss of market value of around $640 billion. As a consequence, world GDP and world trade are estimated to have fallen at an annualised rate of about 6% and 25% respectively in 2008Q4. (My emphasis throughout)

Pretty much as I remember it. However, if we had consulted official figures – those exact same figures Mr Peston quoted – then we would have found that,

According to the National Accounts, the nominal gross value-added (GVA) of the financial sector in the UK grew at the fastest pace on record in 2008Q4.

Pardon ?

As a share of whole economy output, the direct contribution of the UK financial sector rose to 9% in the last quarter of 2008. Financial corporations’ gross operating surplus (GVA less compensation for employees and other taxes on production) increased by £5.0bn to £20bn, also the largest quarterly increase on record [in 2008Q4] .

Something strike you as just a teeny little bit odd? Yeah me too. When the banks were collapsing and destroying the global economy and requiring hundreds of billions in direct and indirect bailouts they were also, according to the same figures which Mr Peston quoted, doing the best and contributing the most to us, they ever had. And those figures are compiled in exactly the same way today as they were in 2008. I suspect there are very few politicians on Capitol Hill or Westminster who are aware of the obvious problem with these official figures and their estimates of what the banks contribute, and those few who are aware, I suspect, are those formerly from or hoping to go to, the financial sector. So no one has said a word, the figures are still used to show how much the banks contribute and the public is unaware.

How the figures are concocted

In 1993 something called the United Nations System of National Accounts (SNA) was updated. SNA is the globally uniform set of accounting ideas for nations compiling statistics. The UN sets global methods so everyone can get it wrong in the same way. Being snide I know. But it helps with sanity. In 1993 a whole new concept was introduced in to the SNA which they called FISIM – Financial Intermediation Services Indirectly Measured. The core of this new concept was that a lot of what banks did was not charged for explicitly (no widget was sold with a price tag on it) and these implicit ‘services’ were not being recognized and the banks were not getting the credit for them. The major thing the banks and their acolytes felt the banks were not getting credit for was the way the banks took on financial risk when they extended a loan. This was an intangible sort of thing but a valuable one – they felt. And so from 1993 onwards the risk the banks took on ‘on our behalf’ (kind creatures that they are) was counted as part of their contribution.

As Mr Haldane puts it in his understated way,

…it is not difficult to construct scenarios where the contribution of the financial sector to the economy could be mis-measured under this approach.

You think so? He goes on to say,

This can lead to some surprising outcomes. For example, assume there is an economy-wide increase in the expected level of defaults on loans or in liquidity risk, as occurred in October 2008. Banks will rationally respond by increasing interest rates to cover the rise in expected losses. FISIM will score this increased compensation for expected losses on lending as a rise in output.

So the more risk the banks charge for and take the more they are contributing. Of course the banks also and at the same time want to claim they are not at any risk and all is fine. Thus we had and have again a situation where the banks take huge risks and make a profit from them, which is counted as their contribution to the nation, but disguise the risks and claim all is risk free when it comes to talking to the regulators. Thus they set up off-balance sheet financial vehicles which house risky stuff which gives great returns, but which is rated AAA by paid-for lubricators from the Rating agencies. Risky when calculating returns and fees but risk free when talking to the regulators. Nice. And if anyone asks any questions from the floor they are told ‘how dare you question your betters? Just look at how much we contribute to your otherwise miserable little island’.

The game for the banks is to increase the total volume of risk as much as possible, but downplay the risks in any particular deal while still charging for as much risk as their clients will stand for. The best way of doing this is to make risky loans funded by debt borrowed from other banks doing the same, but hiding it just like they are. This is known by its more usual name of ‘leverage’. Leverage allows one bank’s risk to become another bank’s loan.

Let me give you a concrete example. This chart is from P.29 of a study done by The Bank of Greece (the central bank) published in Novemeber 2008 called “Assessing output and Productivity Growth in the banking indistry”

The pink line measure the rate at which Greek GDP was increasing. The Blue line is the rate of bank GVA (contribution). Personally I think this is a terrible graph which make little sense. Nevertheless it is what the Bank of Greece believed and still does believe. It shows that as far as The Bank of Greece, The government of Greece, other banks, the Eu and the UN were concerned Greek banks were doing a bang up job and contributing fantastically to the well being and wealth of Greece plc.

