The present global financial ‘crisis’ began in 2007-8. It is not nearly over. And that simple fact is a problem. Not because of the life-choking misery it inflicts on the lives of millions who had no part in its creation, but because the chances of another crisis beginning before this one ends, is increasing. What ‘tools’ – those famous tools the central bankers are always telling us they have – will our dear leaders use to tackle a new crisis when all those tools are already being used to little or no positive effect on this one?

I think it is worth remembering how many financial crises we have had since the economy became globally interconnected and since we began the deregulation of finance and the roll back of all Great Depression safeguards under Reagan and Clinton. It’s also worth noticing that the causes and pattern of the various crises have an unpleasant ring of familiarity about them – as in – the bank lobbyists making sure nothing gets learned and nothing gets changed.

In the 80’s there were four financial crises: The Latin American crisis caused by those countries borrowing and the global banks agreeing to lend them far too much (too much lending to people who couldn’t afford it – check), the American Savings and Loan (S&L) crisis when American S&L’s made too many bad, long-term and leveraged loans relying on rolling over and over short-term loans to fund it all (reliance on short-term liquidity to cover massive loan books of dodgy loans – check) , and the 1987 Stock market crash when the system of global debt had its first major modern global paroxysm (systemic contagion – check) . And before the dust had even settled from that we had the Junk Bond collapse ( Too much junk – check. $400 billion in junk bonds were issued in 2013 alone). In the 90s there were two more crises (if one ignores the Mexican currency devaluation): The Asia currency crisis (a replay of the Latin Crisis with the same global banks doing the same lending to different corrupt or stupid leaders who agreed to loans on behalf of people who couldn’t afford to pay back – ie nothing learned at all – check) and the Dot Com bubble (valuations way above reality fueled by cheap money and lax lending – check). I think that’s most of the kinds of greed fueled idiocy accounted for.

If you line up the S&L, the Junk Bond and the Dot Com bubble, America has had a major home-brewed financial crisis every ten years. If you consider that none of these events happened in isolation nor limited their effects to the country of origin then we have to conclude that the global financial system is prone to crises. You can, if you see the world through resolutely libertarian glasses, blame everything on interfering governments – it matters little. The fact remains that the system as is, is unstable and run by the myopic, the greedy and the corrupt. Where they draw their salary, which side of the revolving door they happen to be on, on any day seems to me irrelevant. The worst of them don’t understand and are easily bought. The best have no concern for anyone or anything beyond their next bonus.

And here we are being led by them.

Of course saying another crisis is coming is like saying we are due a large earthquake in Southern California. True, but it doesn’t mean one is going to happen tomorrow. What I think it does mean is that we should be thinking what our leaders, what the people they work for – the global overclass – might already have in mind or have already put in place, for what they want done next time. I think it would be foolish to imagine they have not thought about it and are not putting in place the things which will close off some futures and force us into others that they prefer. They have so very much to lose and so very much more they want to gain.

The next crisis.

To know what the next crisis might look like we first have to look at the conditions today that will form its starting point. Necessarily everything from here on is speculation, nevertheless even when we can’t know what people will do and what ‘events’ will overtake us, we can, I think, discern quite a bit of the general topography, the landscape, of the future.

The first thing we should bear in mind is that however it starts, the next crisis will be another debt-crisis like the current one. This is because debt is now the global currency and global financing mechanism. Once it starts, however, one thing will be very different from the last time – this time nearly all nations are already heavily indebted. Last time they were not. And this is what changes everything for the over-class.

Contrary to the endless misinformation repeated at every juncture by austerity politicians and bankers alike, the debt load of most nations at the beginning of the present crisis was not already out of control before the banks blew up.