As the study concluded,

The results show that bank output and labor productivity increased considerably during the period under examination, outpacing the respective GDP growth and labor productivity of the Greek economy. Capital productivity and Total Factor Productivity of the Greek banking industry have also improved remarkably mainly since 1999,..

You really could not make it up. They live in a parallel world called ‘Aren’t we so god-damned wonderful’. I could find similar words in similar studies done in your country and mine if I cared to.

What had increased at Greek banks, as in all others, was the risk being taken in increasing amounts of increasingly risky loans. That too is shown in the paper without the authors appearing to realize.

This graph shows the bank’s contribution is made up of three services: Payment services, ‘Others’ and intermediation. The first two are high street banking. The last one, ‘intermediation’ is extending loans and taking risks ‘on our behalf’.

This graph shows the bank’s contribution is made up of three services: Payment services, ‘Others’ and intermediation. The first two are high street banking. The last one, ‘intermediation’ is extending loans and taking risks ‘on our behalf’.

As you can see the pink line is the one which captures all the growth in bank ‘contributions’ to the nation. It also captures the exact size and cause of the financial collapse.

I suggest the difference between the lower two lines and the pink line is better thought of as the gap that opened up between what banks should do, used to do, and which does contribute to our nations, and that part which merely creates the profits for the bond and share holders as well as the bonus pool of the senior bankers. The pink line is not what the banks do for us it is the size of the catastrophe they pile up ready to shove on to our shoulders when it all goes wrong. It is the part which is now killing us but which the bankers are most determined to defend and rebuild.

A subtle but vitally important part of that defence is to have the figures about the bank’s contributions to GDP used without question.

Strip out the risk disaster part of banking from their ‘contribution’ and you find that finance drops way, way down the league table of which sectors contribute and which do not. The truth is the banks as they are currently allowed to operate do not make the huge contribution to the nation they claim to.

What have the Romans ever done for us?

http://www.youtube.com/watch?v=ExWfh6sGyso

Great piece Golem 🙂

Bill Black has a couple of good pieces just up at NEP

The Payoff: Why Wall St Always Wins – Jeff Connaughton

http://neweconomicperspectives.org/2012/10/the-payoff-why-wall-street-always-wins-jeff-connaughton.html#more-3532

Jeff speaks about his new book recounting his experiences as a former administraion insider.

And:

http://neweconomicperspectives.org/2012/10/the-city-of-london-continues-to-drive-the-criminogenic-regulatory-race-to-the-bottom.html

Dear Golem xiv — thanks for everything — you might want to repair the hyperlink to the BBC above — it should be :

==> http://www.bbc.co.uk/news/business-20002553

Best wishes ~

Fixed. Thanks.

Golem,

You are banging your head against a brick wall with this as http://fullfact.org/factchecks/does_the_city_contribute_14_of_gdp-2397 clearly describes. The truth is the figures don’t exist and we still don’t know for sure the true costs of any bailout.

Factchecks largely chimes with your article yet and assumes GVA and GDP can be used interchangably. yet this ite http://www.cityoflondon.gov.uk/Corporation/business_city/research_statistics/Research+and+statistics+FAQ.htm#gdp puts the square mile at 2% of GDP.

The bail outs are estimated to be north of a trillion so my often derided (in the Mailygraph) view that the City is a net drain on the Uk economy seems on the money, pun intended. Add to that the tax avoidence industry and the conclusion is clear.

Kick them out or tax them out.

Brilliantly researched and succinctly put. Thanks again.

Is there a chance you could stick your references on to the end of the blogs?

I’ll try to remember.

Please correct me if I am wrong but I think there is another aspect to this. The article refers to the use of GDP to calculate what the bankers have ever done for us ( Thanks Roger ), which means that the figure calculated would include the profits of foreign banks within the city that actually go back to that companies country of origin, as would be shown if GNP was used to calculate the City’s contribution.