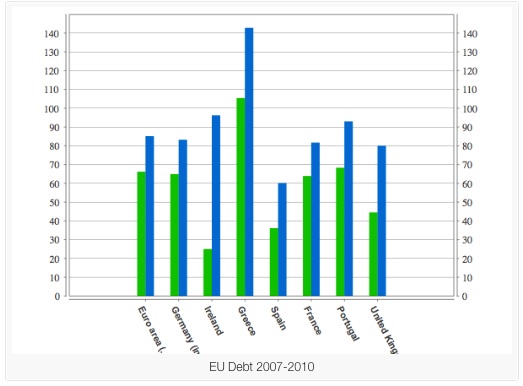

The green bars are debt as percentage of GDP before the bank bail outs and the blue bars are after. These are official Eurostat figures. Notice Ireland. Its debt to GDP was down at 27%. The ONLY thing that altered between 2007 and 2010 was the bank bails outs. Ireland’s ENTIRE debt problem is due to bailing out private banks and their bond holders. Britain’s debt almost doubled and again the ONLY thing that happened was bailing out the banks. The government claims that UK public debt was out of control due to spending on public services is just WRONG. UK government debt against GDP had not gone up in 7 years. Then when we bailed out the banks it nearly doubled. That is the fact as opposed to the propaganda of what happened and why.

If you look a little more closely into the figures for government debt levels in Europe between 2000 and 2010 the fact is that all European nations apart from Portugal were either reducing their debt-to-GDP level or at least not allowing it to grow. Most of Europe was reducing government debt to quite manageable and historically low levels. Ireland’s debt was very low (27%). Take a good long look at those two bars for Ireland. Even Spain was bringing in more in tax than it was spending. Don’t take my word for it look at the figures yourself. Almost every European country was keeping debt to GDP even or going down – before the banks were bailed out that is. The exceptions, of course, were Greece and Italy whose debt was already very high even before they bailed out their banks.

The sudden explosion of European sovereign debt is the direct and indisputable result of all our political parties deciding they would safeguard their mates’ and their own personal wealth (it is the top 10% who hold the bulk of their wealth in the financial products which would be destroyed in a bank collapse. NOT the rest of us!) by bailing out the private banks and piling their unpaid debts on to the public purse.

So whatever the trigger of the next crisis may be, they know any solution which saves the wealth and power of the over-class will have to involve piling new, private-bank bad-debts on to already indebted sovereigns and that, our leaders must be keenly aware, will not be easy to force on an already angry public. They know a whole range of the assurances they might like to give us about what must be done when the next crisis hits and how those things will undoubtably save us, will not be so easy to shove down people’s throats.

“So what,” I can hear the 1% saying, “can we do?”

Here are some thoughts on what I think they can do, will do, are already begining to do and WHY they are doing them.

The over-arching thought that I have, which shapes everything from here on, is that this crisis is no longer primarily financial; it is now political. Any solution, no matter for whose benefit, is beyond the scope of financial ‘reform’ but will depend on radical political change. In my opinion, the era of reformist politics is over. The questions are: radical change in which political direction? in whose hands? and for whose benefit?

At the moment, I believe the radical thinking is almost all being done on the 1%’s side. They may talk about fixing, but what I think they mean is changing. When Obama spoke of change, he meant it. Just not primarily for you. The 1% are not stupid. They see the need for change and intend to control it.

I think one of the cleverset things the 1% have done over the last few years is the way they have created a relentlless public discourse, via their paid political front-men and women and their media empires, to insist on the need to ‘fix’ and protect the system, and the extreme danger to us all should the system not be ‘saved’. This has served as a perfect cover for making sure that not enough people have noticed that the system is, in fact, being gutted and replaced by something that better serves the interests of the 1%. We have not been fixing the banks, we have been feeding them.

So while the 1% are thinking ahead, too many of the 99% are still like rabbits in the headlights, mesmerized and paralysed. They have been told over and over that any radical change to our present financial and political system is impossible, and if tried, would only bring disaster upon us. The 1%, on the other hand, see clearly that the present system will bring disaster upon them if it is not changed radically. They can see that it must be almost done away with entirely – in all but name. The important thing for them is that the direction of radical change benefit them and that the 99% not even realise that it is happening.

And so far it’s working – just. Just enough people continue, if grudgingly, to take refuge in a moribund political system made of parties and theories which date back to the Victorian age. The temporary triumph of the 1% is that despite the fact that no one would drive a Victorian car, nor wear Victorian shoes or clothes, they somehow feel there’s no choice but to rely on Victorian political institutions, parties and ideas. The good news is that the number who really believe this is dwindling and most of those who do, do so out of fear not faith. Which is why our present, 1% controlled politics, is increasingly about engendering fear rather than inspiring faith.

Luckily truth has a wonderfully cleansing effect upon lies and fear. So here are some of the things I think might be true about what is really happening to and around us. Taken together I feel they begin to amount to Manifesto for the 1%.

Sorry to break here but I don’t want anyone to loose the will to live. Next part is almost complete and will be posted in a day or so.

David,

Just to add a pertinent reminder of what the Wall Street Journal wrote about Ireland’s promissory note ‘deal’:

“Under the terms of the liquidation, the government will exchange the promissory note it provided to Anglo Irish for long-term, interest-only government bonds, which will not have to be fully repaid until 2053. The good news is that this debt restructuring will spread out the repayment burden at a time when Ireland is trying to narrow its budget deficit and return to the private debt markets.

In exchange for that forbearance, however, the Irish Government has agreed to accept direct responsibility for the repayment of what was originally Anglo Irish’s debt, so Irish taxpayers will spend the next 40 years paying for losses rung up by a failed private bank.”

Quoted from ‘Ireland’s Bondage’, Wall Street Journal, 7 Feb. 2013

Hi Jonathan, Is that promissory note/bond repayment schedule in the public domain?

Surely the public are entitled to buy a copy or view online this schedule?

This information is public but the public have no understanding of the ramifications. This is by design. If they did actually know what has been done, there would be hangings in the street.

The EU ‘banking union’ which the 1% are pushing through as quickly and quietly as possible, is to ensure the next financial crash will be paid for by a European wide bank ‘bail in’. The respective governments will then plead that they are powerless to stop it due to it being ordered by the ECB.

Mark my words…

The situation would probably become very interesting if the banks, or their government flunkeys had to install meters in every house & give out estimates for the above’s yearly cost – as is the case with the water charges. Nothing like a bill in black & white to deliver a nasty reality check.

thanks for another good article happening David. The looting continues even though we are picked clean. Probably 1% will boil the bones down next to make it all stick.

Can we just acknowledge that bank debt money itself is what is at the heart of these serial crises? This is very solvable: we just need to detach the money system from the credit system.

We can have sound money, based on a basket of PMs, commodities, and renewable resource pools. Then, entirely separately, we can have banking institutions that do reserves-based lending. This way the credit decision made by each and every individual in an economy can be divided in two: do I trust the money as a stable store of value? and do I trust the bank? Those should not be one and the same calculation.

If anyone wants to support such an initiative, based on the superfast and low-cost new digital currencies (not Bitcoin) then please check out Tilikum Investments. Serious initiative under way.

I remember when the “North” picked-clean the bones of the “South”. Rich countries became richer, it was believed, and poor countries were stripped. (Corrupt governments were known to exist, but only in the “South”, so the government borrowed and then stole the money and then the taxpayers had to pay off the debt. IMF helping generously in this stripping.)

Today, all countries are in the “South” and the “North” has been replaced by the consortium of big banks, the Globalized banks, the “system”, and all countries are being picked-clean.

Yea! privatisation! Let the wealth of the world belong entirely to the banks! Cheers! Drinks on the house!

If debt is national and widely distributed it becomes almost like national equity ( although not quite – given the constant dynamics of usury)

However debt (or acccess to capital is not held locally in Ireland in the main)

Therefore wages or social welfare (or a capital allowence under state banking conditions) drives domestic consumption in Ireland.

Wages continue to fall in Ireland……..