I had a look on yell.com – there are 282 banks listed within the borough of the City of London, from everywhere.

http://www.yell.com/s/banks-borough+of+the+city+of+london.html

Ireland GDP in 2010 was $211.39 billion as opposed to GNP of $149.54 billion, most of the gap I would imagine is due to the relatively large percentage of foreign corporations that have invested there, possibly due to the low corporation tax. Irish politicians rarely mention GNP.

I found this video some time ago in which Joseph Stiglitz talks about the preferred use of GDP over GNP & how he & others once proposed a Green GDP which took into account the degradation of the planet. This idea was soon squashed by the US coal industry:

http://www.youtube.com/watch?v=QUaJMNtW6GA&feature=player_detailpage

A very sharp article Golem.

I Like Andrew Haldane, they should make him guv’nor (they won’t because he is a troublemaker)

Almost all of the growth in GDP since 2005/6 has been due solely to financial intermediation (that’s what the banks have done for us Roger)

If you take out fictional finance, GDP was negative the whole time.

I’d say that the banks’ contribution to our economy is even worse than that described here.

Firstly is the thorny issue of tax contribution. The ONS publishes “Summary Supply and Use Tables”, which show direct contribution to tax take by sector, as follows:

Manufacturing GDP: 17% Tax contribution: 59%

Finance & business services GDP: 26% Tax contribution: 12%

They don’t break out finance from other business services, but the gist of the findings still holds. Finance & services sector is a large contributor to our GDP figures, but is woefully under contributing to the nation’s tax revenues. Manufacturing is proportionately paying 6 times the amount and therefore far more efficient at lining the Gvt purse than Finance & Services.

Admitedly this excludes income tax and other tax takings that the employees in these sectors will contribute. However, as their share of employees is low, and especially in the case of finance, many highly paid people will get remunerated on a very tax-efficient basis, I doubt very much that they are indeed “paying their way”.

The second point is even more damning. For this we need to look at the amount of liabilities employed to obtain these levels of GDP contribution. The finance sector sustains its revenue by using a combined balance sheet running at over 5 times our nation’s GDP.

So Return on Liabilities is 9%/500% = 1.8%

Finance has essentially turned the UK into a glorified hedge fund, where the tax payer & citizen is an unwitting guarantor of the liabilities. And a not very good one at that, given that we as a nation get less than 2% return for our phenomenal “skin in the game”.

Brilliant!

This piece Golem and Hawkeyes comment are just the very best kind of analysis… which having been away I have only just seen…these truths need as wide as possible dissemination to counter the endless propaganda from the Banks and their armies of PR duplicators in the media and their Politician fellow travellers.

The standard BS line about how vital Banks are to the economy is key to this government’s ability to ward off real new regulation and control. I’d go so far as to call it the central plank in their NewSpeak line. Destroy that central myth in the common mind and we might actually be able to move forward.

This article would make the basis of a great short book.

(Really wonder too what someone like Ed Balls would make of it central points these days…)

Thanks for keeping on with this Golem. I wish that you, or someone like-minded, could be brought in from the extremities of the blogosphere and actually get involved in sorting this mess out. Has everyone seen this article about monetary reform proposed by the IMF? It proposes eliminating the bankers prerogative to print money:

http://www.telegraph.co.uk/finance/comment/9623863/IMFs-epic-plan-to-conjure-away-debt-and-dethrone-bankers.html

Clearly, there needs to be significantly better oversight and direction of whatever replaces the current system. But it is energizing to see fringe views that have been circulating on blogs like yours gradually becoming mainstream.

David.

Was just going to mention that bizarre Telegraph piece. I caught the IMF paper a few months back but seeing it get attention like that is a nosebleed level of cognitive dissonance.

I was going to bring it up for that closing line: “One thing is sure. The City of London will have great trouble earning its keep if any variant of the Chicago Plan ever gains wide support.”