We can see the neo liberal Irish economy blog celebrating a dramatic rise in GDP today.

http://www.irisheconomy.ie/index.php/2014/09/18/quarterly-national-accounts-3/

Much of the rise in domestic demand can be explained very simply (please correct me if I am mistaken in how domestic demand works in practice)

A large rise in tourist numbers from areas of more concentrated capital ownership.

“Although net exports increased and contributed around 40% of the increase in GDP the remainder is due to domestic demand. Real total domestic demand in H1 2014 is 4.0% up on the equivalent period in 2013. Although all components are up (consumption +1.2%, government expenditure +5.2%) much of the increase is driven by investment which is up 11.3% year-on-year. In recent years much of the volatility in this component has been the result of aircraft purchases by leasing companies based in Ireland.”

What does Seamus Coffee mean by REAL total domestic demand.?

I but a Dork and not a economist.

When a firm buys a bus (investment) to take tourists to Sneem how does this benefit Irish people ?

Will not this investment subtract from Real domestic purchasing power.

Ireland is repeating the boom bust cycle yet again.

It is trading redundancy for GDP growth which is used to pay external players in the main.

http://www.cso.ie/en/releasesandpublications/er/ot/overseastravelmarch-may2014/

We can see from figures that irish travel abroad is static while overseas visitors have increased….

More recent data confirms this trend.

http://www.cso.ie/en/releasesandpublications/er/tt/tourismandtravelquarter22014/

Looks to me like the Irish are trading their domestic purchasing power for GDP “growth.”

This is trade for trade sake.

A open economy such as ireland destroys its wealth or well being and its politicans / local estate managers are proud of it for some funny reason.

I am a stranger living in a strange land.

We were told that it was the people who lost their job were the ones who lost purchasing power……….

How can they explain these figures ?

releasesandpublications/er/elcq/earningsandlabourcostsq12014finalq22014preliminaryestimates

Wages down 1.1 % in second quarter.

Thanks for highlighting the fact that the debt crisis hasn’t gone away even though it has fallen off the media radar. I haven’t been following the Scottish referendum campaign too closely but it looks like everyone has forgotten the track record of the No side’s star attraction Gordon Brown in Britain’s banking debt crisis .

In his 2006 Mansion House speech to bankers he said “The message London’s success sends out to the whole British economy is that we will succeed if like London we … advance with light touch regulation …”. He also sold billions of pounds of gold at the bottom of the market and before the surge in the gold price, allegedly to help the banks stock up their own reserves.

Maybe the subliminal message that the No side is trying to send out is that Scots (like Mr Brown aka “Mr Bean”) are incapable of managing a nation’s economy.

I do not know how a similar chart would look in other countries, such as England.

But I think this one chart is very telling of the broken nature of the financial system, and why there will be no sustainable recovery until there is meaningful reform.

http://jessescrossroadscafe.blogspot.com/2014/09/a-broken-economic-system-in-one-picture.html

I hadn’t seen that chart. It’s a pure indictment of a broken system.

@Jesse

The social credit position has no problem reducing wages (if preformed correctly) as it reduces prices also but wants everbody to share in the capital pie.

That is obviously not the case given current exponential debt dynamics.

I feel our mangers know this – they are therefore engaged in very political goals.

Namely to destroy us.

Turning the world into Glasgow.

http://www.youtube.com/watch?v=bt5K780DKgw

Have you all seen this video clip by the late George Carlin on the 1%? it’s superb. It’s right on target and fits nicely in with Golem’s post above.

George Carlin: The Owners of This Country Have You by the Balls

https://www.youtube.com/watch?v=NledRP4H8bE

My highest compliment is that I wish I had written these quotes contained here in particular.

bit of a tease though on the serialisation, eh Malone? lol.

http://jessescrossroadscafe.blogspot.com/2014/09/european-sovereign-debt-levels-to-gdp.html

Guilty as charged. (hangs head in not very convincing shame).

And thank you – as always.

Not many people take much notice when I write on newspaper sites about how banks work, despite the fact it is costing them a fortune and wrecking their lives. Maybe because most people can’t get their head around the fractional reserve system. I often put this video out, too, where a 12 year old girl explains very clearly how banks rip us off and how they whack our taxes right up. Below is what I wrote on a newspaper site today.

—————————————————————————————————

There has to be a balance between wages and profits for the system to work, but what if there is a third force sucking all the money out of the economy.

Banks can create money out of thin air which means it never run out, but there are never enough houses to go around. Therefore people scramble in a race to buy a property before it becomes too expensive because they fear they might lose out forever.

So people go to the banks – which can never run out of money – which a force outside of market forces – and they borrow as much as they can to buy a house. Now it doesn’t matter how much money people want to borrow because it can always be newly created for them on the spot. Therefore a housing shortage with an infinite supply of money = massive house price inflation = a bubble.

People are forced to borrow more and more, to work longer hours, take on two or more jobs, delay starting families, house share with friends, rent rooms out, give up all luxuries and holidays, live on fresh air, just to be able to buy a house before its too late. But these desperate methods to raise more money just causes house prices to continue to soar and for mortgages to get bigger and bigger.

So people now have hardly any spending money left over after they have paid their bills and so the economy suffers, but the bankers make mega profits for themselves because of the huge mortgages and rents charged.

This is UK Ltd, how the mega rich run our country. All the rest of us – including the large, medium, and small businesses – get scammed. This isn’t capitalism; this is political and financial fixing of the market for the benefit of the few.

Below in this video a 12 year old girl explains how bankers take our money and why our taxes are so high.

https://www.youtube.com/watch?v=JHQOX8EVNmE

I suppose it’s inevitable that the whatever % will do anything to protect their stash, as in my admittedly limited experience of those who value money & power above all else has shown me – there really isn’t much else to them. I once worked closely with a very wealthy businessman who despite his affluence was as miserable as sin – a state that only increased as he got wealthier. Over a period of 5 years I watched as his heart shrivelled within a shell maintained by status & power. It was obvious if he were to lose these props, he would be bankrupt in all senses of the word & would fight tooth & nail to avoid descending to the level of those he despised.

Obviously this is a generalisation which would not apply to all wealthy people, but I suspect it would for many.

@Kavy

Thats all very nice but I prefer to use this video on our growing tourist consumer soldiers whose job it is to spike up our GDP numbers.

I just warn them not to get lost in Sneem.

http://www.youtube.com/watch?v=i4I8flnUy9k&list=UUwFiVn10RzvHKgArk21sL8Q

Fancy a good laugh, this animated video called, The Gospel of Supply Side Jesus, is very good. It’s not offensive, as there two different

http://m.youtube.com/watch?v=Gc-LJ_3VbUA

Funny – but I don’t buy all what he is saying.

Notice at 3.15 – the money changers are angry at supply side (corporate) Jesus for cutting in their action (reducing profits)

I believe in the Greek idea of the state (think of the rectangular or square villa) of defined space and build out from there until you have a functional state.

All benefits of capitlal use and costs (externalties) can be quantified within that space

No need for endless economic growth if all revenue and costs can be accuretly quantified and distributed as generally there is enough to round if managed well.

Franklen expresses compassion for those outside the bounderies of the state not out of Jesus love for his neighbour , no – the idea is to continue economic expansion via the importation of new labour ( less costly) that can be feed into the capitalitic (usury based) economic maw.

http://www.youtube.com/watch?v=JFaEPbzItbI

Never forget we Irish were the first to enter GB en masse in search of tokens rather then wealth.

Capitalists turned Ireland into a ranch during Tudor times (in search of yields to pay exponential debt)

The people ejected from that petri dish were subsequently injected into Liverpool etc etc etc.

The Satanic Mill.

Scotland…..the reawakening of the disenfranchised…..here’s hoping!