I am very hopeful that the “Chicago Plan” gains traction, even if only as a shorthand buzzword for people to act sophisticated without really thinking anything. America’s finest city has always been rather slandered in the field of Economics by association with “The Chicago Boys” — Chicago deserves better company than Milton & his fan club.

This has been proposed previously by others. Allowing the Banksters to print money is a serious threat to our democracies, let alone our long term prospects.

Try http://www.positivemoney.org.uk

CPI and RPI and the change they are now cooking up re: RPI are both examples of politicians and bankers fiddling figures. it is their speciality art commonly known as cheating and it goes hand in hand with lying. when the boat finally sinks these same people will be blaming the general public.

Debt is the enemy and it is the only so called ‘asset’ that banks recognize. By default they will seek to make slaves of most of us to keep their own version of events intact. To stay sane do not give any credence to a single word any career politician or their masters the bankers put out…

Golem,

Can I ask whether you have been in touch with Robert Peston about this? Has he been forwarded this blog article?

I’m afraid I don’t know Mr Peston at all. I have to admit it never occured to me that he would care to know or care what I think.

Perhaps I do him an injustice.

So lets get this striaght.

Banks who got us into this position are allowed to print money from thin air, and charge it into circulation as a debt bearing commodity up to whatever %apr they choose? From thin air? This is fraud, this is criminal, this is counterfieting. If you or I decide to print ourselves up say 10,000 quid and spend this into circulation, what do you think the repercutions of your actions would be????

We have gone to far, we have allowed something insidious to permeate ours and infact the whole worlds psyche. This cannot and wil lnot end well. This whole system should be destroyed.

Getting it straight is rather a horrid experience isn’t it.

‘The process by which banks create money is so simple that the mind is repelled.’

J.K. Galbraith

Hello Charles. Good to keep the ghost of Galbraith haunting us.

Always good to hear from you too.

Y’know I can’t think where I first heard it but isn’t Peston ‘common purpose’ who’s techniques include ‘neuro linguistic programming’, which in my gobbledigook thesaurus comes out as hypnosis light; whether he’s a dupe or a perp is another question, but that’s what this looks like.

I’d like to know a bit more about Mr Peston. I’m not so sure he’s as impartial as some would like us to think.

GDP is in any case a very shoddy, obfuscating, measure.

If I crash my car, kill a kid, end up in hosp, go to rehab, and buy a Mercedes after all that, such a safe car, I contribute significantly to GDP.

The guy who makes diminutive lovely white coffins gets an super order paid extravagantly by my insurance.. Good to go for a Great Xmas party or whatever for him.

To mention only one bizarro statistical aspect, GDP is usually quoted on a country, not a per capita (household..) basis. This makes no sense and is offensive.

E.g. per capita GDP has been sinking in France since the early 90’s at the very least, but no mention, hush hush. And even such a measure – if calculated and reported in the MSM – would not be very valuable, as it would be an average or other central trend measure, it would not inform about inequality, aka distribution into different categories.

It is all BS, smokescreens.

How much does the Banking cartel rip off -with what legitimacy- and how much does it return to the State in taxes? Then …how can that be allowed? How does that circuit contribute at all, really, on the ground?

Yeah, basic rant.

It’s not a rant, Andrea. It’s a very good point, well made.

The UK finance Industry is integral to the real goods trade deficit of the UK.

This subtracts from the UKs GDP but so what ?

It adds to the real wealth of the UK perhaps at the expense of domestic workers.

A Banker gets to drive a nice BMW 3 rather then a Vauxhall Astra and all is right with the world.

The letters of credit written in the city has distorted the entire domestic UK economy to the point of farce.

The UK is now directly linked into the Rhine /Rhur and China industrial systems….i.e. like many places on earth it is no longer a national economy to any degree.

The city has created a entire new world of slave arbitrage where the non labour real input costs are no longer important.

Its the reason why Ford transit is moving to Turkey – they don’t have all the systems in place and its further from the market etc etc but they pay 4 euro a hour.

So therefore to maintain demand in the west they must increase bank credit ratios rather then wages and maintain their skimming operations.

Why users still use to read news papers when in this technological globe all is presented on web?