Golem – hope you had a great holiday, lots of laughter. Great article, along with the last one! These guys are always thinking ahead, always planning. That’s what power-and-wealth-hungry psychopaths do. They use obfuscation, lies, propaganda and, as you say, tell us they are trying to “save” us when they are actually trying to save themselves. Good for you for looking at how they could possibly do this, where they might be heading.

Ilargi at The Automatic Earth says they are going to go after our pensions, the last bastion of money they can get their hands on. Does everybody know where their pension funds are invested? Are they invested in AAA securities?

“The boys in the banks are at it again, and this time their biggest supporters, if not clients, are central banks and treasury departments. If they can bring down investment requirements for pension funds enough from AAA, and they can at the same time – once again – label mezzanine (aka subprime) tranches of complex instruments ‘AAA’, they got it made. How can you go wrong when you have Mario Draghi himself begging you to to play this game?

Germany refuses to allow Draghi to buy sovereign bonds and add to the taxpayers’ risk, but what if you can simply shift it all to pension funds by moving the goalposts on what AAA really means? [,,,]

So now we get this concerted effort, the central banks are involved, the ratings agencies are too, to just about force pensions funds, the only store of real wealth left on the planet, to put their trillions into opaque and extremely risky instruments. Because Mario Draghi needs to find money, or whatever we should label it. […]

The whole shebang is busy re-interpreting and re-defining until there are no more legal barriers for your pension money to be ‘invested’ in subprime loans packaged in ‘securities’ of whatever shape and form. […] This is where our economies are perverted. It’s the final excesses and steps of a broke society. It’s madness to the power of infinity. The only thing that’s certain is that in the end, your money will all be gone.”

http://www.theautomaticearth.com/debt-rattle-sep-16-2014-subprime-is-back-with-a-vengeance/

Never forget a few things.

Many years ago, Romano Prodi already proffered that the crisis engendered by the Euro monetary system would one day give politicians the excuse to implement policies that would have been impossible to implement at the time he uttered these words.

The US Federal Government has already suggested that 401Ks would be better placed in the hands of the Federal Government in order to guarantee their safety

Finally, the IMF has suggested for the 3rd time in two years that pension funds should be confiscated. This would be over and above the suggested “one off” levy on everyones estimated fortune. By the way, if I am not mistaken, I think Spain implemented a RETROACTIVE levy on all bank accounts a few months ago? At the very least, the idea has been pushed through the various government bodies for approval… ?

At any rate.

The above is exactly what can be expected once the Debt/Gdp ratio has fallen below one.

Golem, is the email address found on this site to contact you still working?

Hello guidoamm,

Yes it’s still good.

I sent in a jeremiad for your critique. Maybe check your spam folder?

One more observation Backwardsrevolution.

The arithmetical reality of debt is that once your Gdp/Debt ratio falls below 1 you have only two options left:

1 You can pay the debt off

2 You can have the debt written off

The point we are at, of course, make both these options viable only by coercion.

And here is where most people misunderstand the problem.

The largest holders of Western sovereign debt are not Japan and China as it is widely thought.

The largest holders of Western sovereign debt are Westerners themselves through their pension, insurance and investment funds and, now, through our own central banks…

The actions of sovereigns (TARP, QE, LTRO…) and the IMF (advocating the confiscation of pensions which equals the writing off of the debt) should now begin to come into focus?

Pushing the arithmetical deductions further, makes for a dark reality. Suddenly, things that are happening begin to make more sense and the future is looking fairly destructive….

Ah I see…..thanks Guido.

“A man always has two reasons for doing anything: a good reason and the real reason.” J.P. Morgan

Our new friend, Proton Email?

http://www.newstatesman.com/sci-tech/2014/09/reprivatising-internet-how-physics-helps-you-hide-spooks

“…The 1% are not stupid. They see the need for change and intend to control it….”

==> http://www.nytimes.com/2014/09/14/us/police-armored-vehicle-is-unwelcome-in-california-college-town.html?_r=0

Cheers

Thanks, good stuff.

Just would add that one of the tactics being implemented by the 1% and to be closely scrutinized for in “major events” is “Maya.” Illusions. They are very “adept” at it.

And, I might suggest that there are “cycles” mankind seems to almost involuntarily be caught up in….and to make that “next leap” one needs to “up perception level/internal B.S. alarm” that every inner city kid has right out of diapers. Don’t trust strangers you see on msm.

Don’t distrust, but ask why this stranger suddenly has such “concern” for your safety, and why they alwys seem to have a solution run by them to “keep you safe.” At a financial and Civil Right capitulation price. And please hand over your self-defense weapons to them.

Or why this talkinghead suddenly is so “worried” about events in places you can’t locate on a map. And why you should fund their military adventures. It makes us all less safe.

Teach your kids: question authority always. Education and determined fumigation of political infestations “may” just save us all and bring back optimism of a better tomorrow for our posterity.

That might begin with building an entirely new entity based on the one stolen when we weren’t paying attention. And leaving the old one “holding the bag” they created.

A very thought-provoking article.

You say: “Luckily truth has a wonderfully cleansing effect upon lies and fear.”

Unfortunately, I think we’re entering a sophisticated, Orwellian phase where lies and obfuscations will be the order of the day. There are so many vested interests in maintaining and promoting the status quo: The 0.01%, the politicians on both sides, central bankers, media pundits, op-ed writers, authors, public servants,…

Their tools are the authoritative intellectualisations of theories that are about to create escape velocity and decimate inequality, and stats that can be twisted to give a faint impression of a light at the end of the tunnel.

The complex arguments, the optimism, the weight of support, the denigration and humiliation of gainsayers all combine to confuse and pervert the opinions of Mr and Mrs Average.

And, hey, we’ve got the Kardashians and the Cambridges to keep up with.

This is the future.

i see human beings as the future Mike. we are the latest greatest development in creations garden. it seems we have nothing to combat an inevitable and total defeat of all we hold dear. in fact we have the potential of being human. its going to be essential to realize the potential we have within us…

A very interesting comment from an English Radical on the New Statesman website.

”To put it into perspective – the Scottish independence campaign failed on a popular vote of 45%. Thatcher’s Government in the 1980s, that changed the rules and assumptions upon which politics are possible, claimed a reforming landslide with a popular vote of 42%.

The issue is clear. The Left can have no influence over national politics until a party of the Left can claim a majority of the House of Commons without relying on MPs from Scotland or Wales. There are not enough numbers in the English cities to do this. The Left will have to break ground in the rural hinterlands of the shires, but not in such a way that it becomes simply just another party of the Right. The Peter Mandelson New Labour experiment may have won three terms, but all it achieved was a perpetuation of the system set up by Thatcher.

I live in rural Worcestershire, near the pretty town of Malvern. It is not right to suggest that they are all Tories, even in this affluent part of rural England. My goodness, I once lived in Haslemere, in Surrey, claiming the greatest proportion of first class rail commuters to London in the country, and they came within a couple of thousand votes of unseating Virginia Bottomley at the height of Thatcher’s rule. Malvern claims a goodly proportion of intelligent radicals, and the town is a four-way battle between the Tories, UKIP, the Greens and the Liberal Democrats, with a fair sprinkling of Curse On All Your Houses Victor Meldrew Independents. Only Labour is nowhere to be seen. What chance then have these Malvern radicals if their only choice is between a Conservative Westminster, cleaned out by the tax haven bonus barons of London, or a Labour regional Birmingham, bankrupted by an Equal Opportunities lawsuit that cleaned out their coffers and forced the sale of most of their municipal buildings?

Being reasonably intelligent, the Malvern radicals can also see that democracy, be it in Westminster, in Birmingham or even in Worcester or Malvern, is only skin deep for as long as the European Commission set the agenda, make directives that require a tearing up of a Treaty to oppose, and act entirely in the interests of global corporate lobbyists and their Special Relationship special advisers.

Is anyone in the Labour Party sufficiently heavyweight to do something about it, without setting off the spectre of a run on the pound and a collapse of market values in the City that is enough to scare any voter into submission?”

How do we answer the last question?

“The quote of the day today must be this one from Belgian EU Trade Commissioner Karel De Gucht in the aftermath of the Scottish rejection of independence: “A Europe driven by self-determination of peoples … is ungovernable … ”

I don’t think he understands the implications of what he says, and I’m quite sure he completely misses out on the mastodon sized problem he – quite accurately despite himself – describes.

Which is something along the lines of ‘Europeans should stop wanting to make their own decisions, because that makes it hard for us in Brussels to make those decisions for them’.”

http://www.theautomaticearth.com/debt-rattle-sep-19-2014-scotland-and-the-spirit-of-our-time/

That is an amazing quote! And your paraphrase is exactly what our lords are concerned about.

Here’s De Gucht in April with his recent dealings with the US chamber of commerce in relation to the Trans Atlantic trade deal :

“Towards the end of March, de Gucht launched a “public consultation exercise” on one particularly controversial idea. This idea involves setting up a specialised court system that corporations could use to sue governments and demand financial compensation for laws and policies that harm their bottom line. In trade jargon, the idea is known as “investor-to-state dispute settlement”.

http://blogs.euobserver.com/cronin/

“Luckily truth has a wonderfully cleansing effect upon lies and fear.” This is a nice thing to say and all, but it runs straight into the illusions and ignorance of what all have labeled the 99%. Just as much a problem, and in many ways more so than the greed and criminality of top is the ignorance and illusion of everyone else.

Its nice to think people want a change, but a change to what? Most of what I see is some sort of hope of a return to a past that never was or to a past that is no longer possible. Its no use to keep hitting at the criminality if we dont start looking at what is to come in place of it. And thats going to take a lot of education about where we are, and the breaking of a lot of illusions about how the world can operate. Most importantly this is the heavy lift of those who want things different and in America whether its the economy or and this is the economy, the environment or politics, I dont see any lifting at all.

Protest is not politics.

I agree jc

protest isn’t the same as politics. But there are some people who are doing both. We just don’t always do them both in the same venue.

I protest that we have been waiting too long for Part II!. Lol

“Activism does not rationally convince elites to change their policies. Nor does activism massage their hearts and lead to a moral transformation. Activism wins when it creates conditions within which elites making critical decisions feel they have no choice but to change their behavior. They change when they decide that to pursue their policies and otherwise ignore popular demands, with the risk that this will energize dissent, is a worse course of action for them than not doing so.” Michael Albert & Stephen Shalom

Protest, activism, and politics are not discrete. They are all a part of the whole of progressive reform.

Progressivism is not a single action, or a single party or candidate. It is an outlook, a way of life that is interlocked in a continuing struggle against the forces of greed, inequality, injustice, and repression.

I have to agree with that Jesse,

excellent definition as well.

‘Progressivism is not a single action, or a single party or candidate. It is an outlook, a way of life that is interlocked in a continuing struggle against the forces of greed, inequality, injustice, and repression.’

Welcome back David, time spent with the family is time spent properly, we only get so much and it is easy to get sidetracked (the pressure to pay bills, put up with commenters etc.).

I understand how much work you put into each piece, and that each piece is personal but time is precious.

(which means you have to take the time to read the comments, I fear that some of the comments spill over into your real life)

You used to accept Guest Posts, I’m sure Hawkeye or Jesse or many of your literate commenters would jump at the chance of putting up an article on your site (which might alleviate some of the pressure)

And for gods sake put some adverts on (you don’t have to go mad, just a line between the article and the comments should at least pay for your hosting).

A few ads would not keep me from coming back. I just bought David’s eBook as well.